RIO DE JANEIRO, BRAZIL – Although the country will not be the one to grow the most, it will be one of the few to show an acceleration compared to 2019, which makes this “story” more interesting, according to Claudio Irigoyen, Bank of America’s chief economic officer for Latin America.

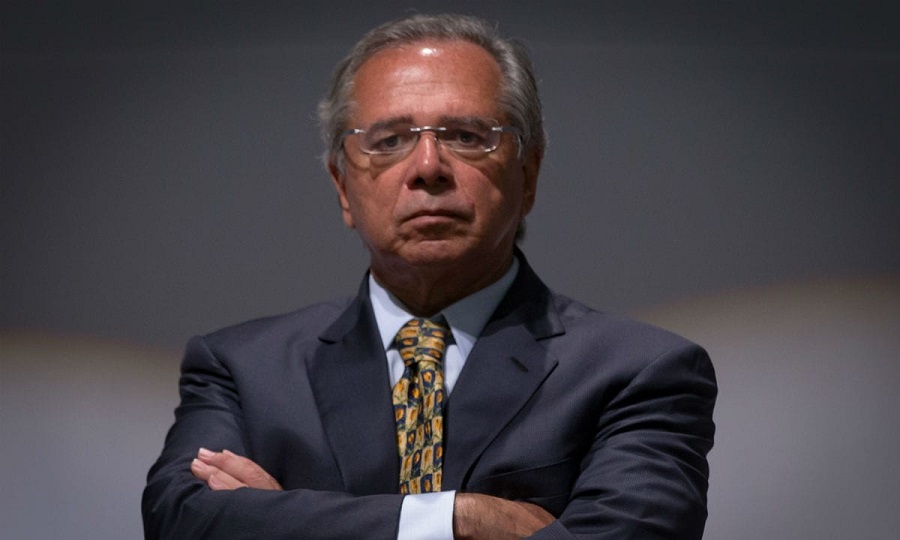

Irigoyen, a graduate of the University of Chicago – the same as Economy Minister Paulo Guedes – says he is concerned about the possibility of shocks hitting Brazil in 2020, hindering robust growth.

“If there is no growth, it will be difficult to explain that things are being done right”.

He also states that the economic recovery at this first moment will come from consumption, as companies still keep great idle capacity, which prevents new investments.

Below are excerpts from the interview.

Q: Two years ago, you stated that Brazil could not go on with consumption as its only growth engine. That hasn’t changed so far. Is that why we haven’t accelerated?

A: Brazil has gone through a severe recession, so the idle capacity is still large. The recovery will come from consumption because with idle capacity, there won’t be much investment. That could go on until 2021. Then it will take more investment to grow sustainably.

Q: What can be done to speed it up?

A: You have to make microeconomic reforms to lower the cost of doing business. For instance, there are several intermediate costs to export. There is a lot to improve in this area, and that’s not something very grand, like the welfare reform.

Our baseline scenario, for now, is a GDP growth of 2.5 percent in 2020, but there may be shocks.

Q: Is it possible for the country to keep this rate of 2.5 percent after 2020? Several economists say Brazil’s potential today is just over one percent.

A: There could be three years of growth at three percent because it is a cyclical recovery. If you want to remain at that rate, you have to increase investment by three or four points of GDP and productivity by 30 percent.

Today, Brazil’s potential output can be between 1.0 and 1.5 percent. But the potential output of all countries has dropped because China is slowing down. On the domestic front, the rules of the game are unstable and the view is that nobody can stabilize the economy in the medium term.

All the adjustments are temporary and no fiscal savings are made in times of prosperity in order to endure the difficult times.

Q: How can productivity and investment be boosted?

A: By stabilizing the economy, the risk premium that investors require to invest money in Brazil decreases. We have already started to see that. Then you have to decrease the uncertainty because the question you could ask is: Will interest rates remain low for 15 years or one year?

It’s one thing to invest in Brazilian assets like stocks, which, if I’m wrong, I’ll sell tomorrow. Another thing is to make physical investments. If I have a five-year investment, I need not only think about whether the government is doing things well, but also about the government that will come after this one.

But the feeling of uncertainty today is global, much because of the (trade) war between China and the United States.

Q: What is the bank’s scenario for Brazil and the world in 2020?

A: Our baseline scenario is that the world will keep the growth rate, but will change the composition a little. The US is going to slow down, grow 1.7 percent. Europe will remain at one percent and China will drop from 6.1 to 5.6 percent.

Latin America will grow 1.5 percent, with Brazil as the engine. Peru will continue to grow by three percent, but there will be a presidential election and it is not very clear what will happen. For Chile, we expect 1.2 percent. Brazil is the story we like best for 2020 in Latin America.

Q: Can instability in Latin America, like that of Chile, contaminate Brazil and further reduce investment?

A: That’s why there will be growth in Brazil next year. Because if there isn’t, it’s going to be difficult to defend the Bolsonaro model. People will say: ‘We’ve had the Bolsonaro model for two years and we haven’t grown. Then it’s going to be difficult to explain that you’re doing things right, but that things that are out of control happen and that’s why the country is not growing, particularly when every year you have a different excuse.

Although we now have some figures that suggest that the economy is going to start growing. One year ago, however, we had a growth projection of 3.5 percent for 2019 and the country grew one percent.

Q: In your opinion, what happened this year that prevented us from achieving 3.5 percent?

A: There was a global slowdown because of the uncertainty of the trade war, the Argentine shock, the Vale shock, and the fact that the government decided, rightly in my opinion, to reduce the size of the State. That makes the economy have less fiscal impulse in the short term.

Q: Was that not expected?

A: I don’t think the short-term impact had been considered.

Q: How do foreign investors view Bolsonaro’s government and the controversies in which it gets involved, like the environmental issue?

A: Maybe these controversies don’t help much, but they aren’t anything major either as long as the economic structure is run by someone like Minister Paulo Guedes. How does the market view Bolsonaro? It sees that he put Guedes in charge and gave him the freedom to implement the current plan.

I also studied at Chicago [University], so I won’t say anything against Guedes. But he was given the freedom to implement his plan.

Source: Infomoney