Mexico’s public finances were openly assaulted with the arrival of the left to power.

Under President López Obrador’s administration, not only did the regulatory and intervening weight of the State increase, but also its size concerning the economy as a whole.

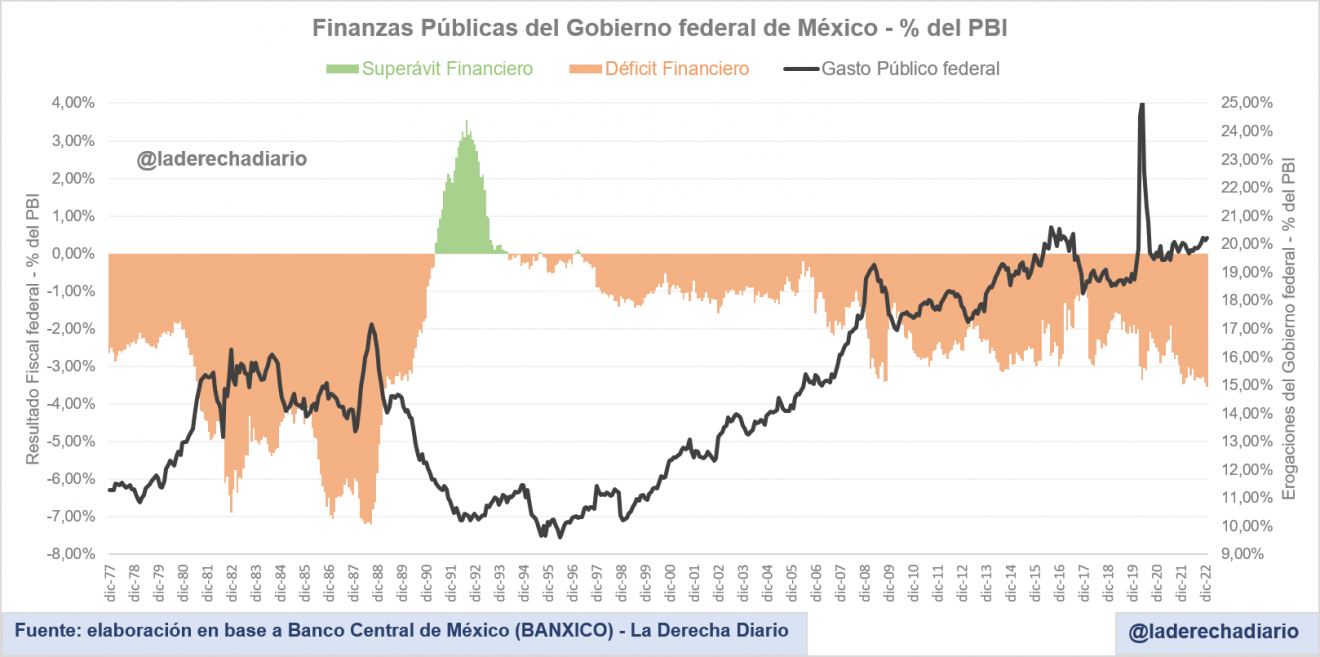

According to statistics from the Central Bank of Mexico (Banxico), the primary deficit of the Federal Government reached 1.13% of GDP in January 2023, the eighteenth month in which the annual accumulated result ends with a deficit.

President Obrador received the government with a primary deficit that did not exceed 0.2% of GDP in December 2018.

Despite overcoming the pandemic shock, it grew uninterruptedly since the third quarter of 2021.

The federal government’s financial deficit (excluding interest on public debt and local jurisdictions) increased to 3.53% of GDP in the first month of 2023.

Thus, the federal state’s imbalance reached the highest level in the last 34 years, something not seen since April 1989.

Total federal public sector outlays amounted to 17.8% of GDP in January, excluding the debt interest burden.

Primary expenditures increased by one point of GDP since the left came to power.

Likewise, total federal expenditures represented 20.2% of the reference product in the same period.

The government increased the weight of subsidies and transfers to state-owned companies but avoided taking compensatory measures in the form of budget adjustments in other areas or tax increases.

As a result, the new distribution of expenditures was passed on in a larger deficit in public accounts.

Secondly, refusing to move towards a comprehensive pension reform also puts increasing pressure on the current and long-term fiscal deficit.

The minimum retirement age remained unchanged at 65, and the formulas for calculating monthly pensions were not modified despite the aging population.

The greater imbalance in public finances conditions the reputation of Mexican public debt in international markets.

It simultaneously limits the effectiveness of the Central Bank‘s monetary policy as expectations about the evolution of the deficit in the medium and long term deteriorate.

Although the year-on-year inflation rate moderated to 6.85% in March, it remains at levels far from the monetary authority’s targets.

López Obrador’s six-year term has almost no assets to show politically.

The leftist reforms severely penalized investment, and the Mexican economy abandoned its long-term growth trend.

Economic activity only grew by 1% since December 2018 and accumulated a drop of almost 3%, considering the increase in population.

The per capita growth rate is the lowest for any six-year term in the last 100 years.

With information from La Derecha Diario