New year, new government, new business. The Brazilian business environment begins a new cycle in 2023 with expectations of changes in the rules of the regulatory scenario, a development turn and less fiscal discipline in the public sector, with the risk of tax increases and greater vigilance by the authorities and interference in the expansion plans of state companies.

Strategic sectors such as oil, energy, mining, civil construction, agribusiness, infrastructure and finance should be those that receive the most attention in the Lula da Silva government, according to analysts consulted by Bloomberg Línea.

Starting in February, with the renewal of the National Congress and the inauguration of the new parliamentarians, lobbying groups will have to mobilize to influence the legislative agenda, which is likely to be dominated by debates such as tax reform.

The fiscal expansion package of RS170 billion (US$32.3 billion) per year to increase social spending, which Lula da Silva managed to convince Congress to approve, turned out to be larger than expected, with possible repercussions for debt sustainability”, evaluated the BTG Pactual’s team of strategists in a report on their expectations for January.

“To avoid a further deterioration in country risk and a worse growth/inflation mix, it is possible that the new government will have to create compensatory measures (tax increases?) to finance more spending,” they analyzed.

The local macroeconomic scenario, characterized by high interest rates and still worrisome inflation, must also evolve following the trends dictated abroad, mainly by the economic rhythm of the largest economies in the world (USA, China and Europe), weakened by monetary tightening to contain prices and awaiting the end of the war between Russia and Ukraine.

The predominantly political profile of Brazil’s new cabinet of ministries generates distrust in the market.

“The selections of the economic team of the new government caused the fear of a return to state interventionism that characterized the last years of their previous mandates (2003-2010). Brazil needs a reformulation of the fiscal rules and a tax reform to guarantee long-term growth and fiscal solvency”, analyzes the report by the consulting firm hEDGEpoint Global Markets, specialized in markets for raw materials, agriculture and energy.

See what analysts expect for seven business areas of the Brazilian economy.

1. SALE OF REFINERIES

Businesses at risk: sale of Petrobras refineries in the states of Paraná (Repar), Rio Grande do Sul (Refap) and Pernambuco (Rnest). The new government must negotiate the revision of an agreement signed in 2019 with the Administrative Council for Economic Defense (Cade), the country’s antitrust body, and withdraw the commitment to privatize eight refining plants and their respective logistics infrastructures.

Businesses on the radar: the new Petrobras must seek more opportunities in energy transition projects in three areas (hydrogen, offshore wind and carbon capture).

Investments are expected in projects to decarbonise the company’s operations, such as the electrification of platforms, the gas recovery system, energy efficiency and the reduction of emissions in refineries.

We see good reasons for Petrobras to position itself in sectors linked to energy with a lower carbon footprint,” says Daniel Cobucci, an analyst at Banco do Brasil, recalling two recent multimillion-dollar operations in this segment (the purchase of Archaea Energy, producer of biogas, by British Petroleum; and the announcement of the acquisition of a stake in Casa dos Ventos by the French company TotalEnergies).

2. NEW AREAS FOR MINING

Businesses at risk: exploration licenses for granite, quartzite and marble, granted during the Bolsonaro government, which must be reviewed. Gold and tin mining projects in the Amazon could also be suspended. Galvani Fertilizantes and the INB (Nuclear Industries of Brazil) may have difficulties in moving forward with the Santa Quitéria Project, which intends to exploit uranium in the state of Ceará.

The new Minister of the Environment, Marina Silva, defends the same opinion of environmentalists concerned about the risks of contamination of the population by the element.

Business on the radar: supervision and control of Tailings regulations must be stricter after the environmental disaster of the Vale dam in Brumadinho, in the Brazilian state of Minas Gerais in 2019. Companies will demand more works to reduce risks and care for the environment. Vale expects not to have any dams in critical safety status (emergency level 3) until 2025.

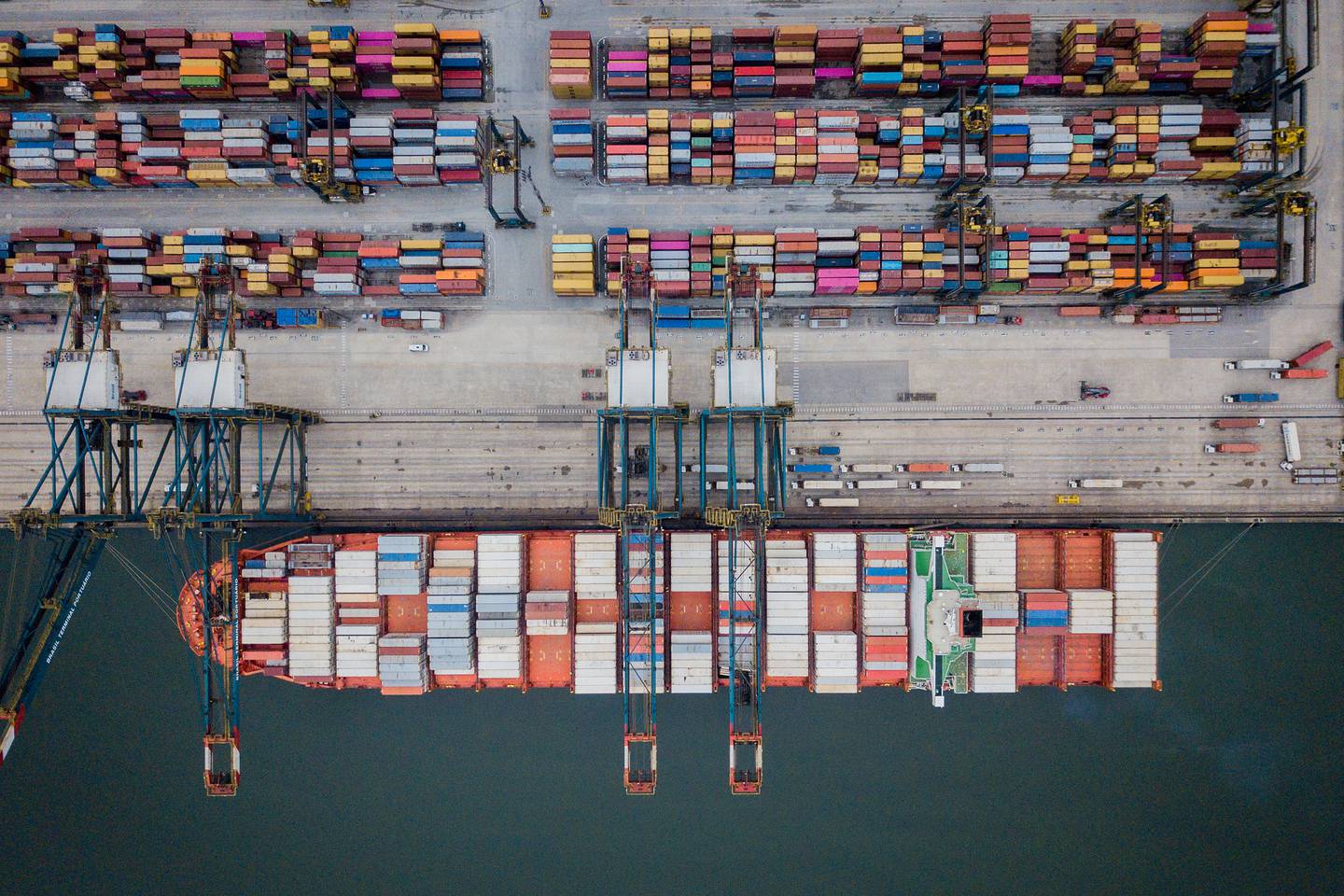

3. PORT OF SANTOS CONCESSION

Businesses at risk: the privatization plan for the port of Santos, the largest in the country, may be shelved. The new governor of the state of São Paulo, Tarcísio de Freitas, is willing to insist on his project by negotiating with President Lula da Silva, but the market considers that, at most, the federal government would support the concession of some areas of the port to companies of docks.

Knowing the port sector, the former governor of São Paulo Márcio França was sworn in on Monday as Minister of Ports and Airports of the Lula da Silva government.

Business on the radar: The new government plans to resume the Growth Acceleration Program (PAC), launched by Lula da Silva in 2007. Now, the focus will be to complete infrastructure works in progress or at a standstill, attracting partnerships with the private sector. Roadworks, focused on transport logistics, should boost collaboration between the new administration and contractors.

The Minister of Transportation, Renan Filho, said at the inauguration, held on Tuesday (3), that the recovery of the highway network will require about R$100 billion (US$19 billion) in investments and that the new railway projects can be implemented through PPPs (public-private partnerships).

4. NEW ELETROBRAS

Businesses at risk: the privatization of Eletrobras, in 2022, would not be challenged, as it would increase the perception of legal uncertainty, but regulations such as the obligation to contract energy from thermal plants and small hydroelectric plants (PCHs) may be questioned, according to analysts. The expected privatization of Companhia Paranaense de Energia (Copel) in 2023 risks losing momentum.

Businesses on the radar: incentives are expected for the construction of small hydroelectric, solar, wind and biomass plants, because the new government’s discourse is to develop renewable energy sources The National Bank for Economic and Social Development of Brazil (BNDES) would reinforce its lines of credit, such as RenovaBio, for energy efficiency programs for the productive sector.

5. REAL ESTATE MARKET

Businesses at risk: The high interest rates in Brazil (13.75% per year) continue to slow down the increase in real estate financing in the country. The market rules out the start of the rate cut before the second half of 2023. This means that construction companies with financial difficulties will have to suspend the launches, without generating cash.

Businesses on the radar: construction companies that serve the low-middle income public, such as MRV, one of the largest in the country, can benefit from the measures to combat the housing deficit promised by the new government, such as the resumption of the Minha Casa, Minha Vida program.

The program must gain new modalities such as urbanized lots, social rent, as well as tax incentives to induce the construction or rehabilitation of idle buildings in urban centers.

“There is a signal from the new government to resume the Minha Casa Minha Vida program. If, on the one hand, the high interest rates on housing loans represent a more challenging scenario for the middle-income market, on the other hand, there is a prospect of a resumption of the low-income housing market, which may mitigate the retraction of the segment”, says Ana Maria Castelo, coordinator of construction projects of FGV Ibre (Brazilian Institute of Economy of the Getúlio Vargas Foundation), about the signs of improvement in confidence in the sector, as an indicator of expected demand.

6. CREDITS FROM PUBLIC BANKS

Businesses at risk: in 2022, high delinquency has led the main Brazilian banks to increase provisions for bad debts, putting pressure on their profitability. The financial sector anticipates a slowdown in the rate of credit granting, with a more rigorous risk analysis by banks. Rising loan spreads are expected to offset the sluggish capital market.

Businesses on the radar: Public banks such as Banco do Brasil, Caixa Econômica Federal and BNDES should gain more prominence with the new government’s plans to avoid a recession and mainly encourage small and medium-sized companies through subsidized rates. These financial institutions can increase their teams through public tenders and open new branches.

Some 120 calls are expected and up to 55,000 vacancies in the most varied bodies, according to Agnaldo Bastos, a specialized lawyer or in public tenders. “Lula’s new government will focus more on the public machine and will invest more in federal public tenders,” says Bastos.

7. AGRIBUSINESS EXPORTS

Businesses at risk: agricultural and ranching activities linked to cases of deforestation, fires and environmental degradation will face greater inspection by federal authorities, as promised by the new government. Control over the list of pesticides may also be strengthened, as well as actions to protect the territories of traditional peoples, especially in the Amazon.

Businesses on the radar: incentives for the development of cooperatives of rural producers and family and sustainable agriculture are on the program of the new government. Banco do Brasil should be encouraged to reinforce the disbursements destined to finance the Plano Safra for crops, as well as to expand the businesses of the agro-productive chain, simplifying the processes, especially for small and medium-sized producers and ranchers.

With informatiom from Bloomberg