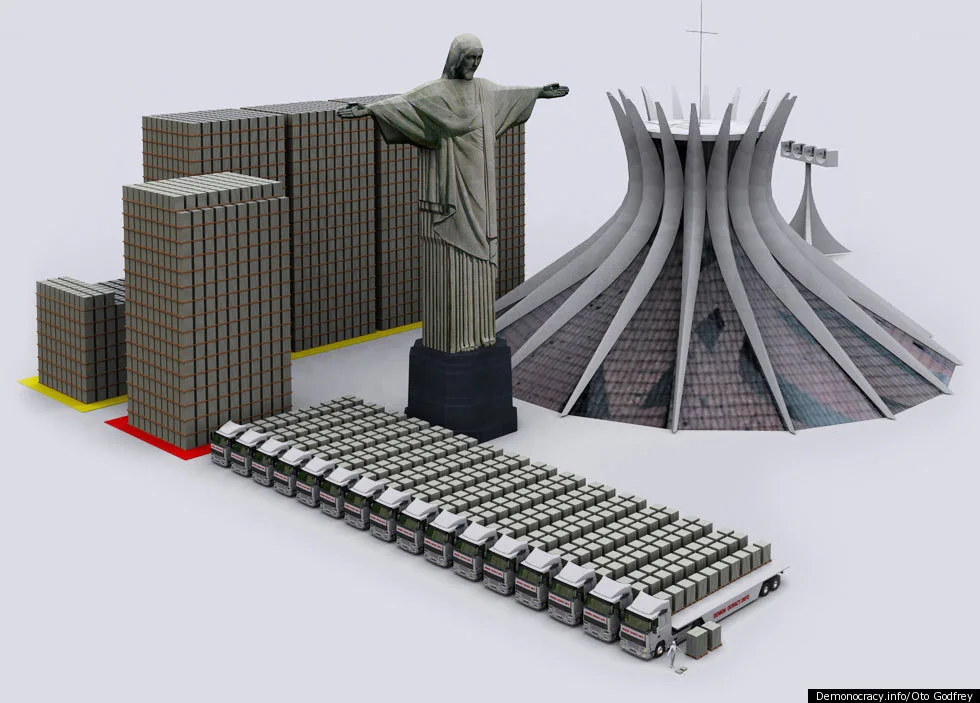

From January to September 2023, Brazil’s leftwing government reported a $22 billion deficit. This is a stark contrast to the $9 billion surplus during the same period in 2022 under Bolsonaro.

The National Treasury highlighted these figures, pointing to a concerning fiscal shift.

Finance Minister Fernando Haddad had initially set a $24 billion deficit limit for the year 2023.

However, Rogério Ceron, the National Treasury Secretary, believes reaching this target is challenging.

There are two major reasons for this concern. Firstly, a $5 billion legal payout to states has been mandated.

Secondly, inflation and currency fluctuations led to a loss of up to $7 billion in tax revenue.

Additionally, Ceron highlighted an expected revenue gap from the Tax Appeals Board, known as Carf.

The initial expectation was to raise $12 billion this year, but now only $2.4 billion seems realistic.

Despite these financial hurdles, Ceron reassures that the government remains dedicated to its fiscal objectives.

Interestingly, the month of September showed a brighter picture. A surplus of $2.7 billion was recorded, making it the best September since 2010.

Unclaimed funds from PIS/Pasep, a social program, boosted the surplus by an additional $6.2 billion.

When compared to September of the previous year, this shows a slight 0.4% increase in surplus.

This financial landscape reveals the volatility and unpredictability of government finances. Although setbacks occur, efforts are in place to meet fiscal goals.

The upcoming months will be crucial in determining whether the government can turn the situation around.

Background

The financial status of Brazil’s government serves as a critical indicator for economic stability.

Historically, Brazil has struggled with economic volatility, marked by bouts of inflation and fluctuating currency values.

This deficit is not an isolated case; in 2020, Brazil faced its worst deficit since the financial crisis.

Therefore, these new figures are causing concern among policymakers and investors alike.

Brazil’s prior surplus in 2022 had raised hopes for a more stable economic future. However, the current deficit is challenging this optimistic outlook.

Meeting fiscal goals is not only important for internal economic health but also influences how the country is perceived by foreign investors.

Hence, the actions taken in the next few months will be pivotal, not just for meeting this year’s fiscal goals, but for setting the economic tone for years to come.