RIO DE JANEIRO, BRAZIL – Following Sri Lanka’s lead, Pakistan is heading for bankruptcy in a highly charged political atmosphere marked by threats of a march by the ousted prime minister on Islamabad’s capital, calling for new elections.

While Sri Lanka is a small country, in the case of Pakistan, we are talking about a nation with 220 million inhabitants, a nuclear power with the sixth largest army in the world, and the most powerful armed forces in the Islamic world.

Pakistan is sitting on a ticking bomb. It can explode anytime. There is a growing concern of infighting within the Pakistan Army’s senior ranks.

Analysts fear that political instability could spill over into violence in the coming days, further dragging down Pakistan’s already reeling economy. The country’s foreign exchange reserves are falling, food inflation is skyrocketing, and the Pakistani rupee is declining, with a massive 21.72% drop against the U.S. dollar in the current fiscal year.

A “perfect base” for a sovereign collapse.

(Pakistan Tehreek-e-Insaf backers denounce ‘imported government’)

Economists and analysts have called for emergency measures to address the looming economic challenges. They suggest eliminating 800 billion rupees (US$4 billion U.S.) in tax exemptions for the corporate sector and imposing higher taxes on land and real estate.

They also call for cuts in defense spending, a special tax on vehicles with an engine capacity of 1600 cc or more, doubling the electricity tariff for residential properties with an area of 800 square meters or more, and downsizing federal agencies.

The lack of money from the International Monetary Fund (IMF) is also causing problems with the supply of foreign currency. A US$6 billion “aid package” is delayed while the budget deficit remains persistently high at nine percent of gross domestic product.

The requested tax exemptions would further worsen the government’s financial situation. Meanwhile, the situation is so miserable that the country’s stock markets are also coming under extreme pressure, with share prices plummeting across the board.

(“If something happens to me I’ve recorded a video where I exposed everyone involved in the conspiracy.”- Former PM Imran Khan)

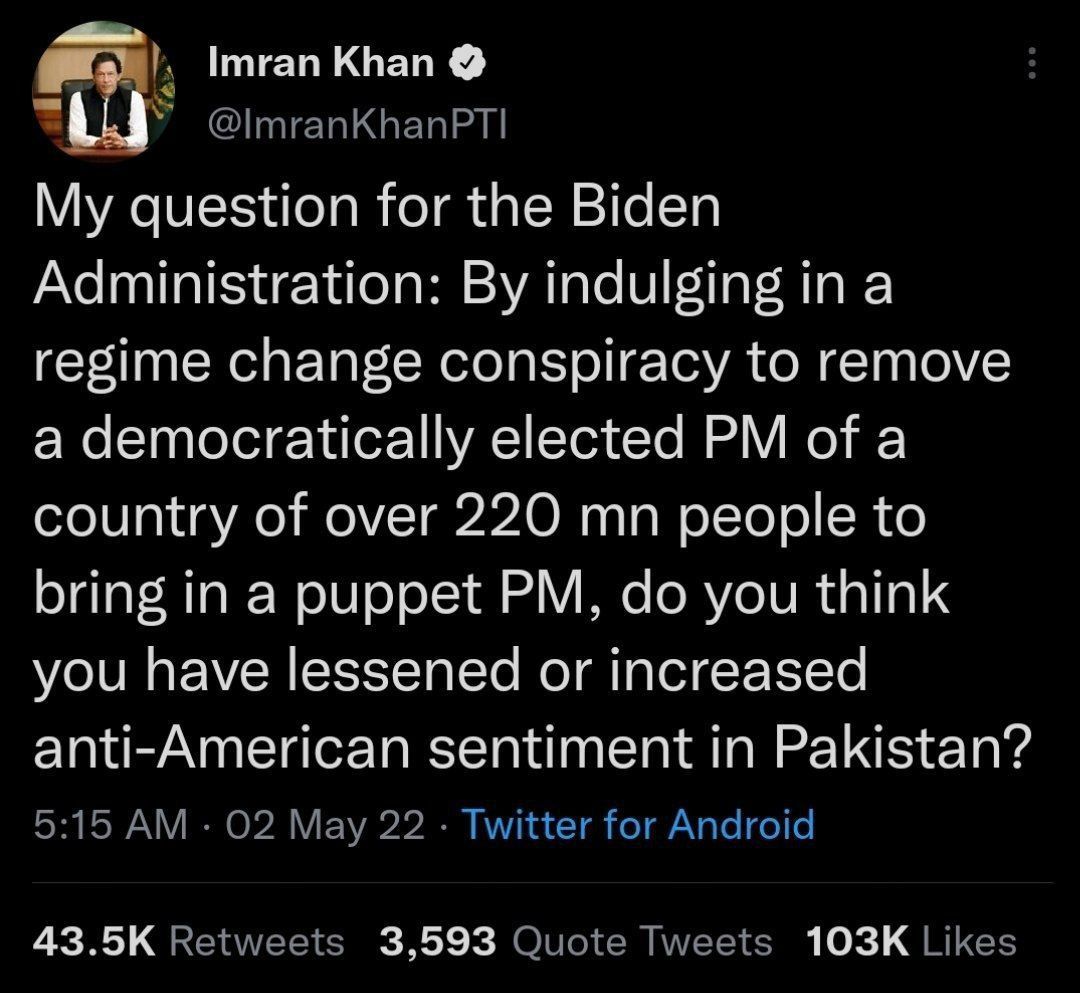

Former Prime Minister Imran Khan, who was removed from office last month following a no-confidence motion against him, has consistently drawn large crowds at his public rallies, calling on the masses to rise against “U.S. hegemony and its secret role” in allegedly attacking his democratic regime through undemocratic and unconstitutional means.

After all, he has made no friends among Americans with his independent policies, making him a target of regime change efforts in Washington.

US MEDDLING

Before his ouster as prime minister in a no-trust motion in the parliament on April 10, Imran Khan claimed that Pakistan’s Ambassador to the US, Asad Majeed, was warned by Assistant Secretary of State Donald Lu that Khan’s continuation in office would have repercussions for bilateral ties between the two nations.

Shireen Mazari, a Pakistani politician who served as the Federal Minister for Human Rights under the Imran Khan government, quoted Donald Lu as saying:

“If Prime Minister Imran Khan remained in office, then Pakistan will be isolated from the United States and we will take the issue head-on; but if the vote of no-confidence succeeds, all will be forgiven.”

The biggest concern for the new unity government that came to power last month is how to stop the erosion of reserves and fund the unfunded fuel subsidies granted by the previous government just days before the no-confidence vote.

The net reserves of Pakistan’s central bank, the SBP (excluding private bank deposits) were only US$10.3 billion in the week ended May 6, 2022, barely enough to pay the bill for four weeks of imports.

Faced with economic hardship and the poor state of the economy, Pakistan Muslim League-Nawaz (PML-N) Chairman Nawaz Sharif summoned party leaders, including Prime Minister Shehbaz Sharif and the party’s federal ministers, to London on May 10 for consultations.

BILLIONS IN DEFICIT

The country’s current account deficit nearly doubled in March, bringing the total deficit in the first nine months (July-March) of the current fiscal year to more than US$13 billion.

The SBP show that imports rose 41.3% in the nine months, compared with 11.5% in the same period last year, mainly due to sharp increases in commodity and food prices. Imports totaled US$62.137 billion in the July-March period, compared with exports of US$28.855 billion.

The rising imports widened the trade deficit and destroyed the exchange rate as demand for dollars remained extremely high in the current fiscal year.

The total trade deficit escalated to US$35.52 billion in the first nine months (July-March) of the current fiscal year compared to US$20.8 billion in the same period of the last fiscal year.

In absolute terms, the trade deficit has increased by more than US$15 billion, indicating a deterioration in the external trade position. With such a large deficit, Pakistan will likely plunge into a balance of payments crisis in the coming months.

Domestically, massive food inflation of 17% has affected the lives of the poor and middle classes, struggling to make ends meet. Analysts believe that a new wave of inflation will begin when the government eliminates fuel subsidies.

The new US-approved government under Prime Minister Shehbaz Sharif, who visited Saudi Arabia and the United Arab Emirates shortly after taking office, has failed to provide relief.

China has still not honored its pledge to reissue loans totaling US$4 billion that Pakistan repaid in late March. Chinese authorities are also reluctant to make further disbursements after the Pakistani government asked for US$20 billion in cash deposits and rescheduling of existing commercial loans from Chinese banks.