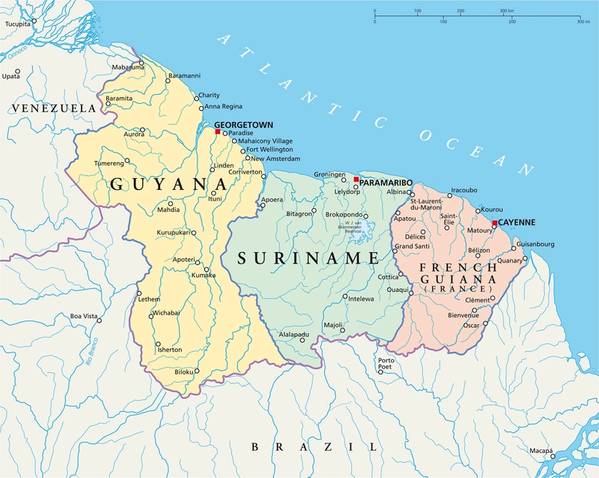

The Equatorial Margin, a maritime zone extending from Guiana to Brazil’s Rio Grande do Norte, has been a significant focus of oil discovery efforts.

By 2015, Guiana, with ExxonMobil’s help, marked its first oil find.

Since then, Guiana has identified oil reserves approximating 11 billion barrels – roughly 75% of Brazil’s total oil reserves, which stand at 14.8 billion barrels.

Brazil acknowledges the region’s potential and has auctioned 42 exploration blocks. However, environmental licensing issues have hampered further research and exploration.

While Brazil is taking measured steps in the Equatorial Margin, Guiana and Suriname have taken significant strides.

Suriname reported its inaugural discovery in 2020, with an estimated potential of 4 billion barrels – about 27% of Brazil’s reserves.

Due to the recent discoveries in both countries, commercial production is still in its infancy.

Factors such as regulatory approvals, platform construction, and environmental licensing play pivotal roles in the commercialization timeline.

For instance, Suriname’s first operational platform is expected by 2025.

Starting its oil extraction in 2019, Guiana now possesses two platforms, producing 375,000 barrels of oil equivalent daily.

Two more are projected to commence operations by 2025.

ExxonMobil aims to increase this figure to 1.2 million barrels daily by 2027, while Brazil’s production in June was 3.2 million barrels/day.

Brazil’s Equatorial Margin consists of five sedimentary basins.

From the 42 blocks granted for exploration, 11 are anticipated to attract investments worth R$11 (US$2.2) billion over the next five years.

The last exploration drill in the region was in 2015 by Petrobras.

One prominent exploration block awaiting approval is FZA-M-59, located in the Foz do Amazonas basin.

Petrobras has been seeking permissions for its drillship operations, but environmental clearance was declined in May.

The key contention for environmentalists is the misnaming of the sedimentary basin by ANP, leading to misconceptions regarding its location.

Petrobras is anticipated to spearhead most regional investments in the coming years. Its 2022-2026 investment plan earmarks US$6 billion for exploration, with almost half aimed at the Equatorial Margin.

Thirteen other companies also operate or hold stakes in the Equatorial Margin, with notable entities being Shell, Enauta, and Prio (PetroRio).