RIO DE JANEIRO, BRAZIL – Next Monday, October 19th, a Federal court will auction off 65 properties (lands, houses, apartments, commercial spaces) and 95 vehicles. It is the first time that courts will hold an online auction; the auctioneer in charge will be Fidalgo Auctions.

The assets will be auctioned at a 50 percent discount, or half of market value, and with payment in installments – 20 percent down plus 59 installments – depending on the proceeding.

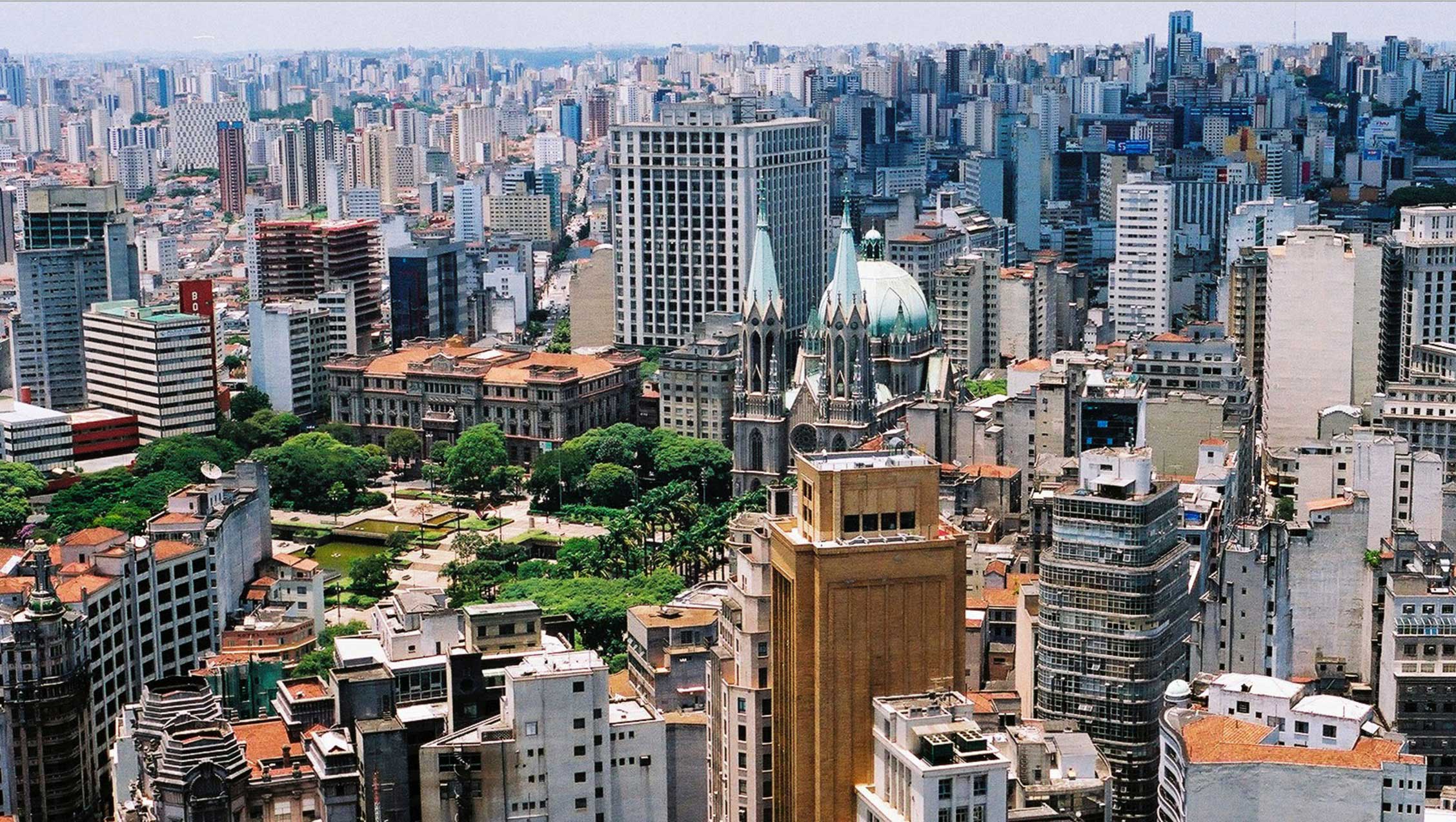

Most properties are located in the state of São Paulo, in the capital and the cities of Araçatuba, Barretos, Bauru, Botucatu, Campos do Jordão, Descalvado, Itapeva, Jaú, Jardim Paulista, Liberdade, Lucélia, Magda, Ourinhos, Pindamonhangaba, Pirituba, Salto Grande, Santo André, São Bernardo do Campo, São Carlos, São José dos Campos, São José do Rio Preto, Urupês. There is also a plot in Novo Acordo in Tocantins.

Among the properties, a building and its land located in the neighborhood of Jardim Peri in São Paulo stand out, with an initial bid of R$380,000. Among the vehicles are a Palio Fire Flex, manufacture year 2006, model year 2007 with an initial bid of R$17,209.0 and a Ford Ecosport FSL 1.6 Flex, year 2011, model year 2012 with an initial bid of R$34,300.00.

Any private person or company may take part in the auction, duly registered at www.fidalgoleiloes.com.br, where a complete list of assets to be auctioned is included.

Care when buying a property

Although discounts are attractive, before buying a property at an auction one must take some precautions. The first is to select properties that are vacant, since often the removal of residents from the auctioned properties may be disputed in the courts, even if the buyer has a letter of sale in hand that allows requesting eviction. To go to court, the property buyer will need to hire an attorney and need some patience, since the eviction date may take longer than expected.

Another important tip is to research if the property has other debts, such as IPTU (property tax) and taxes owed by the former owner. The payment of these debts will fall under the buyer’s responsibility. It is worth noting that the purchase of a property implies the payment of other expenses, such as the notary’s registration fee, and the real estate transfer tax (ITBI).

Likewise, it is essential to assess the payment method of the property as determined in the auction notice. Many auctions do not allow the use of a person’s FGTS (Severance Indemnity Fund) account for the payment of the auctioned property. The auctioneer must also be paid an additional commission of five percent of the bid value at the time of the auction. On the other hand, it is often possible to secure discounts of up to ten percent if the payment is made in cash. In general, a deposit corresponding to 30 percent of the property value is required and the outstanding balance may be divided into several installments. Some auctions allow the debt to be financed, but a loan must be taken out in advance.

Finally, one should check the description of the sales conditions, the state of conservation, the payment method, the minimum price, the auctioneer’s commission, taxes and the model contract that will be signed by the parties in the public notice.

Source: Exame