RIO DE JANEIRO, BRAZIL – The current drop in oil prices on the international markets has serious consequences for Venezuela. The South American country is highly dependent on oil exports.

For years, oil sales have accounted for well over 90 percent of Venezuela’s exports. It is estimated that Venezuela could lose between US$4.5 billion (R$18 billion) and US$9 billion in revenue this year.

Economist Luis Alberto Bárcenas of the Ecoanálisis Institute points out that the country also pays part of its foreign debt in oil. When prices drop, the country must supply more oil to pay off the debt, which reduces the amount available for sale.

Luis Crespo, an economist at the Central University of Venezuela (UCV) in Caracas, believes that reduced export revenues could plunge the government of President Nicolás Maduro into financial distress.

“This crisis will have a major impact and further exacerbate Venezuela’s budget deficit,” the economist said. Crespo believes that the government will be forced to make cuts, particularly in state salaries, petrol, and food imports.

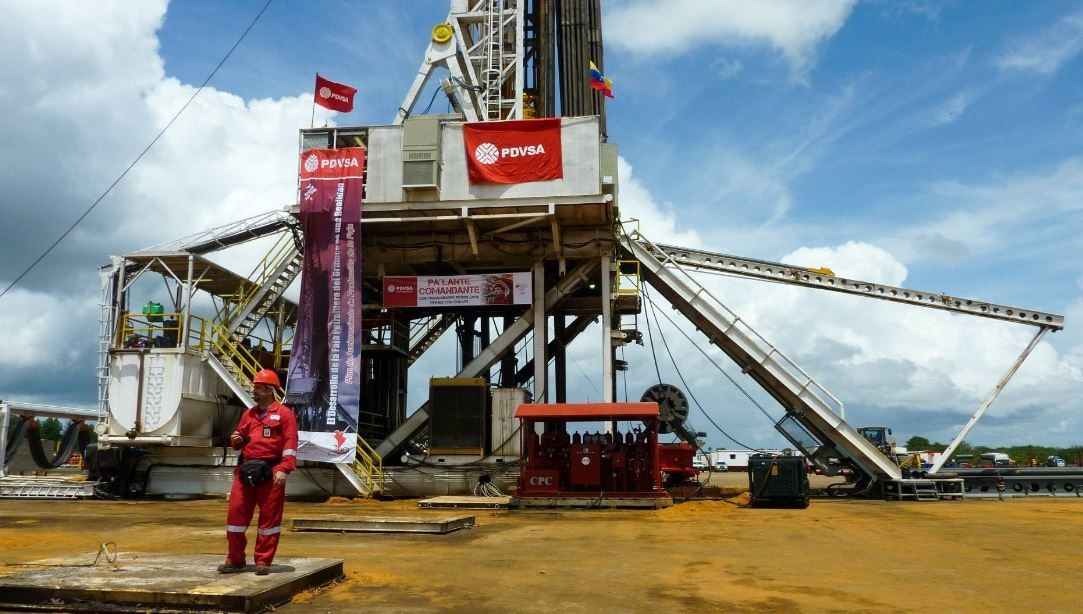

According to a Reuters news agency report, Venezuela’s state-owned oil company PDVSA offered its customers discounts of up to US$23 per barrel this week. At a standard price of around US$33 for Brent oil, Merey grade Venezuelan oil would currently cost only US$10-15 per barrel.

The production costs per barrel in Venezuela amount to between US$10 and US$12. In addition, the company pays tax to the government. Therefore, there is currently no guarantee that Venezuela will be able to profit from the export of crude oil.

Energy expert Francisco Monaldi of Rice University in Houston (USA) is quoted in the Reuters report with gloomy projections: “If the price collapse continues, I envisage a catastrophe for Venezuela. The combination of unfavorable variables is fatal,” the economist said.

In addition to the drop in prices, there are the strict sanctions imposed by the USA on PDVSA and the Venezuelan state. After initial financial sanctions against PDVSA in August 2017 and an oil embargo in January 2019, the US government imposed a general ban on all business with Venezuelan state-owned companies in August 2019.

This also affects third countries and companies worldwide, which will face penalties from the US authorities if they cooperate with PDVSA.

The USA has recently imposed a fine on the Russian group Rosneft and its subsidiary Trading SA for dealing in Venezuelan oil. This week, the USA has now added to this fine and blacklisted the subsidiary TNK Trading International.

The US is still committed to “attacking those who support the corrupt regime’s oil production,” said US Treasury Secretary Steve Mnuchin.

Such a use of unilateral coercive measures on an extraterritorial basis may be contrary to international law, but it is causing increasing difficulties for Venezuela’s oil industry.

The situation is viewed as critical across the political camps in Venezuela. President Maduro described the drop in prices as a “brutal blow”. Opposition politician Juan Guaidó, who supports US sanctions against his country, also described the declining oil prices as a “tragedy” for Venezuela.