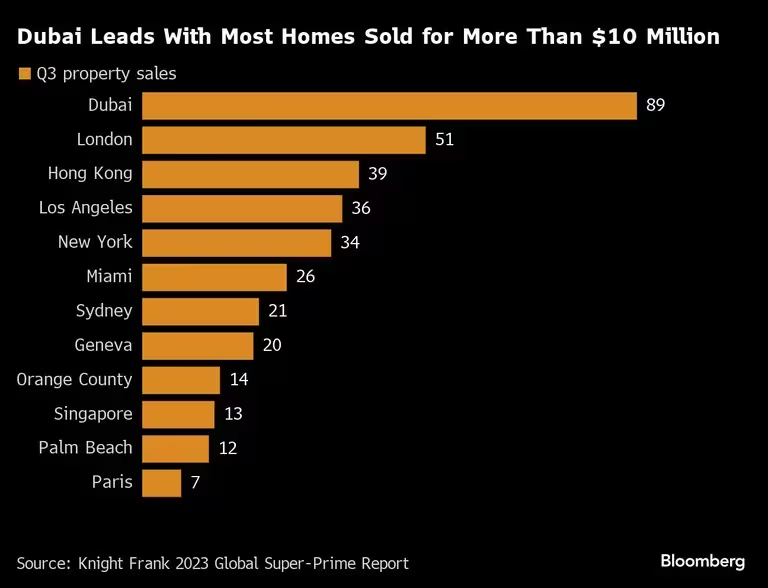

The global luxury real estate market saw a slight dip in the recent quarter, with 362 homes over $10 million sold across 12 markets.

According to Knight Frank, a real estate consultancy firm, this represents a 2.4% decrease from last year.

Key cities like London and Singapore experienced declines in their superprime home sales. London’s sales dropped to 51 from last year’s 63, while Singapore’s fell to 13 from 34.

New York also witnessed a downturn in luxury property transactions. Despite this global trend, Dubai stood out, demonstrating remarkable resilience.

The city recorded an increase with 89 sales of homes valued over $10 million, up from 58 in the same period last year.

Geneva and Hong Kong echoed this trend, showing growth in their luxury markets.

Dubai has emerged as a leader in high-end home sales. This performance is notable in the current global economic context.

The total global value of luxury home sales reached $31.7 billion in the past 12 months.

This figure surpasses the $18.6 billion spent in 2019, though it’s below the post-pandemic peak of $40.7 billion in 2021.

Liam Bailey from Knight Frank observed that superprime sales have been resilient compared to other segments.

The revival of travel and the completion of new luxury constructions have supported these sales.

However, Knight Frank anticipates a further decrease in luxury home sales next year. The construction of new high-end homes is expected to slow, impacting future sales.

This scenario highlights Dubai’s unique position in the luxury real estate market. While other global cities face challenges, Dubai’s market continues to thrive.

The city’s ability to attract high-end buyers, even in a slowing global market, underscores its appeal in the luxury real estate sector.