By Megan Durisin

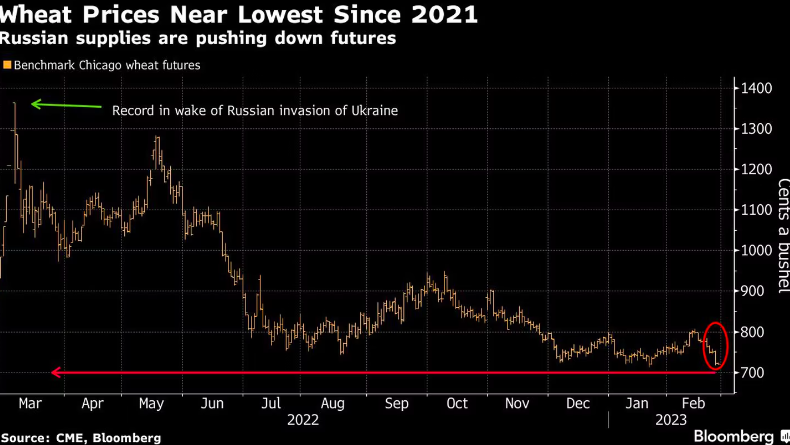

Global wheat prices plunge on a glut of Russian supplies, signaling a further cooling in global food inflation.

Wheat futures in Chicago are headed for their fifth straight monthly loss, the longest streak of declines in two decades.

If they fall any further from this level, they will hit the lowest price in about 17 months, well before the Russian invasion of Ukraine, which sent prices soaring to a record last March.

A surge in Russian exports from a record crop is one of the main reasons for the setback.

Egypt has bought Russian wheat exclusively in four consecutive tenders.

Competition for market share has pressured US and European prices, and the European Union has cut its export outlook.

Attention now turns to the outlook for this year’s global wheat crops.

US farmers are likely to plant more than analysts expect, and almost the entire French soft wheat crop is rated between good and very good.

Traders are also monitoring negotiations on the grain export agreement with Ukraine, which is up for renewal in March.

Corn futures are trading at the lowest since early January.

On the other hand, soybeans are favored by the drought in Argentina, and a good US crop this summer will be crucial to prevent prices from rising much higher.

The latest snapshot of global food inflation is due this Friday when the United Nations releases its food price index for February.

The indicator could extend its decline from the low recorded in September 2021.

With information from Bloomberg