The World Bank has flagged The Gambia’s and Mozambique’s state-owned enterprises (SOEs) as a financial hazard to the nation’s economy.

In a detailed study, they note these entities make up a vast 35% of these countries’ GDP.

Their report, The Business of the State, covers over 76,000 public companies in 91 nations.

It warns of potential economic crises stemming from SOEs’ fiscal issues, like deficits and debts.

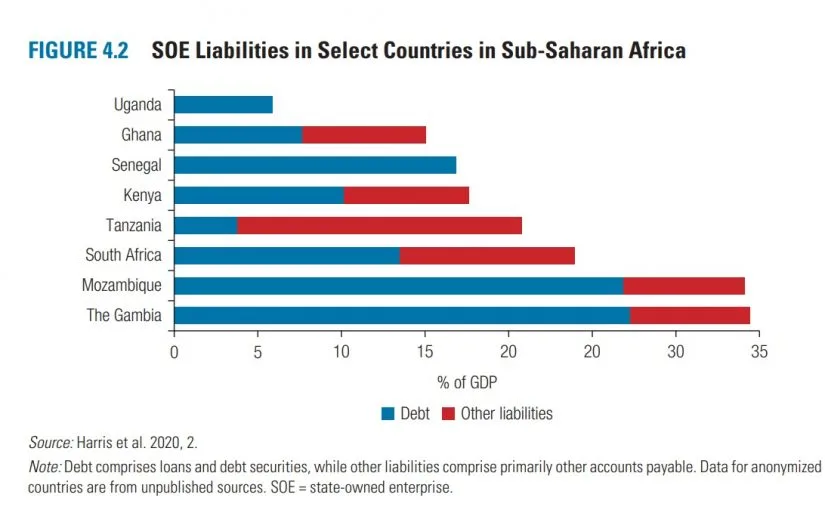

In Sub-Saharan Africa, SOEs’ revenues are typically 7% of GDP. Their assets and liabilities are about 34% and 20% of GDP, respectively.

This large economic role sparks debates on the state’s business involvement.

The report examines the state’s dual role in the economy. It notes how state firms, as seen in Angola and Nigeria, sometimes support public needs.

These firms have ensured essential services like electricity are accessible. However, the report also shows cases where state firms exploit their position.

An example is Angola’s cement sector, where state involvement limits competition. This affects private investment and growth.

The Gambia and Mozambique’s experience is a prime example.

The Gambia

Gambia’s state enterprises face substantial financial risks due to high debts, operational inefficiencies, and unstable revenues.

Additional challenges include political interference, lack of transparency, intense market competition, regulatory shifts, and global economic fluctuations.

Addressing these issues to ensure financial stability and bolster national economic health necessitates reforms like enhancing management efficiency and transparency.

Additionally, restructuring debts may be a crucial step in this process.

Mozambique

Following the 2016 ‘hidden debts scandal,’ the country faced a severe financial crisis.

The Fiscal Risks Report by Mozambique’s Risk Management Directorate points out the financial danger from its State Enterprise Sector (SEE).

Specifically, three companies are major concerns for 2024. However, there was an improvement in 2022.

Due to their fragile conditions, LAM, Petromoc, and TMCEL continue to pose financial risks. This situation in The Gambia and Mozambique mirrors global concerns about SOEs.

Global Concerns About SOEs

Historically, many countries have struggled with balancing state and private sectors. A key challenge is ensuring SOEs don’t undermine fair competition.

Effective SOE management has varied globally, reflecting different economic and political contexts.

In terms of benchmarking, Mozambique’s SOE debt reduction in 2022 is a positive sign. This contrasts with situations in some countries where SOE debts have escalated.

Analysis suggests that proactive management and transparency are crucial for success. The World Bank’s focus on this issue highlights its importance in global economic stability.

Learning from history, it’s clear that balancing SOE roles is vital for sustainable economic growth. This case offers valuable lessons for other countries facing similar challenges.