RIO DE JANEIRO, BRAZIL – The International Monetary Fund (IMF) released its new growth forecasts on Monday during the World Economic Forum, as it has consistently done in recent years.

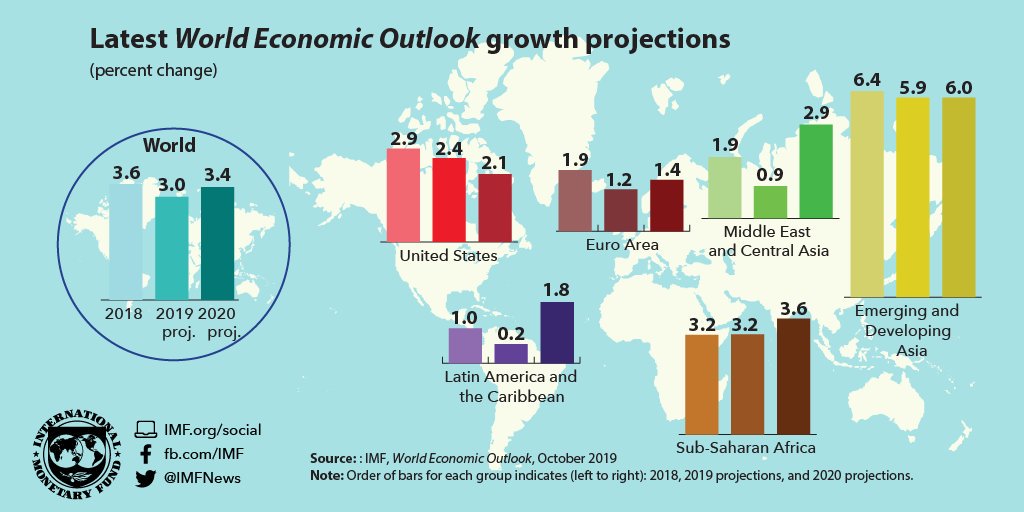

According to its calculations, after expanding 2.9 percent in 2019, the world economy will grow 3.3 percent this year and 3.4 percent in 2021, one and two tenths, respectively, below the estimates released three months ago by the IMF.

The source of the reduction is an “unexpected” negative behavior in a number of emerging economies, particularly in India. In Brazil, the growth forecast for 2020 was updated 0.2 percent upwards, driven by the Welfare reform and the drop in interest rates. The Brazilian economy is projected to grow by 2.2 percent in 2020 and 2.3 percent in 2021 (a drop of 0.1 percent compared to the previous forecast for this year).

Developed countries, in general, will grow at the pace predicted in October or a tenth below, in the worst-case scenario. Japan alone will grow two tenths more than expected, the Fund estimates, but that means reaching 0.7 percent.

Growth in the United States will drop from 2.3 percent in 2019 to two percent this year and 1.7 percent next year, now that the effects of the tax cuts promoted by the country have been diluted.

Growth in the eurozone, however, will recover from 1.2 percent to 1.3 percent this year because of the expected reduction in Spain and Germany, where industry was still in the red at the end of 2019.

Just when its government was boasting of outperforming China in terms of growth rate, India will grow 5.8 percent this year, 1.2 percentage points lower than expected. By 2021, growth will rebound to 6.5 percent, still nine-tenths less than forecast.

China will continue on the path of moderation, with growth of six percent this year, one-tenth less than last year, and 5.8 percent in 2021. However, the trade agreement with the US allows the Asian giant to recover two-tenths of what was predicted in October.

The IMF, presided by Kristalina Georgieva, recognizes the contribution to this scenario – in spite of everything, positive- of the change in monetary policy bias toward a much more flexible position, a turnaround led by the US Federal Reserve.

According to her assessment, “without this monetary stimulus, the estimate of world growth in 2019 and the projection for 2020 would have been 0.5 percentage points lower in each of these years,” the report notes.

Although the IMF sees “tentative signs of stabilization”, as a result of the US-China trade war retreat, it is not adamant about it – “Tenuous Stabilization, Slow Recovery?” is the title that, in a way, summarizes its quarterly report.

The Fund limits the world economy’s expected performance to preventing a further escalation of trade, economic and industrial tensions between the two powers, and between the US and its other trading partners, particularly Europe, and “that the economic ramifications derived from social discontent and geopolitical tensions remain contained,” it stresses.

The institution reiterates on several occasions throughout the report its concern about the impact on growth of the protests that have occurred over the past year in places as disparate as Chile, Hong Kong, Lebanon, and Iran.

To counter all these risks, the IMF stresses the need for strong multilateral cooperation, particularly in relation to the World Trade Organization and the distribution of greenhouse gas emissions reductions, as well as the fight against tax evasion.

In the social sphere, the Fund insists on the need to expand inclusion and social protection instruments. “At this stage, failure to adopt policies would further weaken an already precarious world economy,” it stresses.