By Vildana Hajric and Isabelle Lee*

Bitcoin is back as the best-performing asset in the first quarter after a quick exit from its “cryptowinter.”

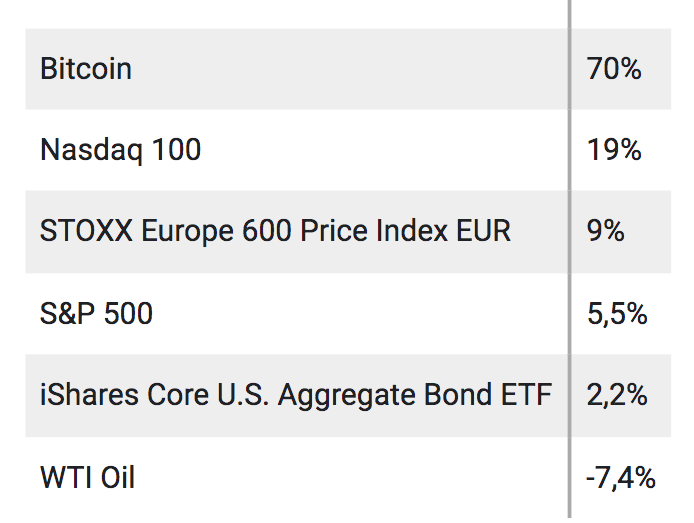

With gains of around 70%, the most significant digital token is finishing its best quarter since March 2021, when it surged 103%, according to data from Bloomberg.

In contrast, the S&P 500 has advanced 5.5% year-to-date, the Nasdaq 100 has seen a 19% rally, and the iShares 20+ Year Treasury Bond ETF has done so by 5.3%.

While volatility is expected with Bitcoin, longtime supporters point out that it is part of the appeal for investors in this relatively embryonic asset class.

In 2017, Bitcoin experienced an annual gain of more than 1,000% before plunging 74% the following year during what became known as a cryptowinter.

After three consecutive annual increases, it fell 64% last year due to industry scandals and bankruptcies.

According to Noelle Acheson, author of the “Crypto Is Macro Now” newsletter, this year’s rally doesn’t surprise many crypto market observers.

She explains that “all signs pointed to a strong price floor starting last November, and it was only a matter of time before either the liquidity narrative changed (which it did in early January) or longer-term investors saw a value booking opportunity (which also appears to have happened).”

Market observers disagree on the exact causes of the big rebound.

The currency started 2023 on the heels of its second-worst year in history.

In part, some say, it could be recovering from such a crushing blow.

However, in recent weeks others pointed out it has returned to demand.

Amid the tremors in the global banking sector, the token can act as a sanctuary given that it is independent of central banks, they argue.

“Most people would have said Bitcoin should perform horribly because markets are under pressure or stress,” said Peter van Dooijeweert of Man Solutions.

“But actually, if you think about the Bitcoin bugs – the people who love Bitcoin – they love the idea of a non-fiat currency like it’s something outside the US dollar and the banking system.”

Matthew Sigel, head of digital asset research at VanEck, agrees.

“Bitcoin has remained resilient thanks to legitimate fundamental improvements and its unique role as a bearer asset in a period of skepticism about bank deposits and more central bank bailouts,” he said in an interview.

Regardless of the catalysts, the currency has recently experienced one rally after another.

Over the past three weeks, roughly covering the period when US banks began to show stress, it has only posted losses in eight of 22 sessions recording a 40% loss.

Not only Bitcoin, which is currently just below US$28,000, has risen during the first quarter.

Ether has done so by about 50%, trading around US$1,800.

There are certainly some companies and exchange-traded funds looking to amplify returns that have done better than Bitcoin this quarter.

Nvidia Corp (NVDA) shares, up 87%, have risen more than Bitcoin since the start of the year, as have some cryptocurrency-specific ETFs, such as Valkyrie Bitcoin Miners ETF (ticker WGMI), which has jumped nearly 100%.

Leveraged products also tend to stand out, with the 1.5x Nvidia and Meta Platforms Inc (META) ETFs up more than 100% year-to-date.

But among the major asset classes, Bitcoin remains the standout.

Bloomberg data shows that, in the world of commodities, sugar has been the best performer so far this year, up 22%.

In bonds, a global inflation-linked total return index is up 4%, while among global stock gauges, the Laos Composite Index is up more than 44% through Thursday.

Stephane Ouellette, chief executive officer of FRNT Financial Inc, notes that “apparently, BTC’s rallies have come from ‘darker moments before the dawn.'”

“After the collapse of SVB and the subsequent closure of Signature, the narrative going into the week was that it would be a difficult period for crypto,” she said.

“Those events fueled the narrative for Bitcoin as an alternative to banking solutions, and all crypto, including BTC, had some fantastic positive trading days, which was unexpected by many.”

*Contributed by Lu Wang, Denitsa Tsekova, and Sam Potter.

With information from Bloomberg