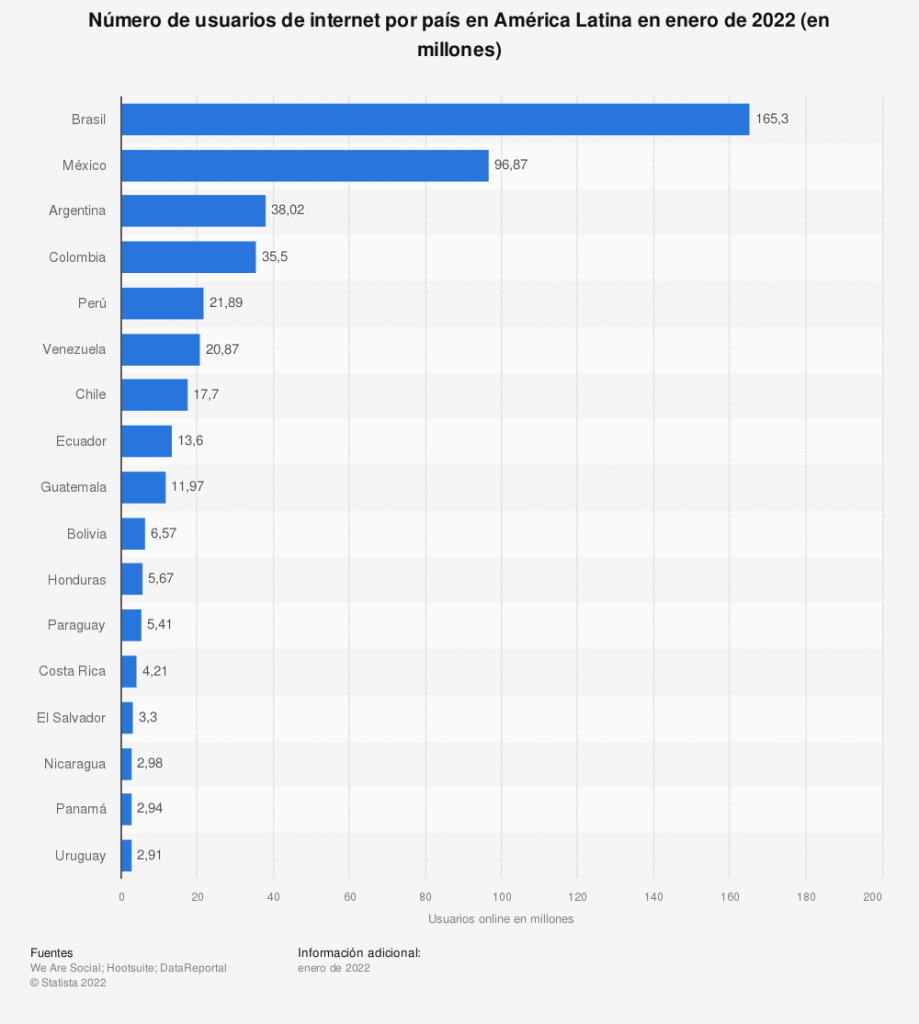

RIO DE JANEIRO, BRAZIL – Currently, Brazil is home to more than 212 million people, about 73% of whom have access to the Internet, according to Statista. Moreover, at the beginning of 2021, Brazil was the Latin American country with the highest number of online users. It is estimated that by 2026, about eight out of ten Brazilians will use the Internet at least once a month.

According to the International Monetary Fund (IMF), Brazil is the world’s 12th largest economy in terms of GDP volume, recording a growth of 4.6% in 2021. Still, experts estimate that this will slow sharply in 2022.

Nevertheless, e-commerce is still considered an essential alternative for generating revenue for the Brazilian economy.

According to eCommerceDB, Brazil is the 15th largest market for global e-commerce, with revenues of US$26 billion in 2021, ahead of Mexico and behind Italy. In addition, the Brazilian e-commerce market contributed to the worldwide growth rate of 29% in 2021, thanks to an increase of 18%.

As in many markets worldwide, e-commerce is changing the way products are sold in Brazil. According to the eEbit Web shoppers 2021 report, e-commerce in Brazil grew 31% in the first half of 2021 compared to the same period last year.

In 2020 alone, the number of online consumers increased by more than 40% due to health restrictions resulting from the COVID-19 pandemic and changing consumer preferences.

According to Statista, sales in the Brazilian e-commerce market are expected to reach US$49.173 billion by 2022. Sales volume is also forecast to increase by 20.73%, which could lead to a market volume reaching US$86.532 billion by 2025.

On the other hand, 45% of the Brazilian population bought at least one product from an online store in 2021. The number of users in the Brazilian e-commerce market will reach 138 million by 2025.

In addition, the Statista report predicts that user penetration will be 57.5% in 2022 and is expected to reach 63.0% by 2025.

HABITS DRIVING eCOMMERCE IN BRAZIL

The self-service segment (entertainment, tourism, durables, consumer goods, and perishables) recorded the highest growth in total orders and gross sales.

However, Home and Decor is the eCommerce retailer with the highest revenue, recording a 155% increase in orders and a 67% increase in revenue.

In the second place, in terms of total orders, are pet stores (56%), followed by sports (48%), department stores (37%), groceries (34%), and self-service (32%), the latter referring to any online transaction (from purchase to delivery) carried out without the help of another person.

Brazilians prefer to make their online purchases through their smartphones rather than computers. Last year, they purchased US$56.3 million worth of goods via smartphone, with an average purchase value of US$100.

In the first half of 2021 and compared to the same period in 2020:

- Sales increased by a record 31%.

- The average price of items purchased increased by 22%.

- Orders increased by 7.4%.

- The number of orders with free shipping increased by 8%.

- Sales of cell phones increased by 56.2%.

The main reason for the considerable growth in online shopping in Brazil is the pandemic. The government has created pandemic ease for most Brazilians by introducing digital wallets, allowing millions of Brazilians to access online retailers for the first time.

Brazil’s southeastern region, which includes São Paulo and Rio de Janeiro, remains the top sales region in Brazil and accounted for 51% of Brazil’s eCommerce growth last year.

According to research by Nielsen, the main reasons Brazilian consumers shop online are as follows:

- 73% of customers do not want to leave their homes.

- 52% prefer special offers such as free shipping, discounts, samples, and loyalty programs.

- 47% value the time savings.

- 38% take into account order delivery times.

THE BIGGEST ONLINE STORES AND MARKETPLACES

Mercado Libre

Mercado Libre (Mercado Livre in Portuguese) is the largest eCommerce store in Latin America. Originating from Argentina, this platform has spread throughout the continent over time, and Brazil has become its core market.

On this website, users (either individuals or companies) can buy and sell items in various product categories, including vehicles, technology, appliances, and other things.

Shopee

Newcomer from Singapore Shopee reached 2 million local sellers in Brazil in April. The sales platform surpassed names like Magazine Luiza and Americanas, with 160,000 and 122,000 “sellers” in the country.

The category resembles the relationship between store owners who pay rent to the mall, where Shopee receives a commission from the sales made. In an interview with Folha de S. Paulo, Felipe Piringer, the company’s director of marketing and strategy in the country, says that 87% of sales come from sellers, where Shopee’s operation in Brazil “is not a translation of a foreign site”.

Americanas.com.br

This is an eCommerce website launched by Lojas Americanas, a well-known Brazilian retail chain. Americanas’ physical store is divided into Convenience Stores, Supermarkets, and Hypermarkets.

But on its website, Americanas.com.br offers everything from automotive products to phones and phone plans, toys, televisions, computers, tablets, audio and home theater equipment, fashion, games, furniture, and more.

Magazine Luiza (Magalu)

Luiza magazine is one of the best-known retail companies in Brazil. The company has more than 800 brick-and-mortar stores across the country.

The company was founded in the 1950s and has become a household name in Brazilian retail. With the expansion to the Internet, the growth was even more significant and naturally reached many more customers. Today, it offers a wide range of retail items, including computers and other electronic devices, televisions, furniture, home appliances, etc.

Casas Bahia

Casas Bahia is a chain of home goods and furniture stores with more than 700 brick-and-mortar stores throughout Brazil and a strong presence in the Brazilian e-commerce market.

The chain offers different products in its online store, including Kitchen, Air Conditioning and Ventilation, Audio, Automotive, Electronics, Fashion, Accessories, Perfume, and more.

OLX

OLX is an e-commerce platform that started its operations in 2006 in the Netherlands and is currently present in 45 countries worldwide, including Brazil.

On the OLX Brazil platform, users can post and sell items, goods, or services in various areas, including Real Estate, Cars, Spare Parts, households, Electronics, Fashion and Beauty, Agriculture, Industry, and more.

Dafiti

Considered one of Brazil’s leading e-commerce success stories, Dafiti was founded to capitalize on the online fashion and footwear market and build a loyal customer base that is always on the lookout for its range of men’s and women’s clothing and children’s fashion.

Founded in 2011, Dafiti has evolved over time, adding new departments to its online stores, such as housewares and sporting goods, to other categories such as clothing, bags, accessories, perfume, beauty products, and decoration.

According to Statista, Mercado Livre’s website recorded around 110.7 million visits in Brazil in January 2022, followed by Americanas.com, which recorded almost 57.4 million visits in that month. Also in the top five of this table are OLX (31.2 million visits), Magazine Luiza (30.8 million), and Amazon Brazil (24.3 million).

According to eCommerceDB, electronics is the most demanded sector in Brazilian e-commerce in 2021, contributing 27% of the revenue of this market on Brazilian soil. It is followed by fashion (22%), toys and hobby and DIY products (19%), furniture and home appliances (17%), and food and personal care products with the remaining 16%.

One of the factors that have boosted e-commerce in Brazil is the proliferation of banks. According to the Latin Business School, the country has developed significantly in terms of financial inclusion. As a result, various government policies have been implemented, leading to 68% of the population having a bank account.

As a result, the population has better access to local means of payment. It has also been the starting point for new payment technologies that optimize transactions and open channels for buying and selling.

Unlike other economies in the region, this has helped Brazil boost e-commerce.