RIO DE JANEIRO, BRAZIL – There is, among economists, the concept of fair value of an asset, but as well as tourists who postpone their travel plans abroad, most of these experts have not considered the new value of the dollar, around the R$4.15, to be right.

There are explanations of why the U.S. currency has gone up, and nothing indicates that it will fall anytime soon, to the disappointment of those who have planned to take vacations abroad.

The first explanation for this complete change in the increase of the exchange rate, frustrating the expectations of those who, at the beginning of the year, projected the currency rate at R$ 3.60, is on the entry and exit of dollars of the Brazilian economy, called exchange flow.

In the year to date, there is a net outflow of almost US$9 billion, compared to the inflow of more than US$20 billion in the same period in 2018.

Here’s the rule of supply and demand: if there are fewer dollars in the economy, the more expensive the American currency becomes in relation to the real.

Variations are no longer abrupt because of the savings of more than US$380 billion that the country maintains.

“Brazil has an exchange flow problem, there is no entry of dollars. The country has little attractiveness for stock exchange investments and fixed income [for foreign investors],” says Sidnei Nehme, an economist, and director of NGO Associados.

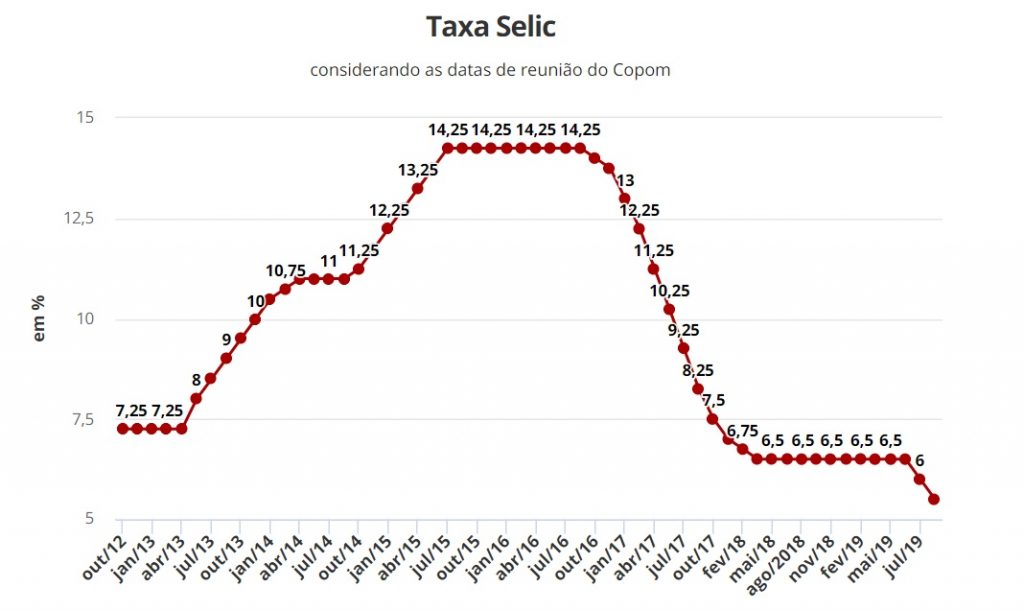

The exit of dollars is directly linked to the fall of Selic, the basic interest rate. The country, which has always been known as the paradise of the rentier, was a windfall for international investors who came to negotiate interest rates and had returns of around 14 percent a year. By bringing in money, the value of the dollar fell.

The recession and the cycle of falling interest rates, which took Selic to 5.5 percent a year, with signs that it could end 2019 at an even lower level, in some estimates below 5 percent, discouraged not only the small Brazilian investor but also prominent foreigners.

Abroad, interest rates also fall – in the United States, they went to the range of 1.75 percent to 2 percent per year on the same day that the Selic fell to the lowest index in history. The speed of the fall outside, however, is lower than here, taking away the attractiveness of investments in Brazil.

As the difference between the interest rates here and the United States was never as small, Brazil lost attractiveness.

“For the investor who had been investing in Brazil looking for income, the difference [between the interest here and abroad] is now so little that he is not coming anymore,” says Nehme.

Also, there is a global aversion to risk, as a result of the trade dispute between the US and China and signs of a global economic slowdown.

In both cases, the instinct of investors is the same: take money out of risky countries, such as Brazil, and take it to the safe harbor of US debt.

“The global movement of risk aversion pressured assets and emerging currencies,” says Julia Gottlieb, an economist at Itaú Unibanco.

Banco Itaú has not yet changed its estimates for the dollar at the end of this year, expected to be R$3.80. For 2020, the bank projects that the currency will end at R$4per dollar.

“There is still a lot of uncertainty. If the interest rate drops more… We are still learning the impact. It’s a new world, a reality difficult to compare with the statistics we have,” says Gottlieb.

At Bradesco, the projections have already been revised. The bank estimates that the currency will end this year quoted at R$ 4 per dollar.

The economists heard weekly by the Central Bank in the Focus Bulletin project had an average projected rate of R$3.95.

The director of an NGO also estimates that the currency should close in 2019 at R$4.00. “I do not see the possibility of closing below that,” he says.

With the financial market unattractive at this time for foreign investors, the key is the significant investments in infrastructure; but the only one on the radar for this year is the auction for concessions, which will offer barrels of surplus oil from the pre-salt area, whose inflow of resources in 2019 still depends on compliance with a tight schedule.

The auction is scheduled for November 6th. “The rest are occasional improvements, such as greater soybean exports,” adds Nehme.

There are still two other signs that it is more likely that the direction of the dollar is up rather than down. One is the way the Central Bank is intervening in the foreign exchange market, says Nehme.

The Central Bank is selling reserves in the spot market, injecting money into the market. However, it simultaneously carries out an operation that, in practice, withdraws dollars in the future market. This tends to keep the currency high in the long run.

Another reason is the way the Brazilian foreign exchange market works, which has the current price determined by the futures market. The metaphor used by economists says that, in Brazil, the tail wags the dog.

In the futures market, you trade a bullish or bearish forecast. And for someone else to buy (believing in the currency’s bullishness), someone else needs to sell (betting on the fall).

Having made this explanation, in the Brazilian market today, foreigners are those bought dollars, with a smaller portion of banks. The sellers are institutional investors.

In part, that’s why the Focus Bulletin indicates that the dollar may still fall below $4 by the end of the year since the latter are the economists in higher volume among those consulted by the Central Bank.

Another saying that exists in the financial market is that the exchange rate exists to teach humility to economists. And that’s why it will be necessary to wait until the end of the year to find out who made the best bet. For tourists who go abroad, the best thing is to buy dollars little by little and avoid counting on luck.