By Peter Willard and Lucia Kassai*

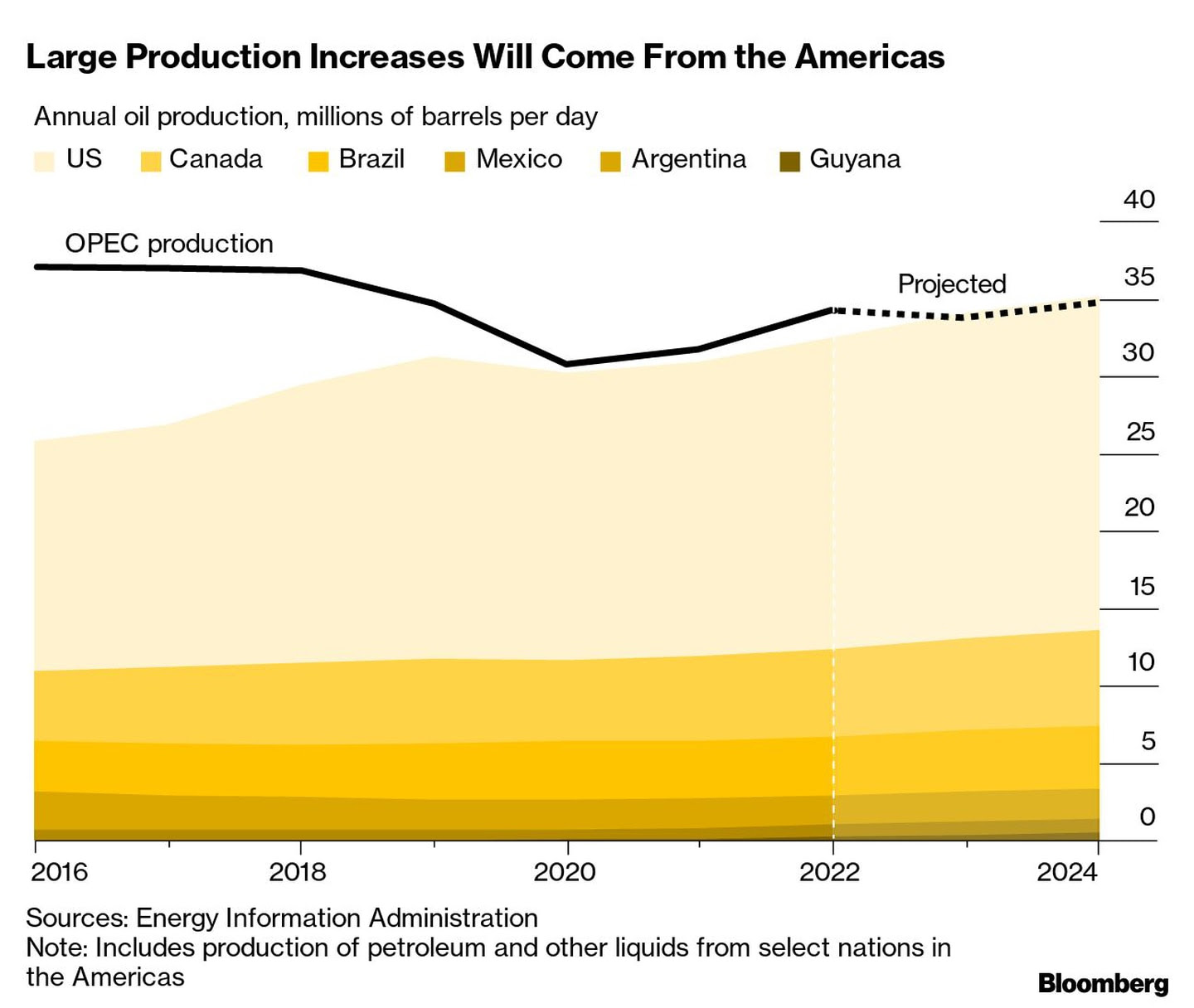

For the first time in at least two years, the Americas will be the world’s biggest engine of oil production growth as OPEC announces cuts.

Western Hemisphere producers will add more than 1.6 million barrels a day of new supply this year, shifting the balance of growth away from the cartel that, until this year, led global production increases, according to the US Energy Information Administration (EIA).

And that growth will come not only from US shale producers, which have long competed with OPEC for market share but from fields in South America and even Canada that cannot easily stop producing when prices fall.

That new production will almost entirely offset the cuts that OPEC – and even its ally Russia – will implement from May in a bid to prop up global oil prices.

“The Western Hemisphere is the secure source of supply the world needs in the medium term to keep oil prices from skyrocketing,” said Schreiner Parker, head of Latin America at Rystad Energy.

“Brazil, Mexico, Guyana, Argentina, and even Venezuela will see production increases this year that will help shore up supply in the face of continued OPEC cuts.”

According to the EIA, growth will continue in 2024, when Western Hemisphere producers are estimated to add another 1 million barrels per day of crude supply.

To be fair, OPEC’s lack of growth is deliberate and does not mean the cartel will wield less power.

But America’s new production will trigger other changes in the global market.

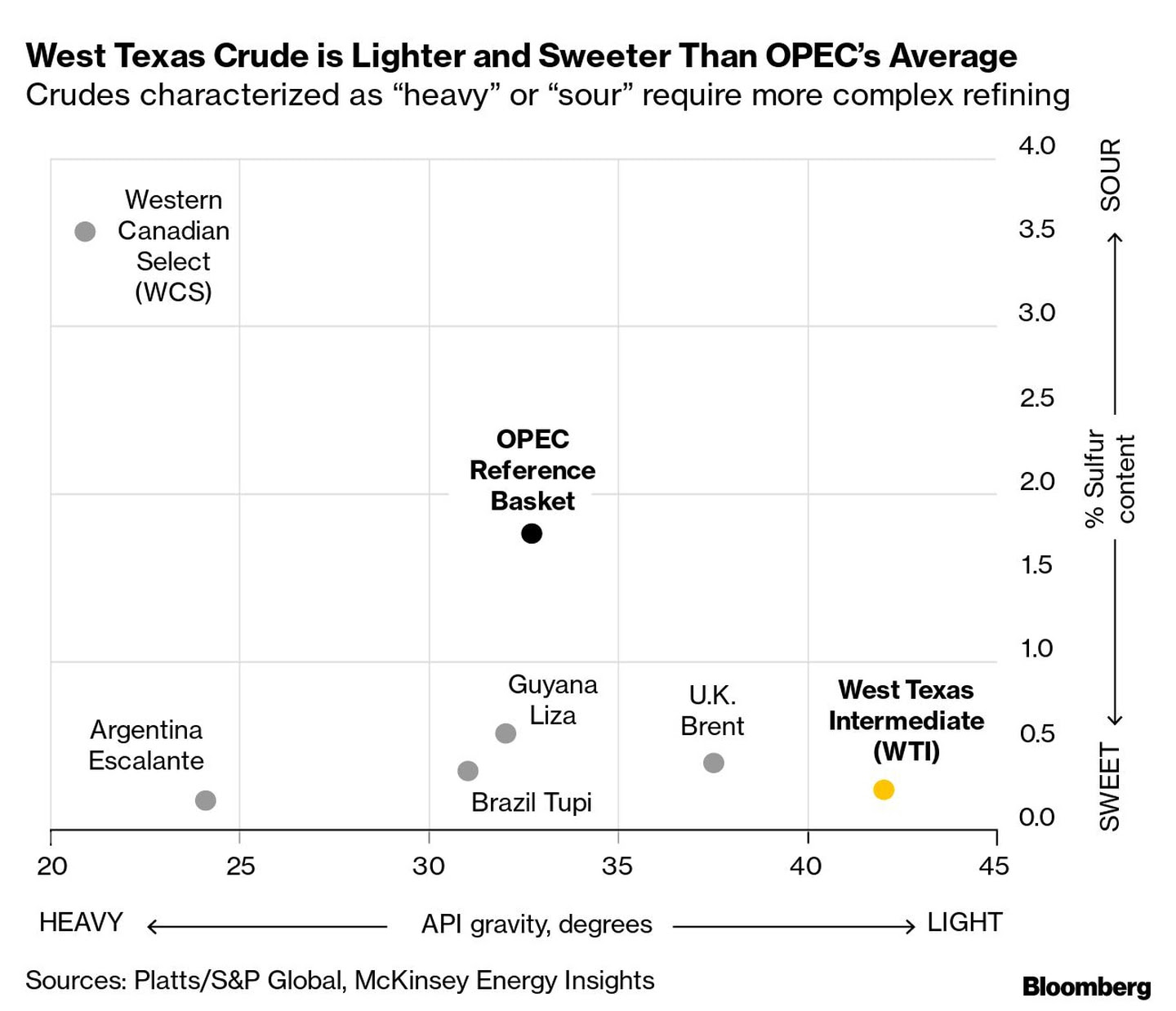

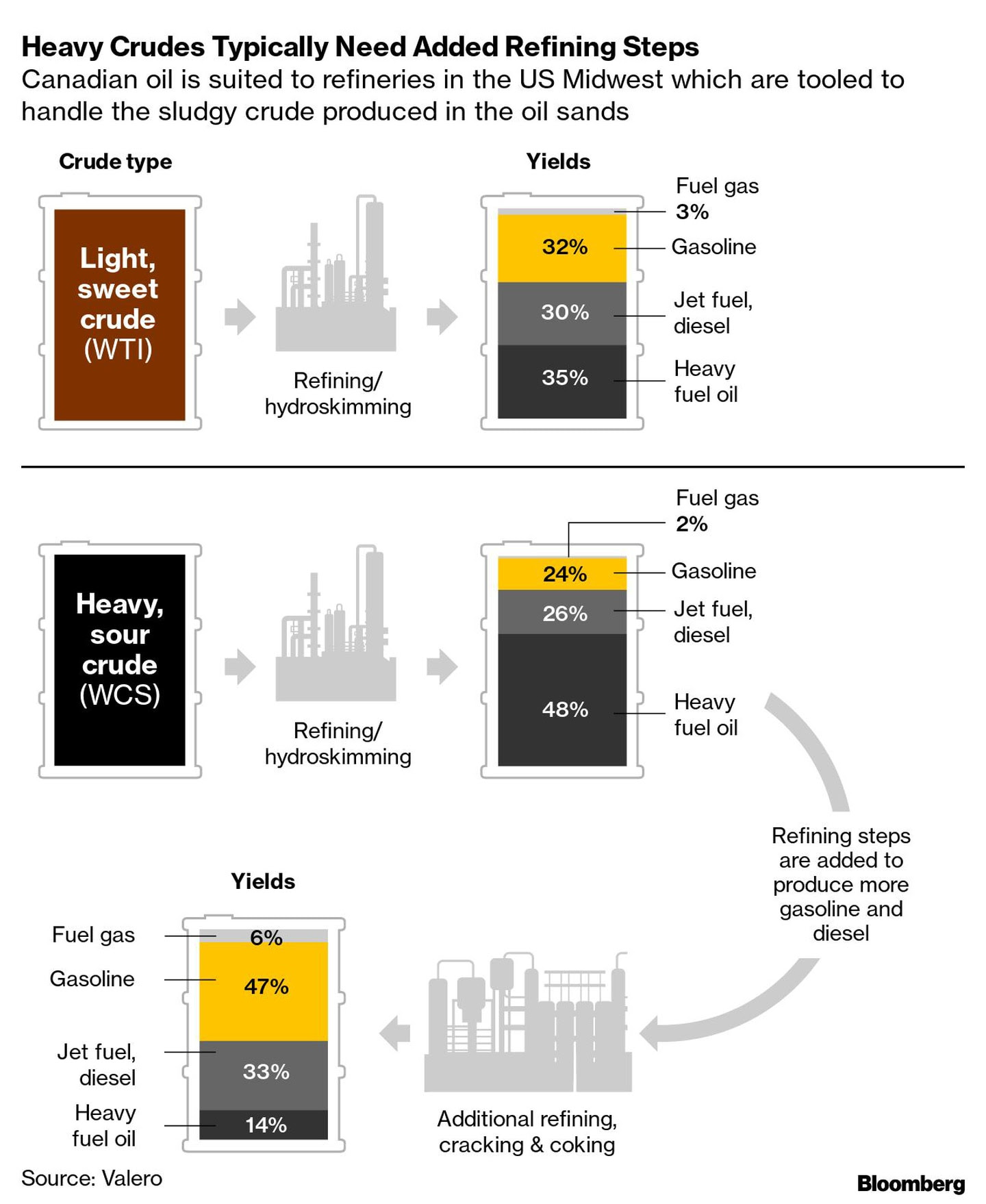

Most of the growth in the region will be in light- and medium-density crudes, which could raise the price of heavy crudes that many refineries have been optimized to process, according to Antoine Halff, former chief oil analyst at the International Energy Agency, now at Columbia University’s Center for Global Energy Policy.

And, given that about 20% of new supply will come from offshore projects that pump crude around the clock, a regional supply glut is a real possibility if oil demand does not increase dramatically this year.

UNITED STATES

The Permian Basin alone will add the equivalent of Iran’s total production through 2030.

According to the EIA and the International Energy Agency, it will grow more than any other region this year and the next.

But that growth in light, sweet crude will be moderate as shale producers focus more on maintaining steady revenues than extracting more oil.

“Before, shale producers used to respond to high prices,” Halff said.

“Now, much like OPEC does, they plan with revenue stability and margins in mind.”

BRAZIL

The International Energy Agency expects Brazil to add 300,000 barrels per day this year from huge oil rigs extracting medium-grade crude from deepwater fields such as Tupi, Búzios, and Mero.

Each offshore vessel costs around US$2 billion, and operators put them into operation as soon as they finish their installation to start paying construction costs.

As a result, later this year, Brazil could relieve oil consumers or flood a weak global economy with surplus barrels.

However, these huge projects are prone to delays, as with Petrobras, which postponed the start date of three units last month.

The EIA, therefore, expects production to grow this year at a more moderate level of about 200,000 barrels per day.

GUYANA

Guyana, a country of fewer than one million inhabitants, has had one of the largest oil discoveries in recent years and will become the region’s third-largest producer by the end of this decade.

Exxon Mobil Corp. will start its third offshore project there in the fourth quarter of this year, earlier than expected, bringing total production to 600,000 by 2024.

According to Goldman Sachs Group Inc, output could reach 1.6 million barrels per day by 2030.

Oil produced from Guyana’s Liza field is light, sweet crude with a grade similar to that of Nigeria’s Bonny Light field.

CANADA

In Canada, the world’s fourth-largest oil producer, an expansion of the Trans Mountain pipeline is likely to spur new incremental production and shift heavy Canadian oil flows from the US Midwest to Asian markets.

Production is at an eight-year high, and producers are beginning to invest, once again, in new production.

Cenovus Energy Inc. plans to extract an additional 120,000 barrels daily over the next four years.

International Petroleum Corp announced plans for a US$850 million oil sands project, scheduled to start production in 2026 and increase production to 30,000 barrels per day by 2028.

*Contributed by Robert Tuttle and Dave Merrill.

With information from Bloomberg