The four years of the administration of President Jair Bolsonaro laid the foundations for the most important economic transformation in Brazil since the 1990s.

The structural reforms postulated based on the Washington Consensus had been completely abandoned since the PT came to power in 2003, and the course could only be recovered 16 years later.

The work of Economy Minister Paulo Guedes, recognized for his orthodox views and educated at the University of Chicago, became crucial in launching Brazil’s economic transformation.

The economic model established after the four years of management pursued the following guidelines: the reform of the State and the privatization of public companies, fiscal discipline, monetary discipline, deregulation of the economy, and commercial opening.

REDUCTION OF THE STATE AND FISCAL DISCIPLINE

The Bolsonaro administration committed to eliminating the “fiscal dominance” regime that was putting inflationary pressures on prices.

The economic model recovered the base of the primary fiscal balance from the year 2022, a path that had been maintained as a constant since 1991 but was deliberately lost during the last administration of Dilma Rousseff.

The federal government’s primary deficit was completely eradicated as of January 2022, and a surplus close to 1% of GDP was recorded since June, the highest figure since October 2014.

This was achieved even by eliminating the harmful effect caused by the pandemic in 2020, which led to a red of almost 10 points for the GDP.

The consolidated financial deficit at the national level decreased from 7% of GDP in January 2019 to 4.15% in October 2022, a reduction of almost 3 points of GDP despite the pandemic.

Bolsonaro and Guedes promoted the reduction of the participation of the State in the economy. Primary disbursements (without interest) fell from 19.4% of GDP to 18.7% in 4 years of management, avoiding all the effect caused by the pandemic.

This is because spending fell by almost 8 points of GDP between November 2020 and October 2022, a drastic fiscal adjustment in record time.

TAX REFORM

The Government modernized and simplified Brazil’s tax system to eliminate distortions on investment decisions in the economy and promote the so-called “supply policies” as an engine of growth.

An update of the non-taxable minimum on Personal Income Tax (IRPF) was approved above the evolution of prices.

This caused millions of people to stop paying the tax (up to 16 million in 2021 alone), and a reduction that affected low- and middle-income sectors more than proportionally.

The tax reform also affected companies, and an exemption of R$20,000 was provided for the payment of Income Tax on profits and dividends. The system unified the tax treatment for the payment of dividends and salaries.

The capital gains tax (financial income) was reformed, and progressive rates were eliminated for the amount of time money retained in the financial system, the highest reaching 22.5%.

The reform introduced a single rate of 15% for all companies for 2021, 12.5% for 2022, and budgets for a rate of 10% for 2023 (now called into question after the election of Lula da Silva).

Two reductions on the internal tax on industrialized products were promoted, a first of 25% in April 2021 and another 35% in August 2022.

It is an extremely distortionary tax with an anti-export bias, levied on household goods with rates ranging from 0% to 300% on more than 9,000 categories. Its reduction was a great boost to the country’s aggregate supply.

Bolsonaro approved a historical reduction of the Tax on the Circulation of Merchandise and Services (ICMS) in the segment applied to fuel, energy, telephony, and internet.

Before the reform, each local State could impose an ICMS rate between 18% and 35%, and after the reform, the margin was fixed between 17% and 18%.

Likewise, the federal government eliminated the tax on liquefied petroleum gas (LPG) from March 2022.

The measures allowed a historic reduction in the price of fuels and an ordering of relative prices in the economy, even enduring the successive supply shocks from the war between Russia and Ukraine.

MONETARY DISCIPLINE

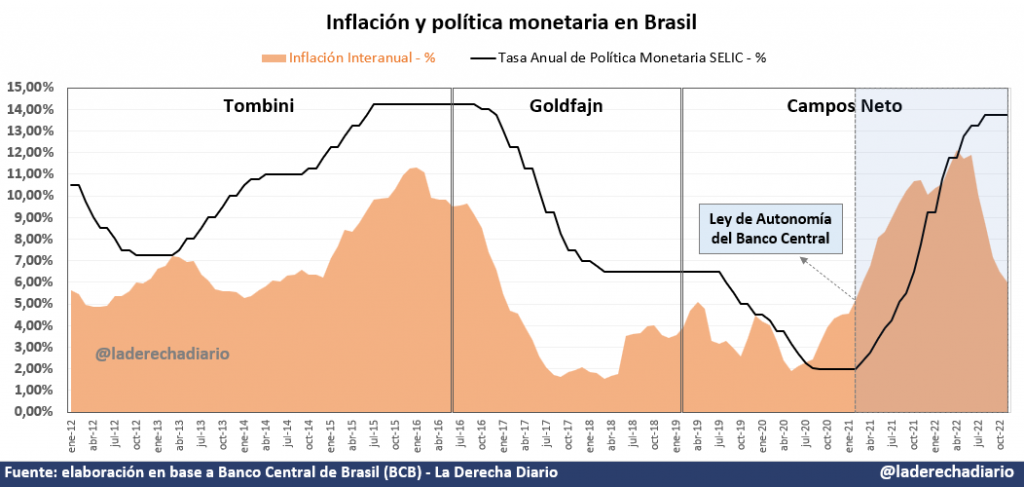

Bolsonaro signed the Central Bank Autonomy Law in February 2021, thus giving the country’s monetary authority the necessary tools to control inflation regardless of the political power in power.

The mandates of the President of the central bank set by law do not conform to political mandates.

In this way, it is guaranteed that each head of state has to live with the leadership of the central bank inherited from his predecessor.

This condition must be considered when developing fiscal policy. The dismissal of a President of the Central Bank without cause is explicitly prohibited.

The greater legal guarantees for monetary independence and the strong fiscal responsibility on the part of the Government allow Brazil not to have risks of fiscal dominance.

Inflation responded positively since the effect of the central bank’s monetary policy was enhanced as its reputation was strengthened.

Retail prices stopped rising from July, averaging an average monthly increase of -0.09% through November, and year-on-year inflation collapsed from 12.1% in April 2022 to 6% in November.

The central bank’s targets have become credible, and inflation is close to the 5% target for December.

PRIVATIZATIONS

The Government completed the successful privatization of hundreds of public companies, a balance of up to 115 entities until August 2021, and the process continued without interruption throughout 2022.

The electric giant Eletrobras was transferred to private hands in June 2022 for an amount of US$6.855 billion. It was the most important privatization in the history of Brazil in 30 years, selling up to 55% of the company’s share package.

The privatization of Correios, one of the largest companies in the country and South America in its field, was approved. Up to 30,400 hectares of national parks were privatized, and the Ministry of Infrastructure celebrated the sale of 28 airports throughout Brazil with concession terms of 30 years.

Brazil’s port authorities were privatized, and the Ministry of Economy implemented 35-year concession contracts at auctions held with companies interested in investment.

Bolsonaro gave the green light for the historic privatization of the Petrobras company, but the operation was halted after the election results and the lack of investor confidence due to an almost certain reversal after the assumption of Lula da Silva in 2023.

DEREGULATION OF THE ECONOMY

As indicated by the World Bank’s Regulatory Quality Index, the President carried out the general deregulation of the markets. The most important deregulation was carried out on labor legislation.

Bolsonaro introduced flexible contracting modalities to promote the formalization of work.

The Special Regime for Qualification and Productive Inclusion (REQUIP) targeted the employment of young people and eliminated the mandatory Christmas bonus and the contribution to unemployment insurance.

The First Opportunity and Employment Reintegration Program (PRIORE) targeted young people and people over 55 years of age.

A flexible modality was created that eliminates social charges for up to 25% of the staffing of an average company.

Profits increase the smaller the company.

The seasonally adjusted unemployment rate fell to 8.5% in October, reaching its lowest level in the last 7 years. Only since the launch of the reform has a fall of more than 4 percentage points accumulated.

COMMERCIAL OPENING

The administration promoted the opening of the economy through the elimination of non-tariff barriers.

Non-automatic import licenses on 600 tariff items were eliminated, and the use of the “reference price” for the application of all the remaining licenses was eliminated, an element that, in practice, functioned as an informal anti-dumping barrier.

Tax exemptions on food and basic necessities were also allowed in accordance with the Mercosur nomenclature’s flexibility.

A 10% reduction was pressured on the Common External Tariff of the trade bloc.

ECONOMIC GROWTH AND SOCIAL DEVELOPMENT

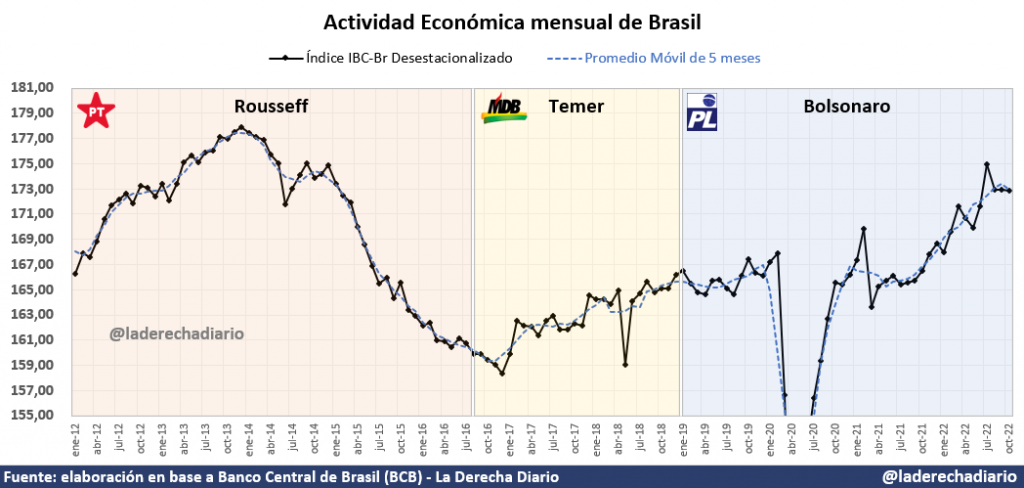

The reforms allowed the recovery of economic activity to its highest level since 2014. Accumulated growth of 3.8% over the IBC-Br index between January 2019 and October 2022, the activity indicator prepared by the Central Bank of Brazil.

In 2020, the lowest extreme poverty rate since 1980 was reached, according to World Bank estimates, above a threshold of US$2.5 per day adjusted for income parity.

With information from La Derecha Diario