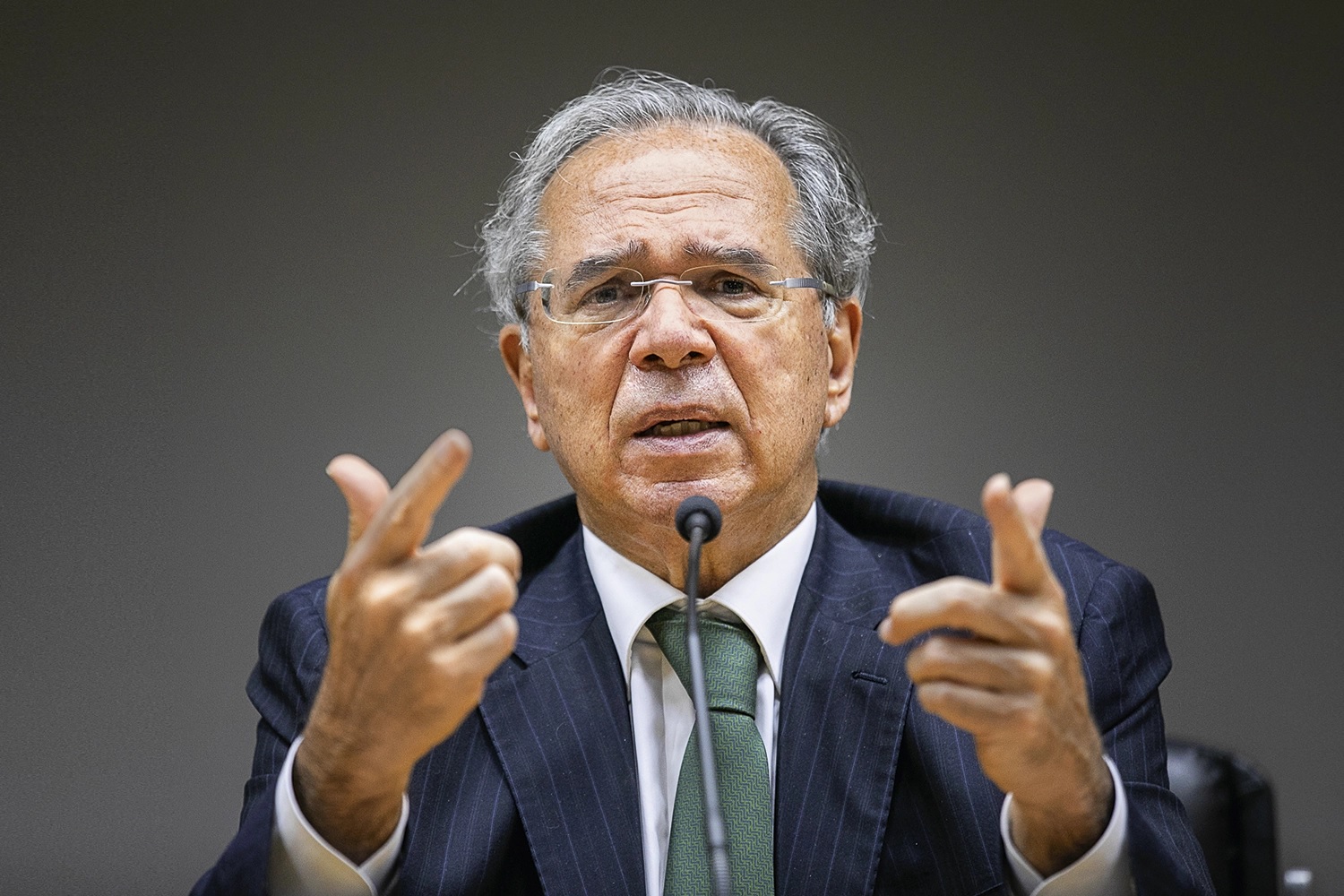

RIO DE JANEIRO, BRAZIL – The Minister of Economy, Paulo Guedes, has not given up on the proposal to create a tax on digital transactions and spoke again about creating a new tax in Brazil during the event “Economic Perspectives of Brazil”, promoted by Arko Advice.

According to Guedes, the Internet has helped create a space in which companies based in other countries sell their products to Brazilians and, therefore, do not pay the taxes due in the country, as is the case, according to Guedes, of Chinese e-commerce companies.

Guedes even stated that these companies could even use bitcoin and cryptocurrencies as a way to leave no trace; however, none of the major Chinese e-commerce platforms such as Alibaba, Aliexpress, BangGood, Cigabuy, Mini in the box, Deal Extreme, Wish, or Shein accept cryptocurrencies as a form of payment.

Guedes stated that the government had not abandoned the proposal to tax digital transactions, especially transactions made with cryptocurrencies. According to him, the Ministry has been working to create a tax for bitcoin payments, which he jokingly called DigiTAX.

“The DigiTAX will appear soon to equalize the game. You have countries thinking about putting a very high tax on bitcoin right off the bat, charging tax first. Our team is working on this, we recognize there is a digital dimension that will escape conventional controls, but this really worries us,” he said.

DIGITAL TAX ALREADY VETOED IN CONGRESS

Since he took over as Minister of Economy in the government of President Jair Bolsonaro, Paulo Guedes has defended the creation of a new tax to tax digital transactions. The press called this new tax the “New CPMF” (Provisional Contribution on Financial Transactions – Brazilian excise tax). After much debate and political wear and tear, in May 2021, Guedes said he had given up on the proposal.

“That [transaction] tax has been halted. I’m not going to fight for it. We are in a democracy. Let it go. Continue with the high burdens and let’s do the broad reform so desired,” he said at the time.

However, in November last year, the issue came up again when the special secretary of the Internal Revenue Service, José Tostes Neto, returned to the subject and stated that it was necessary to create a tax that would impact financial operations, especially those carried out with bitcoin, cryptocurrencies, cashback, mileage programs, among others, which, according to him, are operations that are on the fringes of the system without any regulation.

“Nowadays there is no more commerce only in the traditional form. I use digital currency; I use cashback; I use frequent flyer programs to buy many things. I don’t buy with traditional money. So this cannot be left out of consideration if we discuss how new taxation may apply”, Tostes Neto declared.

On occasion, Tostes Neto stated that at no time has the government completely given up on creating a tax for digital transactions and was waiting for the right moment to put the topic up for debate again.

“The government is observing to enter at the opportune moment in the debate,” he stated.

Like Guedes, Tostes Neto has been advocating creating a tax for bitcoin transactions since 2019, when the first data from cryptocurrency transactions began to be computed by the IRS thanks to Normative Instruction 1888.

In 2019, the government also began writing the text of the then-called Tax Reform (which stalled both in Congress and in the government). In it, from the beginning, the need to create a tax for digital transactions was hinted at, with crypto-active products included in this new scope of taxation.

At the time, Tostes Neto, who was following the Treasury Policy Council (Confaz) meetings, declared that the tax proposed by the government would in no way leave cryptocurrencies out.

Although Guedes has stated that he wants to create a tax for cryptocurrencies in Brazil, for this to happen, he needs the approval of the National Congress (senators and deputies); however, the current proposal for a regulation of the crypto-active market in the country does not talk about creating taxes for the sector.

With information from Cointelegraph Brasil