RIO DE JANEIRO, BRAZIL – The Berlin-based German fintech received a license from the Brazilian Central Bank to “carry out credit operations,” including third-party credit analysis, and issue electronic currency in the country, per AltFi.

This news is long-awaited: N26 first announced plans to enter Brazil in 2019, which CEO Valentin Stalf noted represents a much bigger opportunity than the UK, where the neobank withdrew early last year due to Brexit concerns. The neobank’s future goals include breaking even in late 2021 and raising additional funds, before going public in 2023 at the earliest.

Brazil represents a favorable growth opportunity for N26—but it won’t be without challenges.

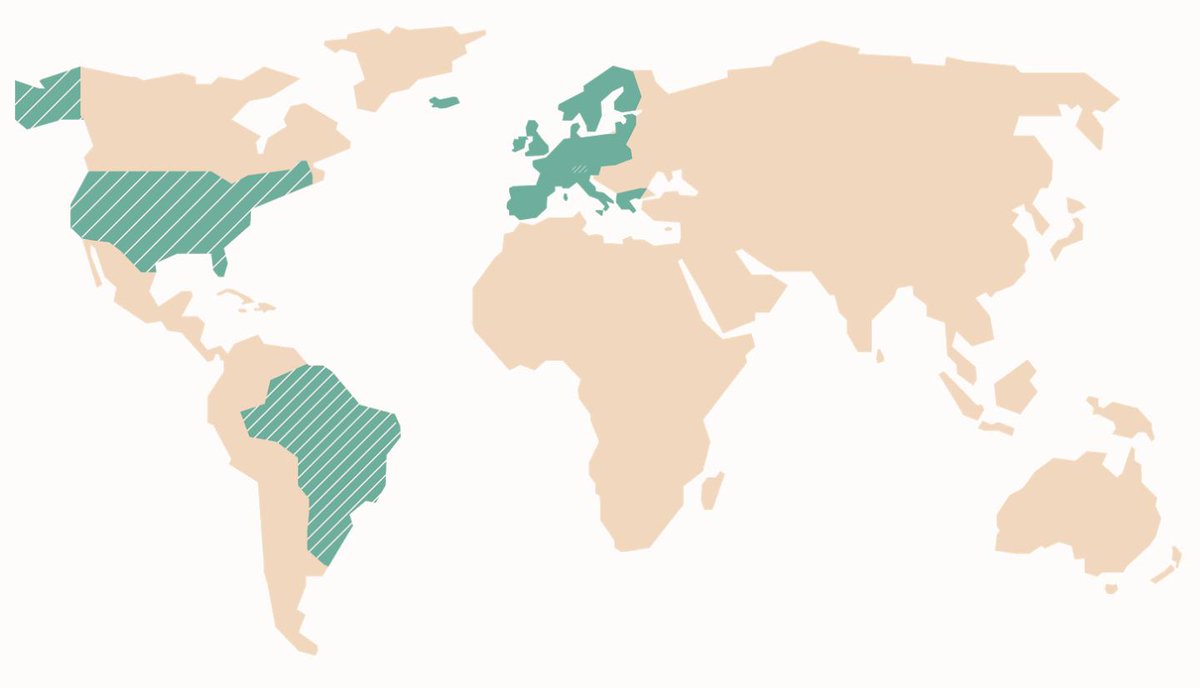

The Germans are entering the market with good credentials: N26 is one of the most valuable start-ups in Europe and one of the biggest fintechs in the world, supported by well-known global investors. N26 has more than 5 million customers across 25 European markets and the USA and has experience in entering and conquering new markets.

Brazil boasts a large addressable market due to its high percentage of underbanked yet connected consumers. Fifty-five million consumers in Brazil are underbanked, representing around one-fourth of the total population. But 60% of the unbanked consumers have cell phone or internet access, meaning that new entrants like N26 can bring their digital services to a wide base of tech-savvy consumers who aren’t already entrenched in an incumbent financial services ecosystem.

But homegrown fintech Nubank holds an early advantage in Brazil, and its dominance will likely be N26’s biggest growth hurdle. Nubank is the world’s largest fintech by customers and valuation, hitting 25 million users in June and a valuation of US$10 billion as of its last funding round in July 2019.

It operates only in Brazil and Mexico—though it is reportedly eyeing a launch in Colombia, which presents a similar opportunity in its large addressable base of financially underserved consumers. Nubank CEO David Vélez previously attributed Nubank’s success to its novelty, saying that “personal finance tools in both Brazil and Mexico are so limited that Nubank has not had to spend a dollar on customer acquisition.” That’s unlikely to be the case for N26, as it will have to contend with Nubank’s powerful brand name and an unfamiliarity with the Brazilian market.

To capture Brazilian customers, N26 should follow its own playbook for entering new markets and implement an aggressive marketing push in the country. N26 has proven it can identify growth opportunities and adapt to new markets, with its core markets outside of Germany including France, Spain, and Italy. And in the US, it amassed 500,000 users in the year after its 2019 launch.

To achieve similar success in Brazil, N26 should prioritize building brand awareness: When it launched in the US, the fintech established brand partnerships to incentivize card usage through discounts and ran widespread ad campaigns across high-traffic areas like public transit in major US cities. Tailoring similar initiatives to the Brazilian market could help N26 establish a foothold, even in Nubank’s shadow.