RIO DE JANEIRO, BRAZIL – On Monday, March 16th, the Ministry of Economy announced a package of measures to help the Brazilian economy face the new coronavirus pandemic. Some 20 actions are planned to encourage consumption and help specific sectors.

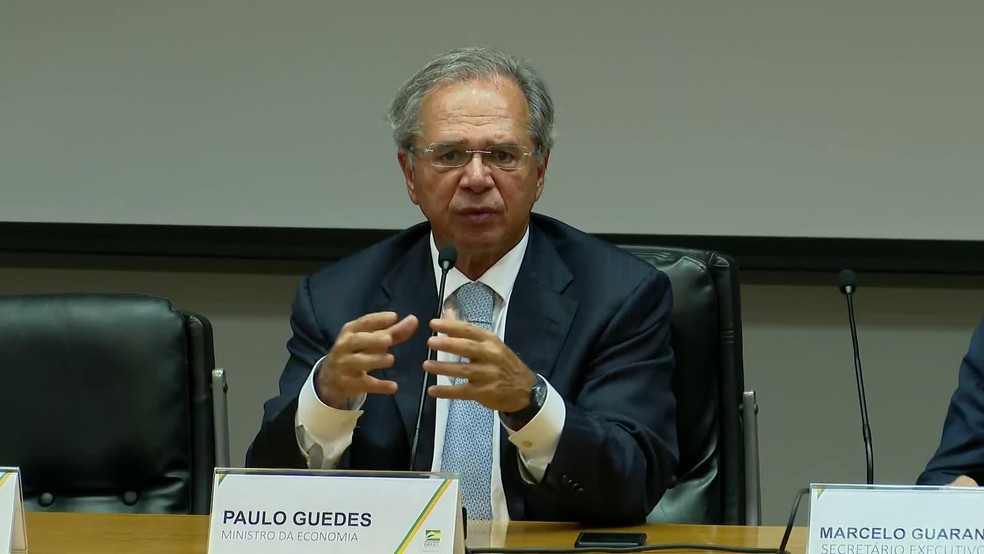

On Thursday, March 12th, faced with the country’s swift spread of the disease, Economy Minister Paulo Guedes had announced that the portfolio would prepare a set of actions to reduce the impact of the crisis. The Minister immediately announced the release of R$23 billion to anticipate the payment, in April, of 50 percent of the 13th month pay to retirees and pensioners of the National Institute of Social Security (INSS).

Other actions were also anticipated on Friday, March 13th, such as the exemption of import tariffs for medical and hospital products and the potential release of resources from the Severance Premium Reserve Fund (FGTS).

Among the expected measures are incentives for the construction industry, credit lines for tourism-related companies and an airline bailout.

The coronavirus crisis hit the country at a time when the economy, which grew by only 1.1 percent in 2019, was still trying to timidly recover. This week, the Central Bank’s Monetary Policy Committee is convening to deliberate on the basic interest rate. It is almost certain that further cuts will come.

The impact of the coronavirus on the global economy has prompted governments around the world to take action. On Sunday, March 15th, the Federal Reserve, the US central bank, announced a further one percentage point cut in the US interest rate, less than two weeks after the previous cut. Now, the US interest rate is between zero and 0.25 percent. By early March, the rate had already been reduced by half a percentage point, to between one and 1.25 percent.

The European Union also released €37 billion in recent days to finance urgent measures to tackle the new coronavirus and offset the economic cost of the crisis for companies and workers. The Italian government also announced on Monday a €28 billion package.

The Japanese central bank said it will provide liquidity to financial markets through purchases of five and ten-year sovereign bonds worth nearly US$2 billion, in addition to an injection of nearly US$14 billion in credit lines. China, where the coronavirus originated, has invested nearly US$16 billion in fighting the pandemic and has been encouraging local banks to lend cheap money.