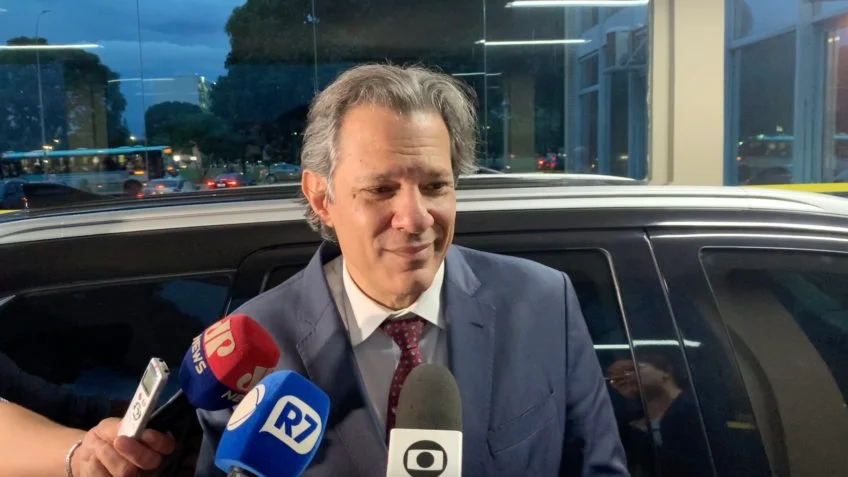

On April 3, Finance Minister Fernando Haddad emphasized the significant influence of Petrobras’ investment plan on future dividend distributions.

Haddad explained in a press conference that dividend outcomes are directly linked to the execution of Petrobras’ investment strategy.

The assessment hinges on whether financial resources will suffice for planned investments. A schedule has been drafted, yet details remain under wraps.

The Finance Minister awaits conclusive data from Petrobras’ leadership, responding to the board’s concerns.

He expressed assurance in the company’s fiscal strength, sufficient to support the investment agenda.

Previously, on March 7, Petrobras decided against issuing extraordinary dividends from 2023’s profits, opting instead to bolster reserves.

At the forthcoming Annual General Meeting on April 25, a proposed dividend of R$ 14.2 billion ($2.84 billion) will be considered, meeting the minimum requirement of its policy.

Additionally, R$ 43 billion ($8.6 billion) is earmarked for statutory reserves, a move solidified in 2023 with a new corporate statute.

Background

Brazil’s President Luiz Inácio Lula da Silva emphasized in March the need for Petrobras to allocate more funds to investments than to shareholder dividends.

During a televised SBT interview, Lula criticized the oil giant for planning to distribute R$80 ($16) billion in dividends.

In 2023, Petrobras marked itself as the world’s fourth-highest-earning oil company, boasting profits of $24.9 billion.

This achievement came even as its earnings dipped from the prior year, moving it up the profitability ladder among global oil giants.

Petrobras stood out among state-owned entities, securing second place, right after Saudi Aramco.

The Saudi powerhouse topped the overall chart, with profits five times higher than ExxonMobil, the runner-up in profitability.