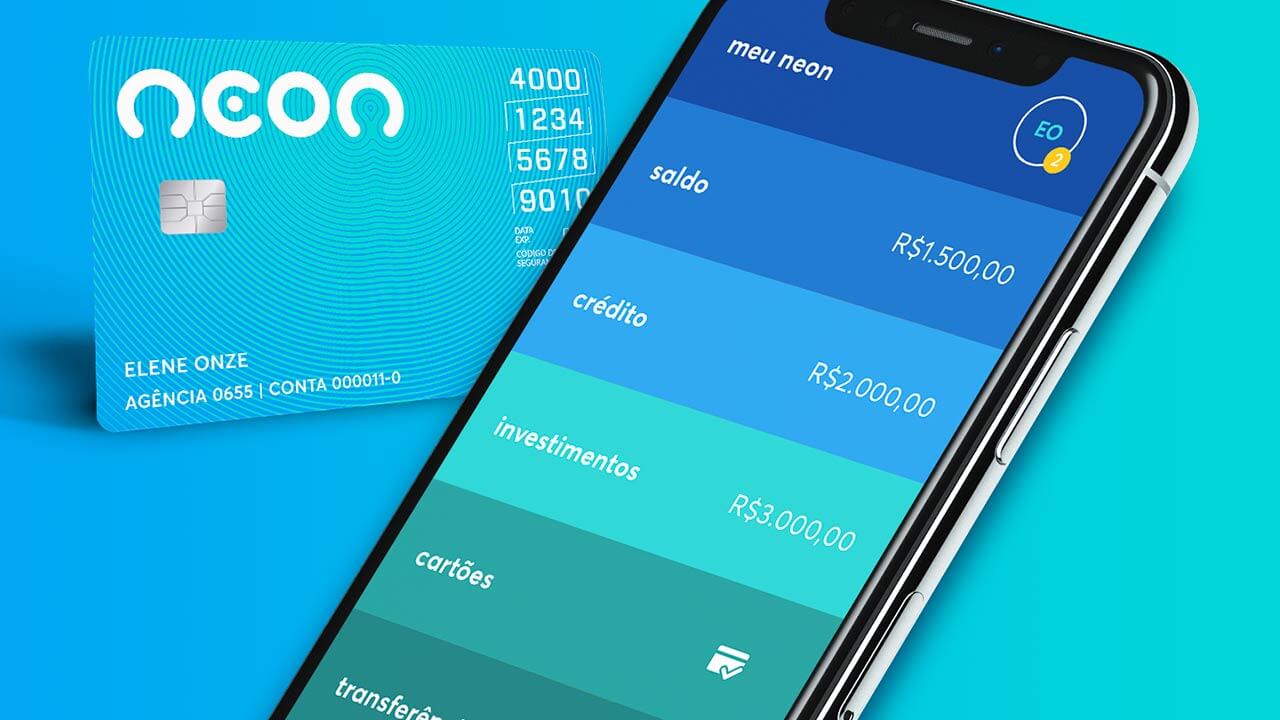

RIO DE JANEIRO, BRAZIL – By building an ecosystem to meet the diverse financial demands of its clients, fintech Neon is extending beyond the payments bearing its name. In late 2019, it bought MEI Fácil, a platform that provides services to microentrepreneurs, and on Thursday, July 16th, it announced the acquisition of Magliano Invest brokerage’s license – the client portfolio and fund management had already been sold to Guide.

“The goal is to become the preferred center for customers, whether in terms of cards and digital accounts or investments,” says Fabio Ramalho, responsible for Neon’s investment area.

The entry of General Atlantic and BV in November last year – with a contribution of R$400 million (US$80 million) – expedited the fintech’s growth, which will now join the dispute with major investment platforms, such as BTG Digital. The difference lies in the public that, in Neon’s case, is low-income.

Some 30 percent of the new customers at the B3 listed fintech have an initial investment of R$500, while 40 percent invest between R$500 and R$5,000. This could obviously mean caution, but it could also be a democratization of access, as was the case with Murilo Duarte – better known as ‘Favelado Investidor’ (Favela Investor). This is Neon’s public, which today has nine million accounts opened among both individuals and companies.

The transaction with Magliano, which still needs the Central Bank’s endorsement to materialize, has not been disclosed. Until this occurs, the aim is to strengthen the relationship with clients in order to understand the products and services that best suit their reality. “The starting point has to be the definition of life goals so that, from there, we can help them choose investments, offering financial data,” it explains.

Magliano’s choice was not by chance. The 90-year-old brokerage house – registered as number 001 in the stock exchange – has always been guided by financial education. “There was a boom in the stock market between 1969 and 1970, but soon after came a crisis. Investors fled and only returned 20 years later,” recalls Raymundo Magliano Neto, president of the brokerage house that bears his surname.

“We realized that Neon cares about the educational aspect, and it is the opportunity to attract low-income people to the stock market. It doesn’t matter the amount of each person’s cash.”

Asked about the future, Magliano says that he and his father, former president of the stock exchange, have nothing certain yet, but one way or the other they will remain in the capital market.

Source: Exame