RIO DE JANEIRO, BRAZIL – The dollar closed higher against the real on Thursday, May 7th, after the Monetary Policy Committee reduced the basic SELIC rate by 75 basis points to three percent per annum.

The cut, more aggressive than expected by the market, pushed the dollar higher by 2.4 percent and it closed at R$5.840, setting a new closing record. The tourism dollar climbed 2.5 percent to R$6.08.

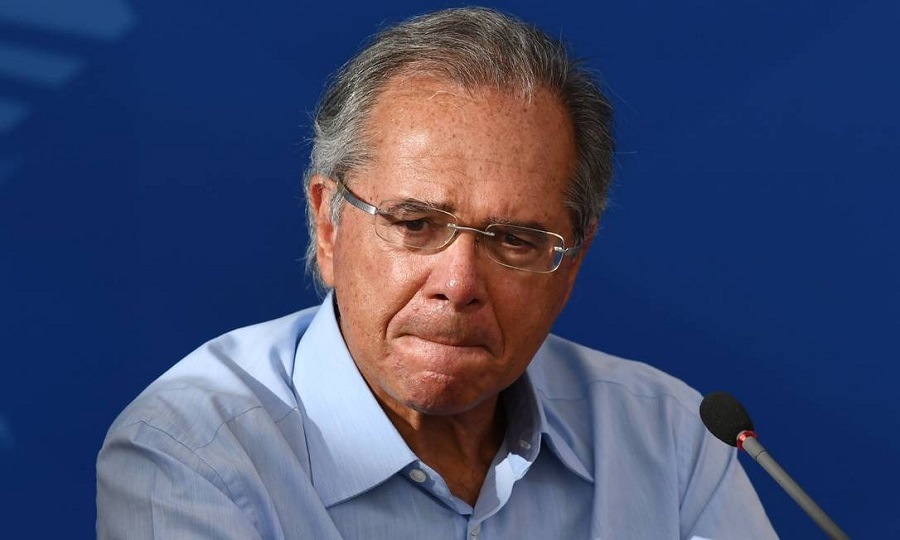

At around 11 AM, the bullish trend intensified after the Minister of Economy, Paulo Guedes, stated that the Brazilian economy “is starting to collapse” due to the coronavirus. At its highest, the US currency reached R$5.872 and broke the intraday record.

“The point is that the dropping interest rates, in addition to being ineffective in fighting the crisis, are pushing up the exchange rate,” André Perfeito, chief economist at Necton Investimentos said in a statement.

“The interest rate cut ultimately depreciates the local currency. And more than that, they left a new 75 basis point cut open for the next meeting,” said Jefferson Ruik, Correparti’s foreign exchange director. Should this occur, the interest rate’s historical minimum would be down to 2.25 percent per year. “If there is a cut, Brazil will have negative real interest rates [after eliminating inflation], and investors will leave the country,” he said.

Although it may speed up economic activity, the interest rate cut tends to reduce the attractiveness of Brazilian bonds, compared to those of other countries that pay higher returns, such as Mexico and Turkey, with interest rates at six and 8.75 percent, respectively.

At the current interest rate, Ruik no longer perceives a likelihood of dollar inflows through carry trade operations, which aim to borrow money in economies with lower interest rates and invest in countries that pay higher returns. “Carry trade no longer exists. But the current rate is scaring the foreign investors who are already here, and they’re leaving,” he said.

Despite the unfavorable exchange rate in Brazil, the day was positive for most emerging currencies, which appreciated against the dollar. The international good mood is due to China’s import and export data, which were above projections.

Source: Exame