RIO DE JANEIRO, BRAZIL – Russia’s economy is coping better with Ukraine-related Western sanctions than could be expected, JPMorgan Chase said in a note to clients dated last week and made public on Monday.

JPMorgan also backtracked on its earlier forecasts of a 35% drop in Russian GDP in the second quarter and 7% for all of 2022, now saying the figures are likely to be much less alarming.

However, the bank did note that the impact of current and potential sanctions will be felt and that the country’s economy would be in far better shape if Moscow had not launched its military operation in Ukraine.

Read also: Check out our coverage on curated alternative narratives

The Russian ruble strengthened slightly above 63 per dollar for the first time since February 2020 and hit a five-year high against the euro at 66 rubles on the Moscow Exchange.

Russia’s capital controls have turned the ruble into the world’s best-performing currency this year, though not many people can pocket a profit on the rally.

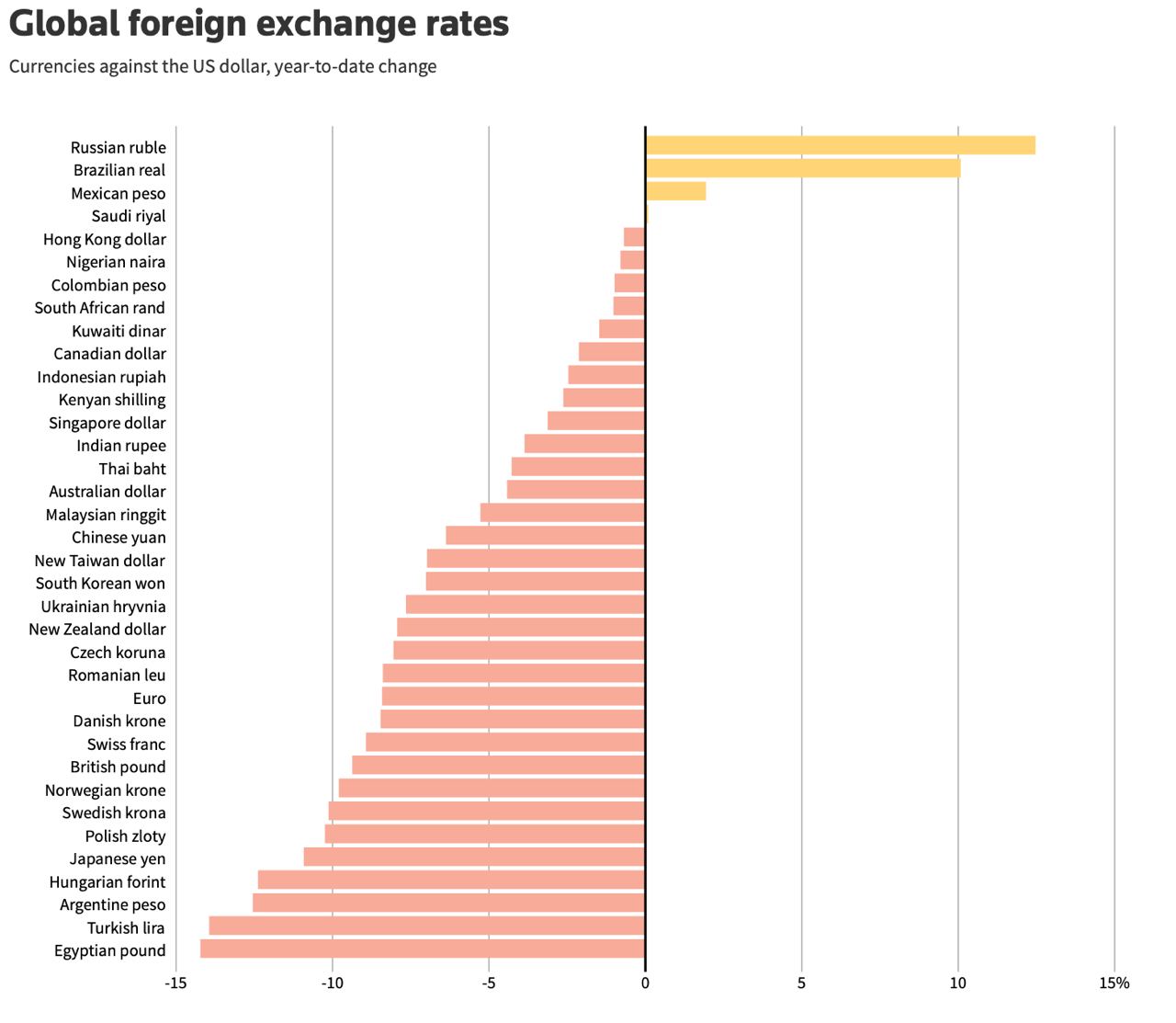

Thus, the ruble is the biggest gainer with a 12.5% increase against the US dollar among the 36 major currencies and has overtaken the Brazilian real, which is up 10.1%, to become the world’s best-performing currency this year, according to Reuters.

The ruble’s gains result from a series of measures taken by the government to defend the battered currency in the aftermath of Western sanctions.

ARTIFICIAL STRENGTH?

In March, the ruble hit new lows against the dollar and the euro when the US and its allies placed harsh economic sanctions on Russia over the Ukraine war.

However, once the government implemented a series of support measures, the Russian ruble began to gain substantially and has been rising since then. The Russian Ministry of Finance has ordered Russian exporters to sell 80% of the total of their foreign exchange earnings, in addition to imposing temporary capital controls.

The creation of a ruble-based mechanism for gas export payments also contributed to the stabilization of the ruble by increasing the currency’s availability on the market and increasing demand.

Some Western analysts, according to Bloomberg, believe the ruble’s rise is artificial. According to the article, “some strategists” believe that “the rally isn’t credible as many currency-trading shops have stopped dealing in the ruble on the grounds that its value seen on monitors is not the price it can be traded at in the real world.”

Other countries, including Turkey and Argentina, have lately implemented capital controls but have not had the same success as Russia, according to Bloomberg. The Turkish lira has lost 13% against the dollar since the beginning of 2022, while the Argentine peso has lost 12.3%.