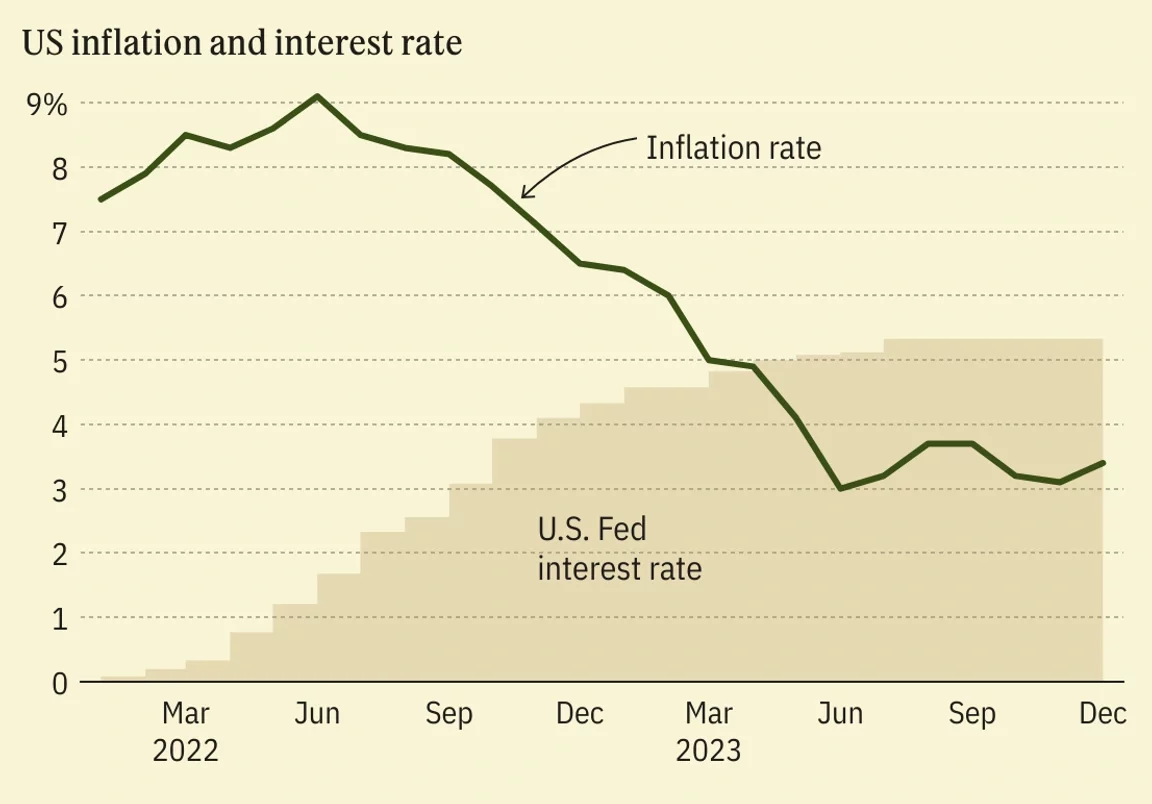

Recent U.S. economic shifts hint at slowing inflation, sparking talks of Federal Reserve (Fed) rate cuts in 2024.

These changes are key as President Joe Biden eyes reelection, with the economy’s state influencing voter opinions.

After a phase of raising rates to tackle inflation, the Fed, led by Jerome Powell, now hints at possible cuts.

Markets have reacted well, expecting policy easing could start by next spring.

This move aligns with efforts to balance inflation control while supporting job market strength and consumer spending power.

The Fed’s potential rate cuts could boost Biden’s reelection campaign by improving the economic landscape.

Though Biden has stayed quiet on Fed policies, softer monetary policies might indirectly benefit his campaign, especially as inflation and economic management concerns linger.

However, economic uncertainties remain, including recession risks and global events affecting inflation.

Public sentiment, shaped by job security and consumer prices, is crucial.

Yet, current trends suggest cautious optimism for a steady economy, which could favor Biden as the election nears.

In summary, the interaction between economic policy, inflation trends, and political outcomes highlights the Fed’s significant influence on U.S. politics.

As 2024 approaches, this economic narrative will likely be central to electoral discussions, affecting both Biden’s campaign and his challengers.