The Ecuadorian economy was going through the same problems that Argentina has today, including high inflation, economic stagnation, deterioration of the social fabric, and lack of long-term credit.

Dollarization laid the foundations for a model change that made it possible to overcome these problems.

The dollarization of Ecuador not only implied a change in the monetary regime but also functioned as the pillar for a change in the economic model and a change in the way of making economic policy.

The political system lost the tools to maneuver at the expense of price stability and seigniorage collection.

Despite having an “autonomous monetary policy” and ample tools to intervene in the economic cycle or respond to external shocks, the Ecuadorian economy stagnated between the 1980s and 1990s, as measured by per capita income.

Real per capita income accumulated a 1% drop between the first quarter of 1990 and the same quarter of 2000, most concentrated in the brutal financial crisis of 1999.

This changed radically with the dollarization process.

GDP per capita at constant prices expanded by 36% up to the fourth quarter of 2022 and up to 49.6% if compared to the fourth quarter of 2014 (the highest level reached in Ecuadorian history).

According to the World Bank database, the number of people with incomes below US$6.9 in 2017, adjusted for purchasing power parity (PPP), exceeded 65% before dollarization.

The multilateral lending agency estimates that by 2021, people with less than US$6.9 (PPP) represented 32% of the total population and even reached a low of 27% in 2017.

Dollarization caused the poverty rate to halve in 20 years.

The systematic reduction of social marginality is due to eliminating the inflationary component in determining poverty, which allowed the consolidation of income in purchasing power.

The real wage has doubled since 2000, and the current poverty rate responds mostly to the fluctuations of the economic cycle and the evolution of the unemployment rate (which fluctuated between 10% and 3% under the new monetary regime).

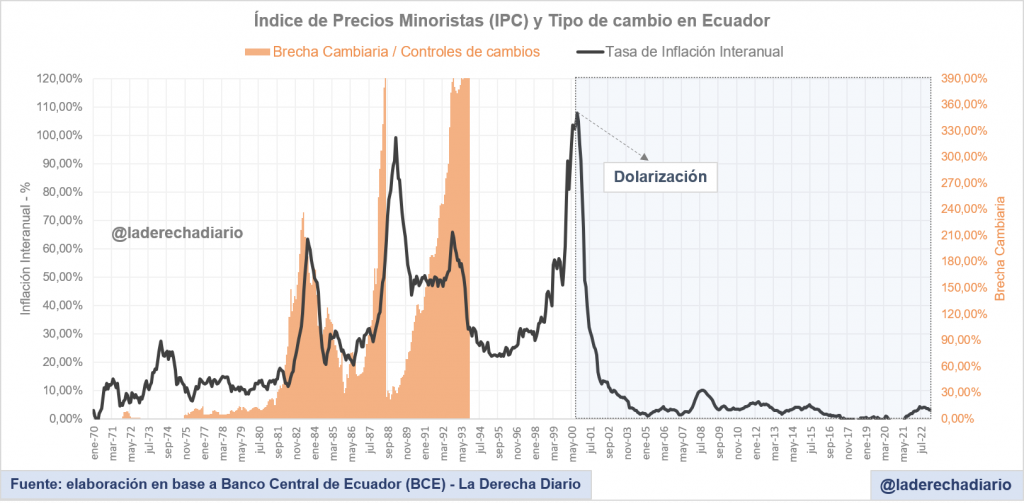

Like Argentina, Ecuador’s economy was characterized by high price volatility and multiple exchange controls implemented by various governments to suppress demand for foreign exchange as a refuge from inflation.

Retail inflation averaged 29% between 1970 and 2000, with an average monthly increase of 2.14%.

Likewise, the exchange rate gap between the free dollar and the one zealously determined by the Government reached 236% in May 1983, 410% in July 1988, and up to 407% in November 1993, when exchange controls had to be abolished due to the collapse of the Central Bank’s reserves and the impossibility to continue maintaining the legal parities.

The high inflation regimes throughout the 20th century were closely associated with price, wage, exchange, and capital account controls.

However, the dollarization process overcame all this since these tools became obsolete, and the inflationary problem was eradicated.

Stability allowed for a rapid reactivation of long-term credit, a phenomenon lost due to the lack of predictability (it was impossible to establish a credible interest rate for a ten or 20-year term).

Domestic credit for Ecuador’s private sector increased from 18% of GDP in 2002 to 47.2% by 2020 and continues to increase.

The lack of long-term credit has a major impact on access to home ownership, the financing of business projects that require heavy investment (especially utilities), and the opening of all types of investment projects.

With the new monetary regime, Ecuadorians stopped constantly worrying about the exchange rate of other currencies, about the erosion of their real wages and the desperation that this implies, or about the crises of “reserve management” in the framework of exchange controls.

All these elements were eradicated in Ecuador thanks to the dollarization process.

With information from La Derecha Diario