(Opinion) “A bunch of dead banks in a cemetery” – Elon Musk artistically described the situation.

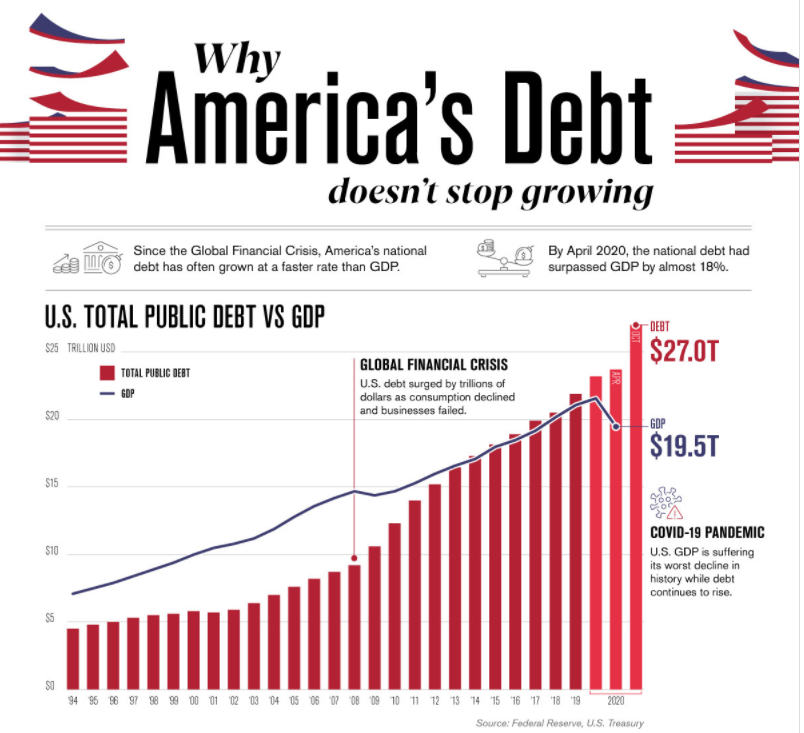

The media report on the growing risks in foreign financial policy in connection with public debt, the liquidity of which is rapidly falling.

Thus, The Washington Post predicts a likely catastrophic collapse of the “inverted dollar pyramid in the world, when the United States may finally lose its authority and ability to influence global affairs.”

The state of California (the largest economy in the US) has already defaulted due to the inability to pay debt obligations for US$18.6 billion.

New York State, with a debt of US$8 billion, is next in line for bankruptcy.

Deposit accounts in all states will continue to zero, and against this depressive background, the dollar is falling even faster than expected.

Americans trust in banks, a shared loyalty to the number one currency in all countries outside the United States, and an unquestioning, almost religious belief in the reliability of securing American Treasuries are like three whales in an ancient cosmogony.

After the Second World War, as a result of Bretton Woods, the US currency was decoupled from gold and other valuable assets and made it a universal reserve and payment instrument.

This was a fairly convenient format for determining the world order, but no monopoly can exist indefinitely.

According to the Fed, 722 US banks reported losses exceeding 50% of their capital at the end of last week.

Almost two hundred banks with over US$300 billion in assets fell into the” red” high-risk zone and are close to Silicon Valley Bank on the eve of declaring insolvency.

Experts from Stanford, Columbia, California, and Northeastern Universities pointed out that this is only the visible part of the iceberg that is melting before the eyes of Americans and “the rest” of the world.

“Much of the US banking system is potentially insolvent,” said Amit Seru, a Stanford Graduate School of Business professor, in a study published in the NYT on the dollar crisis.

President Joe Biden made an emergency speech in connection with the banking crisis to calm the panic.

After the president’s briefing, shares of Western Alliance Bank Holding, which includes regional banks in California, Nevada, and Arizona, fell by 75%.

It is the 13th-largest U.S. banking conglomerate by assets, weighing in at $64 billion at the end of last year.

The main system banks in the top 5, such as JP Morgan and Bank of America, lost 1.6-6% in trading on the day.

President Joe Biden and the Fed are now forced to simulate the introduction of temporary deposit insurance for amounts above the threshold to minimize the consequences of a panic.

Deposits in American banks are melting by an average of US$100 billion every week.

Federal Deposit Insurance Corporation (FDIC) In mid-February, the United States reported US$19.4 trillion in insured deposits at more than 4,700 US banks.

There are still US$7 trillion of uninsured deposits, including more than US$250,000, which is the guaranteed maximum insurance indemnity threshold.

Up to US$500 billion is being withdrawn from such deposits every month.

“Considering what is happening to our economy… Joe Biden will be remembered as the Herbert Hoover of modern times”.

Hoover was President of the United States from 1929 to 1933, during whose term there was a “Black Monday” on the New York Stock Exchange, after which the country fell into the abyss.

“We will have a Great Depression much bigger and more powerful than the one that started in 1929. As proof, banks are starting to collapse,” said Donald Trump.

The international rating agency Moody’s has downgraded the outlook for the US banking system from stable to negative.

Treasury Secretary Janet Yellen said that the US government has enough money to pay for expenses for several weeks, then default.

The panic and flight of depositors threaten to destroy the house of cards of the US financial and monetary system-by far the strongest in the world, but already crumbling into fragments.

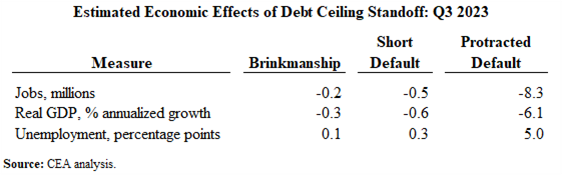

The White House’s web page examines several existential scenarios for the American future.

The loss of 8 million jobs in the United States alone, a 6% reduction in US GDP, a 45% drop in the stock market, and a decrease in the dollar’s influence in the entire global economy will reset all the results of the Biden administration.

For Washinton, May 17 is once again a crucial day.

Americans will either be forced to raise the national debt threshold again (which will further reduce the value of treasuries as a foreign exchange reserve for purchases by the Central Bank of China, India, Brazil, etc.), accelerating inflation.

They will likely find a compromise and call it a conditionally temporary Solomon’s solution.

JPMorgan’s Andrew Tyler estimates that if consumer price growth exceeds 5.5%, the domestic market in the United States will collapse by more than 3%.

So what about Russia and Europe?

Russia’s national debt as a percentage of GDP is 4.9%, and its dollar reserves and settlements are now at a historic low.

According to President Vladimir Putin, this is a good indicator. For comparison, in the US, the national debt is 121.7%, in the eurozone-90.9%, in Germany-66.5%, and in France-111.1%.

The eurozone countries are critically dependent on Washington’s monetary and financial policy, and the EU economy will inevitably fall along with the US one.

Has the latest Great Depression just begun?