RIO DE JANEIRO, BRAZIL – Disappointment with recent indicators of the Brazilian economy has caused the market to rethink its forecasts. With local economic activity weaker than expected and inflation exceeding estimates, stagflation is being discussed among investors and economists.

The current of Brazilian economists talking about stagflation in 2022 is growing, especially after the semi-disappointing GDP updates.

The second-quarter PÌB released this week contracted 0.1%, while the consensus estimate for the period had been for a rise of 0.2%. On Thursday, September 2, industrial production figures came in lower than expected, falling 1.7% in August, while the market had expected a 0.5% decline. The deterioration in industrial activity was the fourth in the last seven months.

For some economists, this possible economic weakness and high inflation scenario are related to the water crisis. The possibility of rationing and power outages could wipe out growth expectations and affect inflation in 2022. Therefore, there is a risk of stagflation, they say.

Some also point to the possibility of a worsening water crisis due to the La Niña climate phenomenon.

INFLATION AND INTEREST RATE HIKES

As for inflation, the IPCA-15 reading for the first half of August rose from 8.59% to 9.30% in the 12-month period ending in August, well above the central target of 3.75% for this year and the upper target 5.25%.

The Focus Bulletin – which receives estimates from over 100 economists – has been revising upward estimates for inflation this year for more than 20 consecutive weeks. While the consensus at the beginning of the year for IPCA was 3.32% in 2021, today, the consensus is 7.27%.

Some economists see inflation at 8% by the end of the year but think it is too early to discuss stagflation. However, they see the possibility of that scenario occurring in 2022.

The Central Bank is expected to raise the benchmark SELIC interest rate to 8% by the end of the year to contain inflation and keep the exchange rate low. However, there is already talk in the market of a double-digit Selic rate.

The rise in interest rates and lower expectations for economic growth have made public bonds more attractive recently. With the Treasury paying real interest rates above 4% and up to 10% on fixed-income investments, investors weigh the risks, considering the stock market’s poor performance. This year, the Ibovespa index is down 1.7%.

Perhaps in times of greater uncertainty, investors rush to fixed income because they seek the security of profitability.

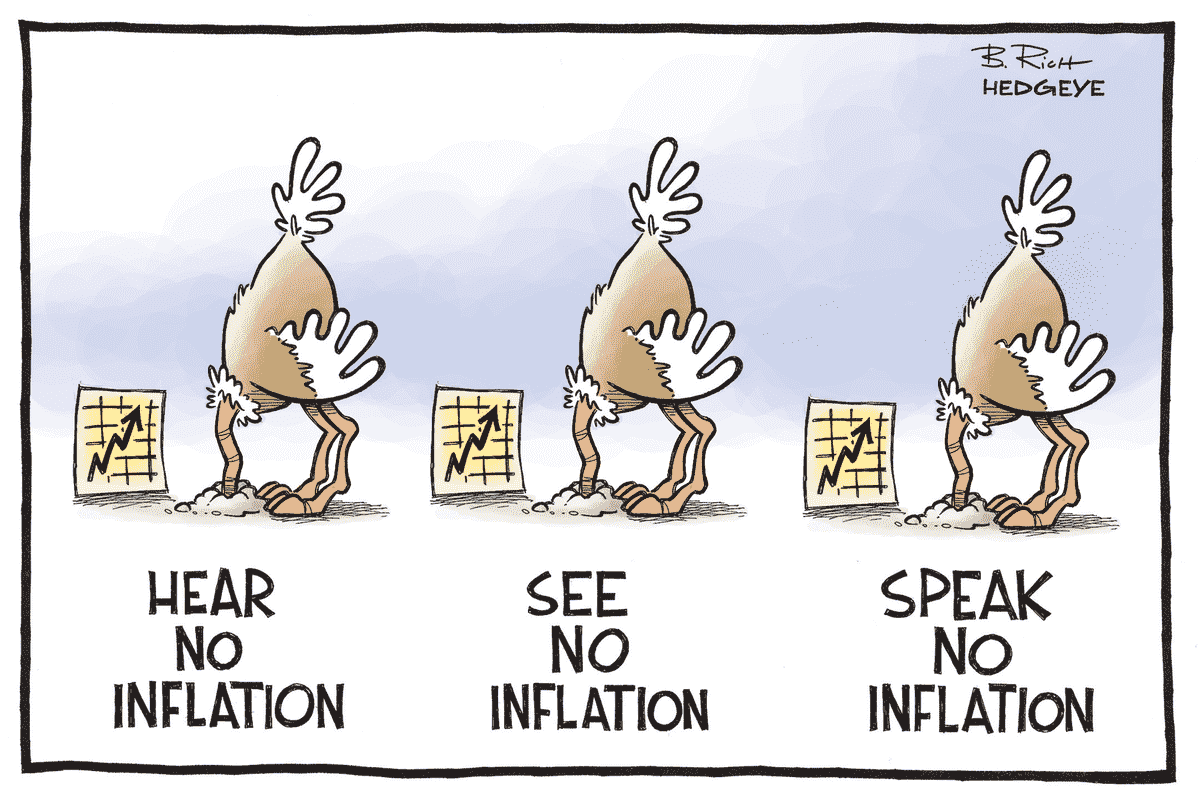

In economics, stagflation or recession-inflation is when the inflation rate is high, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since actions intended to lower inflation may exacerbate unemployment.