Latin America is at the forefront of supplying a crucial resource for electric vehicle batteries: lithium.

With at least 17 projects underway or about to commence in Argentina, Chile, Brazil, and Bolivia, the region seeks to secure its position in the industry by fostering a favorable business environment and avoiding potential investment losses to other global competitors.

A comprehensive study by KPMG reveals that Australia, Argentina, Chile, and Brazil collectively account for 84% of global lithium production and approximately 80% of global reserves.

Additionally, Bolivia holds significant untapped lithium potential, estimated at around 21 million tons, which remains underexplored.

KPMG points out a shift in the geographic distribution of major lithium reserves, with recent announcements of significant lithium discoveries in Iran, Zimbabwe, and India.

While Chile boasts substantial lithium reserves, Argentina and Brazil also make their mark in the lithium market.

Ensuring a stable regulatory environment, contract reliability, and predictable environmental regulations is critical to attracting international investments.

For example, Canadian company Sigma Lithium’s Brazilian project “Grota do Cirilo” has captured the attention of automakers like BYD, Stellantis, and Tesla.

Executives in the sector say the average time to develop a project from scratch is about nine years.

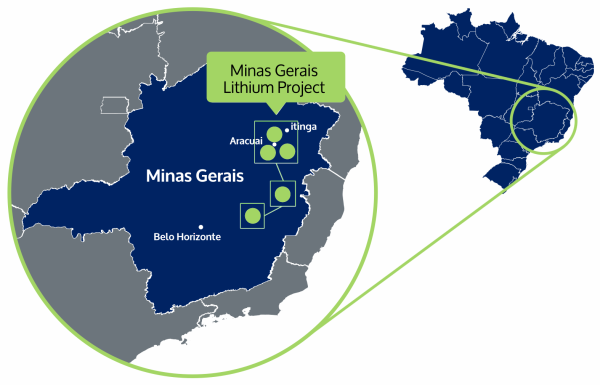

Studies by the Brazilian Geological Service (CPRM) indicate the existence of 45 lithium deposits in the Jequitinhonha region with economic potential.

In this context, the government of the state of Minas Gerais launched the “Vale do Lítio” (Lithium Valley) project on the Nasdaq in New York in May of this year to attract investments in the sector.

“Vale do Lítio” consists of 14 cities. Companhia Brasileira de Lítio (CBL) currently operates in Jequitinhonha and AMG, which already produces lithium concentrate in the region.

Other companies, such as Latin Resources, Atlas Lithium, and Lithium Ionic, actively participate in the mineral drilling program.

CAR GIANTS

Like copper, lithium has attracted the attention of major automakers seeking to secure raw material supplies for battery production.

Chinese BYD, one of the world’s leading electric car manufacturers, is looking for mining assets on Brazilian soil.

The automaker has signed a memorandum of understanding to invest R$3 billion (US$633 million) in Ford’s factory in Camaçari, Bahia state, to produce electric cars.

According to BYD’s advisor in Brazil, Alexandre Baldy, the company also plans to invest in lithium in the country.

“The investment package is based on some pillars, including lithium extraction. The company is looking at existing mines and greenfield projects, as a direct investor or not,” said the executive, a former Cities Minister, in an interview with Bloomberg Line.

Baldy said that BYD is already in talks with lithium companies in Brazil to invest or sign contracts to supply the resource.

“This is an alternative if our own extraction doesn’t succeed.”

The Chinese company already operates a battery module factory in Manaus, Amazonas state, to assemble electric buses manufactured in Campinas, São Paulo state.

The expectation is that BYD’s electric vehicle production will be “end-to-end,” meaning from lithium exploration to the final product manufacturing in Brazil.

Also, in February, Stellantis, the group that owns the Fiat, Jeep, Peugeot, and Citroën brands, announced a US$155 million investment in a copper project in Argentina, aiming to supply raw materials for electric cars.

Antonio Filosa, Stellantis’ president for South America, said the group is looking for lithium assets in the region.

“Like copper, lithium also interests us a lot in the future. We are exploring opportunities everywhere,” he told Bloomberg Line shortly after the acquisition.

According to people familiar with the matter, Tesla is reportedly considering buying Sigma Lithium, as Bloomberg News reported earlier this February.

“Car manufacturers don’t have many options. Europeans have committed to banning combustion engines from 2025, but regional car manufacturers don’t have the sources to electrify their fleets quickly.”

“The automotive industry will have to invest much more to ensure the supply of electric batteries,” said the KPMG partner.

Fernandes noted that Brazil hadn’t seen so many investments in the exploration phase of the mining industry – the first and riskiest of all – amid the expansion of lithium assets for a long time.

POLITICS

With the strong expansion of lithium demand, an old issue is emerging in the region’s governments: greater state participation in mining projects.

Chile, the world’s second-largest lithium producer behind Australia and responsible for 30% of global production, recently announced that it would promote changes in its lithium regulatory framework.

Currently, the royalty paid for lithium extraction in the country is 40% of the export price, considered one of the highest in the world.

President Gabriel Boric has announced that the country will nationalize the lithium industry, transferring existing operations to a state-owned company in the future.

Last year, the Mexican government also announced the nationalization of its lithium deposits.

According to Sigma’s CEO, governments must work to improve the sector’s rules, providing predictability and speed to the processes.

He cites Decree 11.120/2022 as a positive example in this regard, which eased lithium exports and imports in Brazil.

Previously, foreign trade operations of the resource depended on prior authorization from Brazil’s National Nuclear Energy Commission (Cnen).

“Brazil has been working on this since last year, and companies are already settling in Jequitinhonha,” said the executive.

According to KPMG’s study, Argentina is the Latin American country that, at first glance, presents better prospects for ensuring the region’s leadership in the lithium market, “although Brazil has greater economic stability and a more favorable business environment.”

According to the consultancy, Argentina has shown resilience, and its rich mineral reserves and natural resources have been attractive to local and foreign capital.

In Argentina, the Salar del Hombre Muerto in Catamarca and the Salar de Olaroz in Jujuy are the geographical areas where public and private capital is applied for mineral extraction.

To elevate the industry, governments across Latin America must prioritize regulatory improvements and expedite processes related to the lithium sector.

By doing so, the region can solidify its position as a leading player in the global lithium market and attract significant foreign investments.

With information from Bloomberg Linea