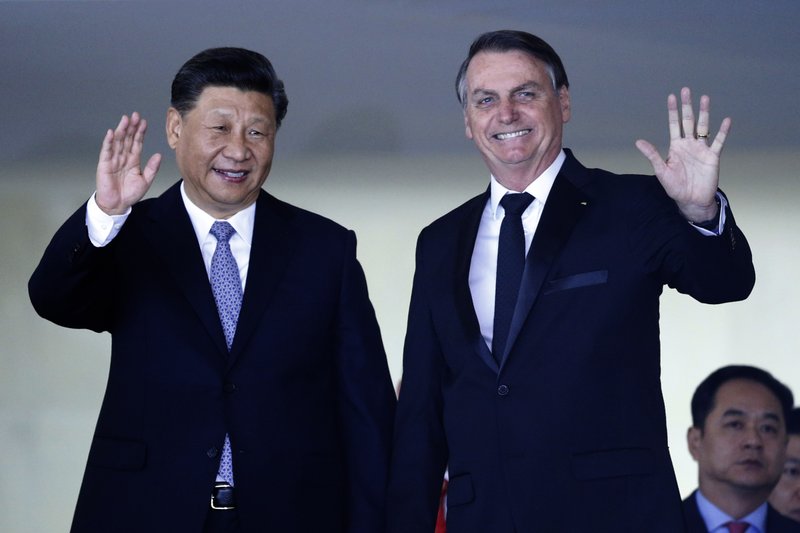

RIO DE JANEIRO, BRAZIL – At the heart of recent controversy sparked by statements from those close to President Jair Bolsonaro, China has been increasingly important to Brazilian foreign trade.

Although the Brazilian President said on Sunday that the Chinese need Brazil more than the Brazilians need China, the figures show that the dependence balance hangs more heavily to the South Americans’ side.

Between January and October this year, a third of everything the country sold abroad was bound for China, Brazil’s main trading partner since 2009, when it overtook the United States, and one of the few nations that increased purchases of Brazilian products this year. On the Chinese side, Brazil‘s representation in total trade is lower: last year, Brazilians sold 3.8% of everything the Chinese bought from abroad.

In an interview on Sunday, Bolsonaro said that “we need China and China needs us much more”. “They have 1.4 billion to feed, it has become more urban than rural, they buy many commodities,” said the President, in reference to products classified as basic for having no technology involved or finishing, which account for most of what Brazil exports.

“It’s not like that,” said Welber Barral, ex-secretary of Foreign Trade and consultant. “China depends on Brazil, the United States, and Argentina in soybeans, which is the main issue. But in terms of trade volume, Brazil’s export to the Chinese is low. Soy is strategic, but if China thinks that Brazil is unreliable, it will seek alternatives.”

According to experts, the relationship between the two countries produces mutual gains. But if China stops buying Brazilian products, the Asian country could turn to other markets, including the USA. On the other hand Brazil, particularly in agribusiness, is highly dependent on these sales and might even find new buyers, but China’s closure would result in lower prices for products exported by Brazil.

Growth

This year, exports to China increased by 11% by October. According to Ministry of Economy data, only soybean shipments to China, which totaled US$ 20.5 billion until October, exceeded everything Brazil sold to its second trading partner, the United States, to which it shipped US$17 billion in Brazilian products, less than 10% of the total sold by the country.

Even the rapprochement of the Bolsonaro government with U.S. President Donald Trump was not enough to increase trade between the two countries as exports to the U.S. fell by 30.6% through October.

The significance of Brazilians to the Chinese and vice-versa varies according to the product exported. In the case of soy, the main item shipped to the Asian country, Brazil accounts for 65% of all Chinese imports, according to data from the Brazil-China Business Council (CEBC). China, on the other hand, buys 73.4% of the soy exported by Brazil. Some 87.2% of Brazilian meat sold abroad, 71.6% of iron ore, and 47.5% of cellulose are also exported to China.

Government sources believe that the situation of “mutual dependence” currently prevailing in the case of soy, the export of which grew in the wake of the Brazil-China trade war, tends to be reduced from 2022 on, to the detriment of Brazilians.

The assessment is that the election of Democrat Joe Biden should lead to a better relationship between the Americans and the Chinese, with the prospect of negotiations in which China commits to buy more products from the U.S., including soybeans.

Moreover, the fact that Brazil needs China more than they need Brazilians in markets such as meat, for instance, makes room for trade retaliation against the country. This could be the case if Brazil banishes Chinese Huawei from the 5G technology auction, for instance. In exchange, the Chinese could stop buying Brazilian products where it would be easier to find other suppliers.

“China doesn’t think in 2022, it thinks strategically in 100 years. It is now undertaking a huge soybean plantation project in Tanzania. Brazil can’t think that it will defy China right now and that’s that, because it won’t,” adds Barral.

For the executive director of the International Chamber of Commerce in Brazil (ICC BRAZIL), Gabriella Dorlhiac, there is a “two-way dependence” and the best thing to do is to expand the Brazilian trade agenda, adding destinations and products. “Over the past ten years, the agenda has diversified, but still within agribusiness. Temporary statements may not help, but they will pass. Long-term strategies are required that do not depend on governments.”

Source: O Estado de S. Paulo