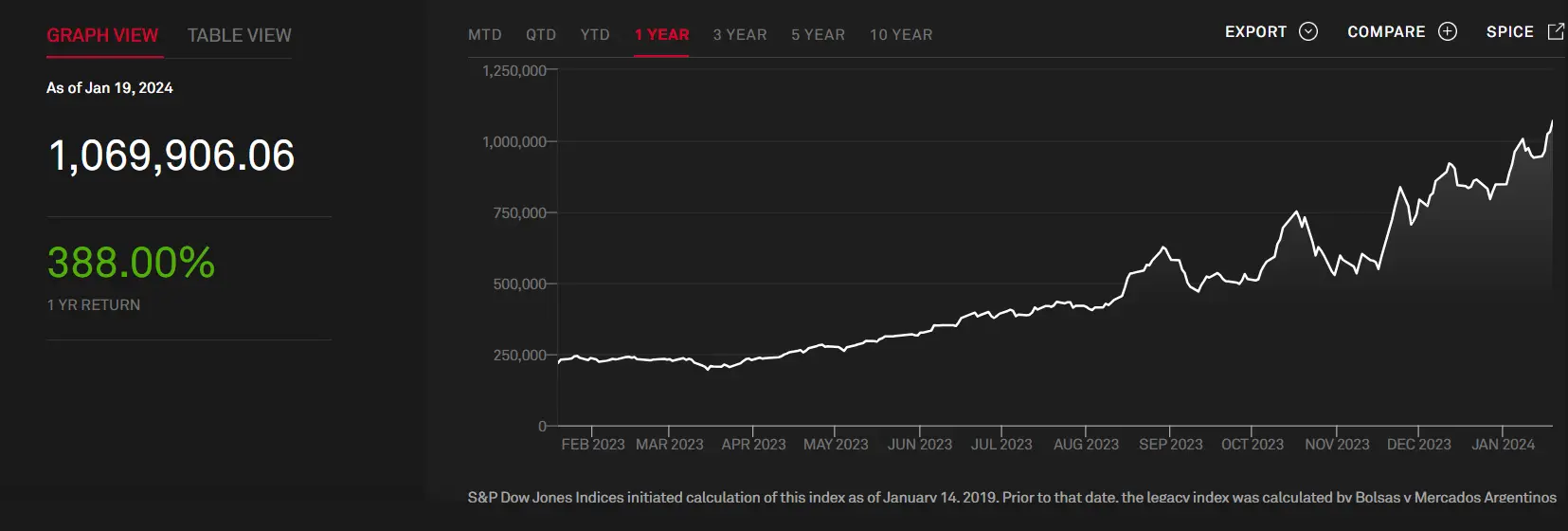

Following President Javier Milei’s election, Argentina’s main stock index, the S&P Merval, reached an unprecedented peak.

On January 19, 2024, it soared to 1,174 billion points, a notable increase of 3.6% in its latest session. Since Milei’s victory, the index has impressively climbed by 82.1%.

For five days straight, the nation’s stock market has been on an upward trajectory, marking a 9.73% rise.

This growth coincides with Argentina’s successful debt renegotiation with the International Monetary Fund (IMF), reflecting President Milei’s commitment to rigorous fiscal goals.

The parallel market’s US dollar rate, also called the ‘dollar blue,’ escalated to 1,195 Argentine pesos.

This reflects a 29.2% hike from the pre-election rate of 924.9 pesos, a change since the election’s second round.

Similarly, the Brazilian real’s parallel exchange rate rose to 242.2 pesos, up from 189.5 pesos before the elections.

President Milei has revised the official exchange rate, which was stagnant under the previous government.

This led to a gap between the currency’s actual value and its market rate. He initially increased the dollar’s value from 366 to 800 pesos to rectify this.

The official dollar rate continues to climb at 819.8 pesos, a 131.6% increase post-election.

The Brazilian real’s official rate has followed suit, now at 166.2 pesos in Argentina. However, transactions at these official rates for US dollars or Brazilian reals are rare due to limited foreign currency availability.

Background

Argentina’s stock market surge under President Milei provides a unique backdrop for understanding regional and international economic dynamics.

The country’s financial landscape contrasts with its neighbors in South America, many of which face their own economic challenges.

Unlike Brazil or Chile, Argentina’s stock market response to political change shows a distinct investor optimism, potentially fueled by Milei’s market-friendly policies.