A bridge collapse in Baltimore threatens to slow down the export of crucial commodities like coal from a key East Coast port.

This event underscores commodity supply chain vulnerabilities, notably at Baltimore port, a major U.S. coal export hub to Asia.

Iron ore prices are wavering at about $100 per ton, reflecting a soft demand for steel in China.

The oil and gas sectors buzz with activity, highlighted by Exxon’s $60 billion acquisition of Pioneer, the largest in over twenty years.

Coal’s Challenge

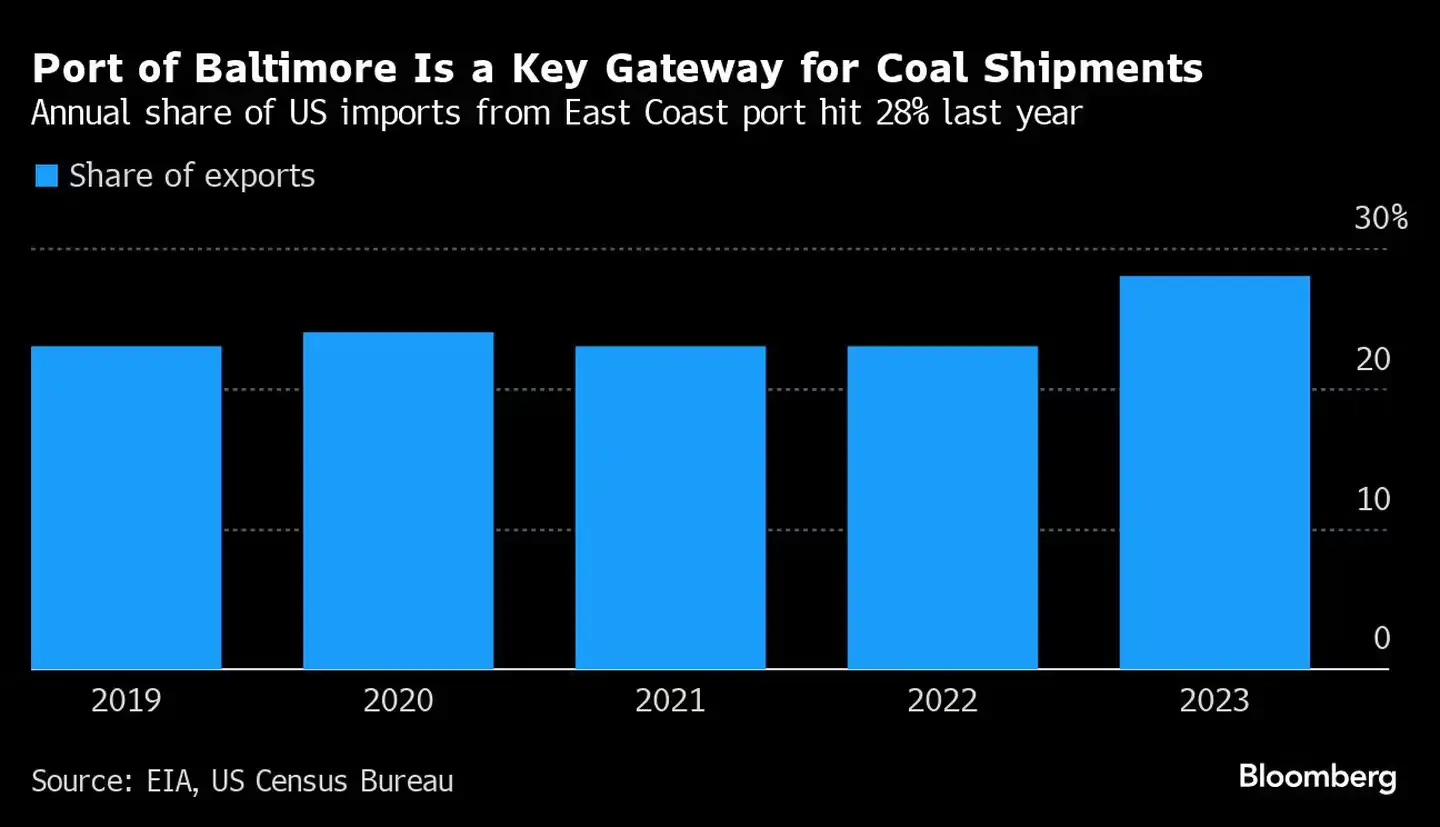

The unexpected collapse of the Francis Scott Key bridge complicates coal exports from Baltimore, a critical hub that accounted for 28% of the nation’s coal exports in 2023.

The U.S. Energy Information Administration notes the port’s significant role, with exports spiking last year due to increased Asian demand.

This incident is set to affect export volumes in 2024, underscoring the fragility of supply chains.

Iron Ore in Flux

The iron ore market faces uncertainty, with prices teetering around $100 per ton amid China’s real estate woes, which are impacting steel demand.

Despite some positive signs in the steel market, overall demand is pressured, suggesting potential price adjustments ahead.

A Surge in Oil and Gas Deals

The year kicks off with a wave of mergers and acquisitions in the oil and gas sector, totaling over $84 billion.

High-profile deals, including Diamondback Energy’s and EQT Corp’s strategic acquisitions, point to a vibrant industry seeking expansion and new drilling opportunities.

Agricultural Shifts: Corn and Soybeans

Agricultural trends show a shift from corn to soybeans among U.S. farmers, driven by soy’s higher market price and demand for renewable diesel production.

This adjustment reflects broader market responses to global supply and demand dynamics.

Hurricane Season’s Impact

The looming Atlantic hurricane season, predicted to be more active than usual, presents another layer of commodity risk.

With significant oil and gas infrastructure in vulnerable areas, storms could disrupt energy markets and affect agricultural production in the U.S. South.