Lithium has been one of the stars among Argentina’s productive sectors in 2022.

For its investment announcements in the north of the country and the leap in its exports due to the high price of this strategic resource for electromobility.

However, it will be necessary to wait for Argentina to climb up the world’s largest producer ranking.

This 2023 will still be a transition year.

LITHIUM PRODUCTION RANKING

- Australia

- Chile

- China

- Argentina

LITHIUM EXPORTS IN ARGENTINA IN 2022

According to information from the Secretariat of Mining, lithium carbonate exports reached US$696 million in 2022.

Although this figure is small compared to other export complexes, even within the mining industry (gold exported US$2.159 billion in 2022), it represents a year-on-year increase of 234%.

The dizzying rise was mainly explained by the high lithium prices in the international market since the quantities grew by only 5.2%.

Even so, it was enough to add share within the sector: in 2021, lithium accounted for just 6% of mining exports, while in 2022, it grew to 18% of the total.

LITHIUM PRICE

Also, with information from the Ministry of Economy, the tonne of lithium carbonate reached US$71,500 in February, representing a drop to December’s peak of US$80,545.

The average price of lithium in 2022 reached US$71,189, “which is 335% higher than the average price in 2021″.

WHAT WILL HAPPEN WITH LITHIUM IN ARGENTINA IN 2023?

For this year, the expansion of the two projects that currently produce lithium in Argentina is expected: the Fenix project in Catamarca, operated by Livent, and the Olaroz project, operated by Allkem in Jujuy.

In addition, the Cauchari-Olaroz project, operated by Minera Exar, with the participation of Ganfeng and Lithium Americas, will start production.

“With the expansion of these projects, we are going to be closer to 100,000 tonnes of installed capacity,” Nadav Rajzman, economist and former national director of mining promotion and economy at the Ministry of Productive Development, told Bloomberg Línea.

However, producing and exporting that level of installed capacity could take up to two years.

Rajzman affirms that it is “totally feasible” to surpass Chile among the main lithium producers in the world because Argentina “has a greater volume of projects”, but he affirms that it will not be something immediate.

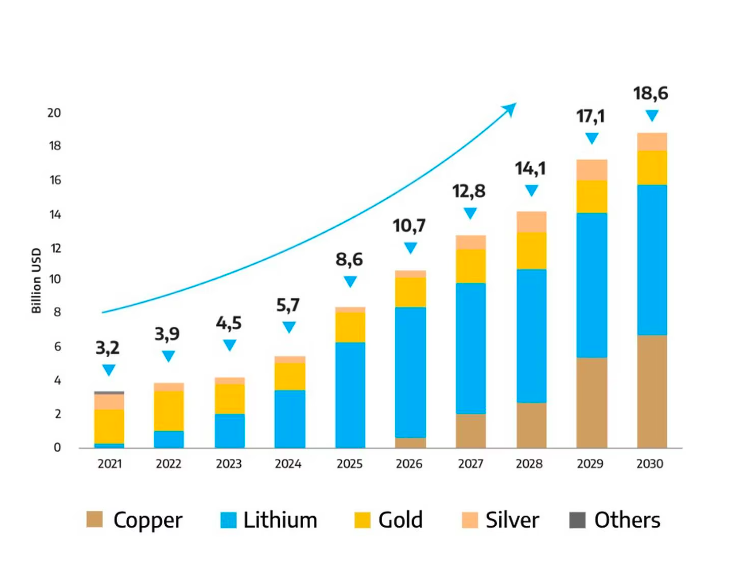

He imagines that goal closer to 2030.

According to Andrew Leyland, managing director of SC Insights, global lithium supply will increase by almost 25% by 2023, “but despite all the projects, Argentine production will be lucky if it increases by 10% this year″.

“Lithium projects take time; we will have to wait until 2025 for many of the Argentine investment announcements to turn into production and revenue announcements,” he said.

For Marcelo Elizondo, a specialist in foreign trade, Argentina’s opportunities in the energy transition grew due to the war in Ukraine and the need for European countries to do without Russian energy.

From this event, “we are beginning to see how the potential in Vaca muerta, the production of clean energies, hydrogen and the specific case of lithium are starting to be seen with more weight”.

Elizondo “sees a gradual, trickle-down growth, much lower than it could be” in these sectors.

And for this to be transformed, “institutions, an orderly macroeconomic environment, and an international architecture that Argentina does not have today are needed”.

THE IMPACT OF BIDEN’S ENVIRONMENTAL LAW ON ARGENTINA

One of Joe Biden’s flagships in his environmental policy, the inflation reduction act, which benefits clean energy projects produced in the US or countries with free trade agreements with credits, will have a negative impact in Argentina, despite the national government’s attempts to participate in the benefits of this initiative.

According to Leyland, this law has already impacted the country. “General Motors recently announced an investment of up to US$650 million with Lithium Americas,” he said.

“They have less interest in Argentine operations, as these do not have access to IRA subsidies.”

The United States is among the top four lithium export destinations, with 9% during 2022.

TOP LITHIUM EXPORT DESTINATIONS IN 2022

- China: 42%.

- Japan: 32%.

- South Korea: 13%.

- United States: 9%.

- Rest of the world: 6%.

TARGETS OF LITHIUM COMPANIES IN ARGENTINA

In the last report to investors in November 2022, Livent communicated that it “continues to meet the planned schedule for all announced capacity expansions,” which includes the first expansion of 10,000 metric tonnes of carbonate that will enter production by the first quarter of 2023, while the second phase of another 10,000 tonnes in Argentina is expected by the end of 2023.

In the report published in January, with the balance of 2022 and the objectives for this year, Allkem announced that “phase 2 of Olaroz is 96% complete and pre-commissioning and commissioning activities are underway”.

Along these lines, “first production is scheduled for the second quarter of 2023″.

Lithium Americas, which participates with Ganfeng in the Cauchari-Olaroz project operated by Exar Mining, reported that the commissioning and production of the project are scheduled for this year.

With information from Bloomberg