Fitch Ratings forecasts a 4% growth for Sub-Saharan Africa in 2024, signifying a steady economic progression.

This growth aligns with the five-year average up to 2019, although it’s slightly lower than the robust trend prior to 2014.

The analysis highlights a neutral trend in ratings for the region, indicating stable economic conditions.

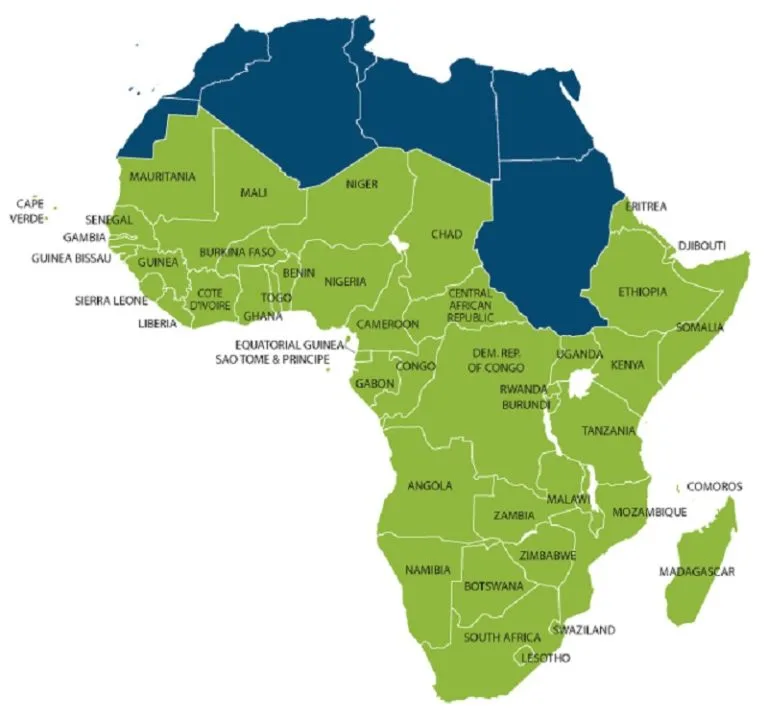

Despite the overall average growth, there are notable variations among the 20 countries analyzed.

Seven of these countries are expected to grow at rates equal to or exceeding 5.5%, illustrating the diverse economic landscapes within the region.

Key risks identified include financing constraints, climatic events, and the possibility of slower global growth impacting African economies.

These factors underscore the interconnectedness of global and regional economic dynamics.

Inflation in the region is projected to slow down, decreasing from a high of 7.4% in 2022 to an anticipated 4.9% next year.

This expected decrease in inflation could contribute positively to economic stability across the region.

Regarding public debt, Fitch expects a stabilization of 67%.

This prediction is based on ongoing fiscal consolidation efforts supported by International Monetary Fund programs in many countries.

The stabilization reflects concerted efforts to manage fiscal challenges effectively.

Countries in the region have public debt exceeding 70% of their GDP

The debt-to-GDP ratio in this region is maintained at 67%, higher than pre-pandemic levels, indicating the long-term impact of the pandemic on the region’s economies.

This level of debt highlights the importance of continued fiscal management and economic reforms.

The report also notes that half of the Fitch-rated countries in the region have public debt exceeding 70% of their GDP.

This high debt ratio presents ongoing challenges and underscores the need for careful fiscal planning and management.

The analysis concludes that the average debt-to-revenue ratio will remain above 300%, suggesting that tax revenues cover only a third of debt servicing costs.

This statistic points to the ongoing need for economic reforms and efficient tax collection to ensure regional fiscal sustainability.