RIO DE JANEIRO, BRAZIL – Brazil’s share in international funds are currently in free fall. In global funds, Brazil’s asset share fell to only 0.2 percent in May from 0.4 percent in December 2019, according to a study by BTG Pactual, which considers data from the US consultancy EPFR, which monitors portfolios managing US$24 trillion.

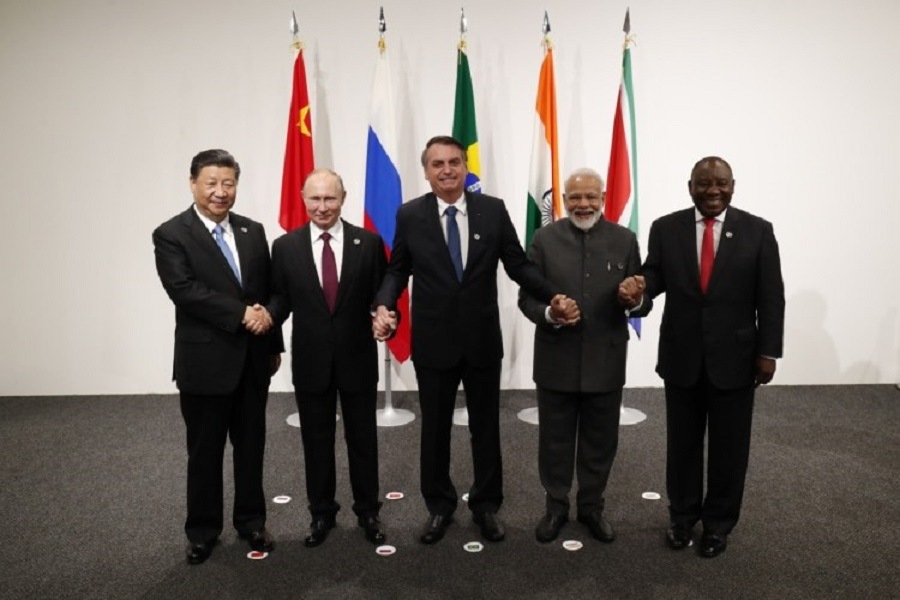

In investment funds dedicated to the BRICs (Brazil, Russia, India, China, and South Africa) the drop was even sharper, from 17.4 percent in December to half, 8.8 percent last month.

In terms of funds dedicated to emerging economies, Brazil’s share has also declined further and now stands at 5.2 percent, down from 8.6 percent in December, the BTG study shows. In all funds, the Brazilian share is the lowest in over 15 years. “Looking at the allocations of international investors, we saw that Brazil has become insignificant,” says Tag Investments strategist Dan Kawa.

The Brazilian share in specialized Latin American funds also fell this year, from 66 percent in December to 58 percent. In the region, fund managers have favored Mexico, with a six percent interest rate, three times the Brazilian rate, and much lower risk.

Even Argentina, which has deferred its debt payments to international investors, climbed from 1.6 to 3.3 percent over the same period.

Source: O Estado de S. Paulo