RIO DE JANEIRO, BRAZIL – Three years after a strong offensive in the Brazilian market, when they bought CPFL Energia, the largest private company in the electricity sector, Chinese entrepreneurs are back for more.

This time, interest is mainly focused on water and sewage treatment companies and large infrastructure projects, such as the construction and operation of roads and railways.

In their last expedition around the country, in 2017, the Chinese invested some US$9 (R$36) billion, most of it in energy assets. But then they pulled the brake to assess the changes taking place in the political scenario. This caution reduced the volume of investments in the following years by nearly 70 percent, around US$3 billion.

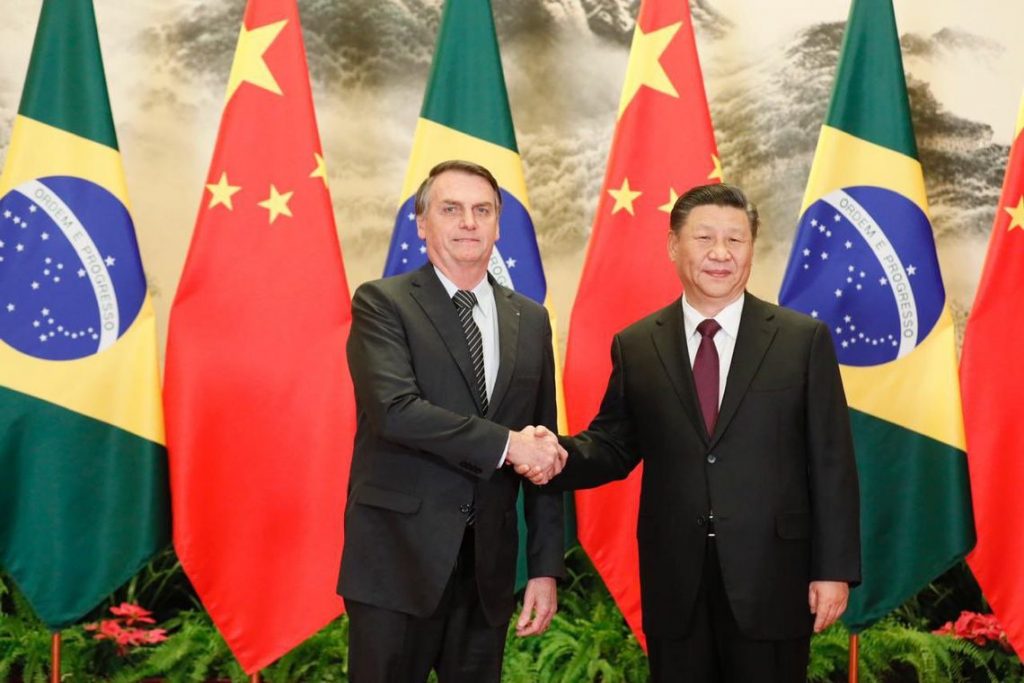

Uncertainties about the outcome of the presidential elections, President Jair Bolsonaro’s unfriendly speech (“China was not buying in Brazil, but rather it was buying Brazil”) and the government’s unconditional alignment with the US, the Chinese trade rival, cooled Brazil’s relationship with the Asians.

Now, after Bolsonaro’s approach to Xi Jinping and, in particular, the various concession and privatization projects on offer in Brazil, the Chinese have put the country back on its radar.

The Chinese are expected to invest something like US$7 billion in Brazil this year, says Eduardo Centola, president of Banco Modal. The executive, also a member of the Brazil-China Business Council (CEBC), advises Chinese groups interested in the country.

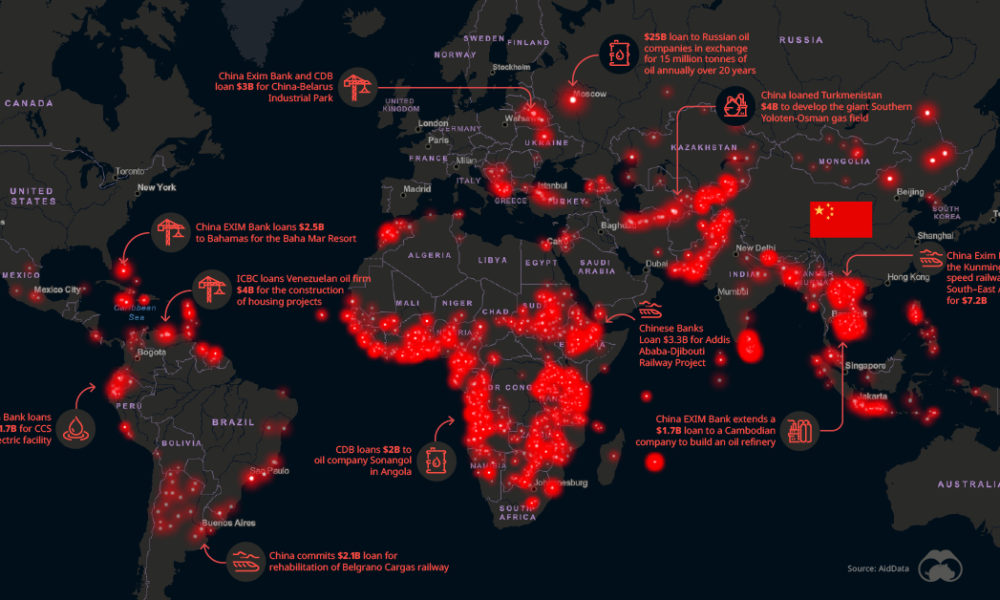

Experts say the Chinese want to repeat in Brazil what they have already accomplished in Africa. Among the world’s great powers in the area of infrastructure, the Chinese have dominated the construction of roads, railways and hydroelectric plants in countries like Angola, South Africa, and Mozambique.

With poor infrastructure and a government lacking the resources to make investments, Brazil is fertile ground for the Chinese. “China is willing to invest heavily in Brazil and South America,” says Charles Tang, president of the Brazil-China Chamber of Commerce and Industry (CCIBC).

One of the main targets at the moment is SABESP, the country’s largest private water and sewage treatment company. The company has nearly 28 million customers in the state of São Paulo and has an annual turnover of R$16 billion (US$4 billion).

Media company ‘O Estado de S. Paulo’ has learned that the China Railway Construction Corporation group, one of the largest in infrastructure, is holding talks to buy a large part of the company.

The São Paulo state government, which owns 50.3 percent of SABESP, valued at R$40 billion, is studying whether to dispose of its entire stake in the company or find an investor to buy half of its share in the group.

The pace of concessions will dictate contributions

The appetite of Chinese entrepreneurs to make heavy investments in Brazil this year will depend on public concessions for infrastructure projects in the country. In addition to the federal government, many states and municipalities, also in debt, are seeking private partnerships for their companies.

The government’s list this year includes seven competitive bids for road maintenance and construction, which could raise R$42 billion, and another R$52 billion for railroad renovation and construction.

“The pace of Chinese contributions will depend on the progress of the concessions this year,” says Eduardo Centola, a partner at Modal Bank.

Many Chinese companies have already mapped out investments in Brazil, looking at privatization models and concessions planned for the coming years, says attorney Luiz Eduardo Vidal Rodrigues, a China-based partner at L.O. Baptista law firm.

Vidal Rodrigues’ office was among those who prepared to bridge the gap between Chinese entrepreneurs and Brazil when Asian investors began to increase their presence in the country. According to him, as the Chinese are already consolidated in electric energy, the resumption will be in other areas, among them natural gas.

In this case, the interest in Petrobrás’ assets weighs heavily. The Brazilian oil company started a plan to sell companies considered non-strategic in 2017. From 2017 to November last year, the state-owned company sold some US$30 billion in assets, which include the NTS and TAG gas pipelines and the Liquigás cooking gas company.

This year, it plans to raise between US$20 and US$30 billion with the sale of piped gas distributors and oil reserves, while further reducing its stake in BR Distribuidora, the country’s largest fuel distribution company.

Three years ago, most of China’s contributions were led by state-owned State Grid, which bought control of CPFL, and by China Three Gorges.

These two companies continue to keep an eye on the privatization of transmission and power generation companies of the federal government-owned Eletrobrás and also of Cemig, which belongs to the government of the state of Minas Gerais, says attorney Gustavo Buffara Bueno, of the law office bearing his last name. Buffara advised State Grid on the purchase of CPFL.

Ambition

In addition to the electricity sector, the Chinese have ambitious plans to move forward in heavy construction companies and rail freight transport. If they can combine the two, so much the better. According to Carlos Frederico Bingemer, a partner in the infrastructure department of the Barbosa, Müssnich, Aragão (BMA) law firm, they want to deliver the complete package in an infrastructure project.

In other words, in a wind power plant venture, for instance, they want not only the concession but also the construction and supply of the equipment.

This is the case with China Communications Construction Company (CCCC), a company that made its debut in Brazil with the purchase of the construction company Concremat, in 2016. One of the company’s goals is to increase its range of business in the country, particularly in projects that are built from scratch (greenfield).

The giant’s onset came at a time when Brazil’s main contractors were in the eye of the hurricane of Operation Lava Jato, which investigates corruption involving business with Petrobras.

CCCC, which is also a partner in the Porto São Luís construction project in Maranhão, has its eye on two major railroads, considered important for grain transportation. One is Fiol, which will connect the landlocked interior state of Tocantins to the coast of Bahia, on a stretch of 1,500 kilometers; the other is Ferrogrão, which will carry over its tracks a good part of the soy and corn production from Mato Grosso to Pará in the Amazon, a project nearly 1,000 kilometers long.

Since 2017, Brazil has been the second-largest destination for Chinese infrastructure investments in the world, behind only the United States. But little by little, the country is beginning to attract Asians to other businesses, such as technology.

Didi, the “Chinese Uber” bought the Brazilian app-hailing company 99 in 2018. That same year, Internet giant Tencent made a US$180 million contribution to fintech Nubank.

Group announces bank in Brazil with an eye on construction

A showcase of the Chinese resumption in Brazil was the announcement last week of the arrival of the Xuzhou Construction Machinery Group (XCMG), a giant in the manufacture of construction machinery.

The group announced the installation of a bank in the country – the first of the XCMG – with an eye on the infrastructure sector. The global president of the XCMG, Wang Min, said at an event in São Paulo that one of the goals is that the financial institution is a point of connection between China and Brazil and that this economic integration will help the Chinese capital to land in the country.

In December, Chinese companies CCCC and CR20 won an auction of the Public-Private Partnership (PPP) by the Bahia government to build the Salvador-Itaparica bridge, with a length of 12.4 kilometers. The work is valued at R$5.3 billion. The Chinese have intensified partnerships with state governments.

But other sectors are also emerging for the Chinese. The BYD company voiced its interest in buying Ford’s plant in São Bernardo, metropolitan São Paulo, says Tulio Cariello, director of analysis for the Brazil-China Business Council (CEBC).

The oil and gas sector has also attracted Chinese capital: last November CNOOC and CNODC Petroleum joined a consortium with Petrobras in the pre-salt auction.