RIO DE JANEIRO, BRAZIL – The federal government’s revenue grew in December for the fifth consecutive month, but closed the year with a drop of 6.91%, at R$1.479 trillion (US$273.8 billion) , the Federal Treasury said on Monday, January 25th, a performance showing the negative impact of the economic crisis as a result of the Covid-19 pandemic.

The aggregate result for the year was the worst since 2010, when revenues totaled R$1.474 trillion, considering figures corrected by the IPCA (Extended National Consumer Price Index).

In the last month of the year, revenues rose 3.18% over the same month in 2019, to R$159.065 billion, the best result for the month since December 2013. However, the increase was lower than the 7.31% growth seen in November.

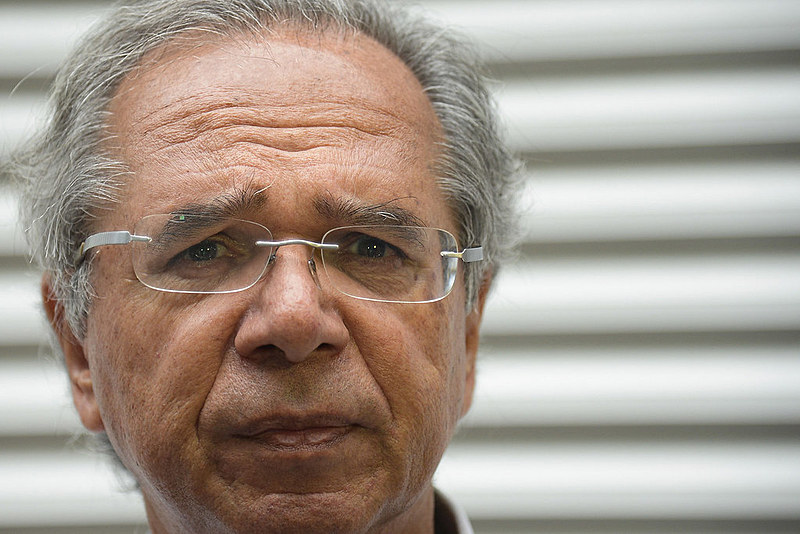

In a brief presentation by the Federal Treasury to the press to detail the data, Minister of Economy Paulo Guedes said that the nominal decline of 3.75% in federal revenue in 2020 was an “excellent” result, considering the challenge of the Covid-19 pandemic faced by Brazil and the world.

According to him, the drop in revenues was “well below” previous projections by economists, organizations and international bodies.

“Given the collapse of revenues in May, which dropped by 30%, when the greatest impact on the economy was felt, closing the year with a drop of just over 3%, compared to the initial impact of 30% is demonstrative of the vigor of the rebound,” Guedes said.

He stressed that the country showed a ‘ V’ shaped recovery, and that most business sectors today have a Gross Domestic Product (GDP) “slightly” above pre-pandemic levels.

Referring to the measures implemented by the government to tackle the economic impact of the pandemic, Guedes said that out of a total of over R$80 billion in deferred taxes, there was a recovery of over R$60 billion from the third quarter onward.

“Companies recovered and paid these deferred taxes. Of the more than R$80 billion in deferrals, only R$8 billion have not been recovered”, said Guedes.

The Minister also mentioned the increase, in nominal terms, of the Simples (a single tax regime for micro and small businesses) revenue from small and medium-sized companies. “It is clear that it was the strength of the rebound since the third and fourth quarter that enabled this sharp increase in revenue.”

In its presentation, the Federal Treasury stated that the revenue result in 2020 followed the behavior of the main economic indicators, affected by the impacts of the Covid-19 pandemic.

According to the body, in 2020, there was a nominal increase of 58.86% in the volume of tax compensations, totaling R$62.1 billion.

Tax revenue was also affected by the reduction to zero of the IOF (Tax on Financial Transactions) rates applicable to loan operations, which began to have an impact on tax collection as of April, with a tax waiver of R$19.7 billion.

On the other hand, there was a collection with non-standard payments of Corporate Income Tax (IRPJ) and Social Contribution on Net Profits (CSLL) last year of about R$8 billion.