Gold hit a two-month peak, driven by poor U.S. manufacturing data and declining consumer confidence, suggesting potential interest rate cuts.

February’s sharp decrease in U.S. factory activity, alongside the first drop in consumer confidence in three months, signaled economic concerns.

The economic downturn caused Treasury bond yields to fall, pushing gold prices up by 1.3%, the biggest rise since mid-January.

This scenario fueled speculation that the Federal Reserve might reduce borrowing costs, impacting non-yielding bullion negatively.

Federal Reserve officials’ remarks further propelled gold. Governor Christopher Waller expressed a preference for increasing short-term Treasury holdings.

Austan Goolsbee from the Chicago Fed commented on the restrictive nature of the current funds rate.

Both Thomas Barkin from Richmond and Lorie Logan from the Dallas Fed shared insights on potential rate cuts and balance sheet strategies, shaping market expectations.

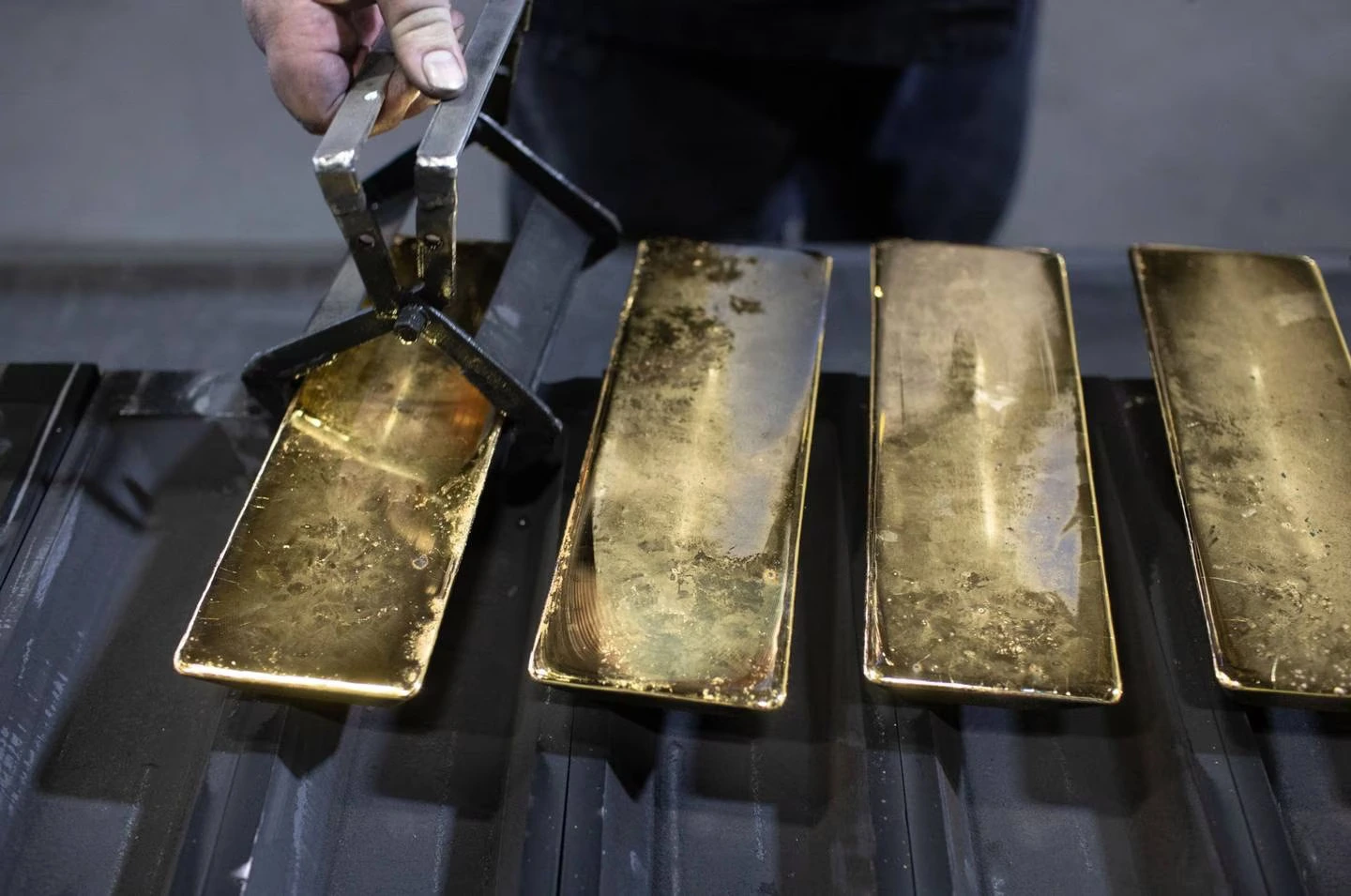

By Friday, spot gold was up 1% to $2,073.31 an ounce, aiming for another week of gains.

Increases in silver, platinum, and palladium highlighted the wide-reaching effects of economic reports and Federal Reserve statements on precious metals.

This sequence illustrates the close link between economic data, monetary policy decisions, and the commodity market, with gold acting as a refuge during economic uncertainties.

Background

This surge in gold prices amid economic uncertainties is not an isolated phenomenon; it’s a trend observed historically during periods of financial instability.

Gold, often seen as a safe haven, tends to appreciate when confidence in traditional investments wanes.

This pattern reflects broader economic dynamics where investors seek stability in tangible assets.

The recent economic data from the U.S., indicating a slowdown, has global implications.

Similar downturns have prompted central banks worldwide to adjust monetary policies, often leading to increased interest in gold.

This dynamic underscores the interconnected nature of