By Juliana Estigarríbia

A fundamental metal in the infrastructure sector, copper is gaining a new status with the accelerated growth of electric car sales worldwide.

In addition to mining companies, the auto industry raises the stakes for copper projects in Latin America to secure raw material supplies for electrified vehicles.

And despite the expansion movement toward the mining sector, investments may be insufficient to meet the demand that lies ahead.

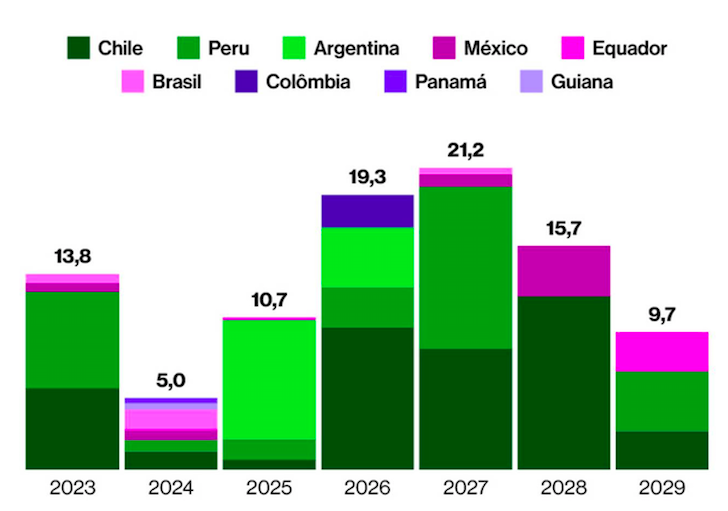

From 2023 to 2029, estimated investments in 68 copper projects in the region total US$95.4 billion, according to a survey by KPMG at the request of Bloomberg Línea.

Chile, Peru, and Argentina lead in values, respectively.

Mexico, Ecuador, and Brazil come next.

According to the study by the global consulting firm, a global fall in copper production is expected as of 2024 due to a reduction in the volumes produced at the mines already in operation – a phenomenon known as depletion – which should generate a deficit of 5.1 million tonnes by 2030 against an annual demand of 28.4 million tonnes worldwide.

According to KPMG, the 20 major copper projects under development in Latin America have the potential to supply an important part of this deficit. But not eliminate it.

For Adriano Levi, strategy and transaction advisory partner for KPMG’s natural resources and energy industries, there has been a lack of synchronism between the latest waves of investment in copper projects and the current demand, which stems from a relatively fast energy transition movement.

“Historically, copper is used in construction, telecommunications, and industrial equipment. Now, we are seeing a strong demand boost with the energy transition, as the metal has great conductivity and has been applied in renewable energy projects and electric vehicles,” he said in an interview with Bloomberg Línea.

Mining giants are conducting relevant copper projects in Latin America.

This is the case of Brazil’s Vale, which, besides holding the metal’s main assets in Brazil, is looking for opportunities in Peru.

The British Anglo-American, the Australian BHP, and the Chilean state-owned Codelco also stand out in this race.

In Brazil, niche companies such as Ero Copper, with operations in Bahia and headquarters in Vancouver, Canada, and the British Appian Capital, with operations in Alagoas, are also betting on the business.

“Mining has a relatively long cycle, which starts with research and then evolves to the proof of reserves and licensing.”

“Regardless of the country, it is a challenge. For a project to effectively enter the production phase, it can take 10 to 15 years,” explained KPMG’s lead partner for mining, Ricardo Marques.

Marques said that market conditions for mining are not as favorable, which may impact new copper prospecting.

“The supply of various types of ore is not necessarily going to keep up with the demand generated by the energy transition.”

Otavio Costa, portfolio manager at Crescat Capital, based in Denver, United States, pointed out another challenge: the lack of skilled labor.

According to him, there is currently a shortage of geologists in the global market, a reflection of the mining downturn just over a decade ago.

The manager explained that the mining industry is divided into three parts: exploration, development, and production, and geologists are of paramount importance to kick-start projects.

“The lack of manpower leads to inefficiencies in the industry, which is compounded by the scarcity of capital in the market,” he assessed.

But despite the challenging environment, copper operations are gaining increasing value.

Levi pointed out that Vale decided to sell a slice of its base metals unit with an eye on the sudden increase in demand from the automotive industry.

Swiss commodities giant Glencore is also said to be eyeing the base metals division of Canadian miner Teck Resources for the same purpose.

THE AUTOMOTIVE INDUSTRY ALSO INVESTS

According to the director of Bright Automotive Consulting, Murilo Briganti, copper represents about 10% of the minerals present in the batteries of electric cars.

He explained that copper is responsible for conducting the electricity from the outside of the battery to the inside, and vice versa, hence its importance.

In 2022, 13% of global new car sales were electrified models.

Today this level is around 18%. And the trend is increasing every year.

In this context, the major automakers have also entered the race for copper supplies.

At the end of February, Stellantis, the Fiat, Jeep, Peugeot, and Citröen group, announced a US$155 million investment in a copper project in Argentina.

The group’s CEO for South America, Antonio Filosa, said in an interview for Bloomberg Línea that the plan to expand the supply of electric vehicles considers the search for more copper and lithium assets, raw materials used in fleet electrification.

“Just like copper, lithium is also of great interest to us in the future.”

“We are looking 360 degrees at opportunities, doing risk analysis on the supply of these raw materials required directly in battery production,” Filosa told Bloomberg Línea.

Stellantis agreed to acquire a 14.2% stake in McEwen Copper, a subsidiary of the Canadian mining company McEwen, which owns the Los Azules projects in Argentina and Elder Creek in Nevada, US.

With the transaction, the automaker becomes McEwen Copper’s second-largest shareholder, alongside the Anglo-Australian mining giant Rio Tinto.

The executive also highlighted that the group evaluates reserve opportunities in Brazil, Chile, Argentina, and other South American countries.

KPMG’s Levi noted that there is indeed a verticalization movement in the automotive industry to secure raw materials through direct purchase of participation in mining projects and by establishing long-term contracts for supply.

“We didn’t see this movement so much in the past, but today this is much more common,” he said.

In February, General Motors (GM) announced a US$650 million investment in a company that promises to explore lithium in the US state of Nevada.

According to Bloomberg News, Tesla is also evaluating the lithium mining assets of Sigma in Brazil.

INVESTMENTS IN BRAZIL

According to the National Mining Agency (ANM), Brazil’s copper potential is found mainly in the Carajas region of Pará.

Other important potential areas to be explored are in the Juruena Mineral Province, in Mato Grosso, the Arco Magmatic Goiás, in Goiás and Tocantins, and the Cuprífero District of the Curaçá Valley, in Bahia.

According to the authority, the main copper-producing companies in Brazil are Vale, in the state of Pará; Lundin Mining, in Goiás; and Ero Copper, in Bahia and Pará.

Today, several projects expect to expand production in the country.

There are 3,289 research authorization processes and 41 processes of mining concession for copper currently in progress at the agency.

The ANM reported, however, that some copper mines in Brazil are close to exhaustion.

According to the coordinator of Mining Affairs of the Brazilian Mining Institute (Ibram), Aline Nunes, old copper projects have been resumed, given the high global demand.

From 2022 to 2026, the expected investment in copper projects in Brazil was US$1.3 billion, according to Ibram’s monitoring.

The projection has jumped to US$4.5 billion between 2023 and 2027.

Despite the positive movement, the Ibram coordinator made the caveat that there are challenges in the segment.

“We have bottlenecks in developing mineral research and quantifying the size of reserves. We don’t see rapid changes in this sense.”

According to her, today, Brazil has a portfolio of 10 projects in the copper area in the hands of the main mining companies in the industry.

The largest copper reserves in the world are in Chile, followed by Peru, China, and the United States, according to data from the United States Geological Survey (USGS).

Although the proximity to large copper-producing countries might suggest that Brazil’s geological formation is similar, Nunes explained that mineral deposits vary greatly over small distances.

“Brazil is not among the main global producers, but there are promising regions,” he said.

One of them is the Amazon region that became known as the National Reserve of Copper and its Associates (Renca), created in the 1980s during the military regime to concentrate mineral research in the hands of the public mining company (CPRM).

Experts report that located in Pará and Amapá, the area of approximately 47,000 square kilometers – equivalent to the state of Espírito Santo – has great potential for deposits.

But the questioning of its exploitation has never allowed the activity to advance.

Environment Minister Marina Silva, facing a battle over oil exploration at the mouth of the Amazon by Petrobras, may have to deal with yet another clash over mineral resources in the Amazon.

As reported by the newspaper O Estado de S. Paulo last week, parliamentarians from the region want to resume discussions to liberate mining in Renca.

For the leader of Ibram, however, there is no forecast to take an exploration of the reserve from the paper.

“We have research development in other areas of Pará,” he said.

With information from Bloomberg

News Latin America, English news Latin America, Latin American copper