Brazil’s announcement of a new industrial development strategy, involving significant financing, has prompted a notable rise in the dollar’s value against the real.

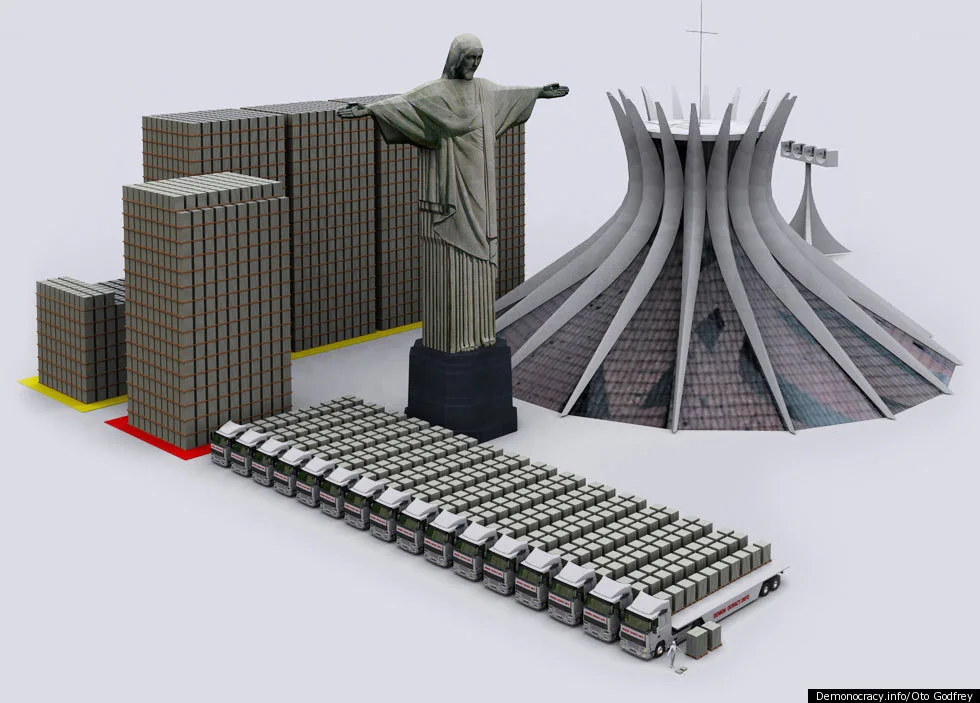

This financial plan, involving R$ 300 billion (approximately $60 billion) and extending to 2026, has intensified concerns about the country’s fiscal health.

On the day of the announcement, the spot dollar escalated by 1.23% to R$ 4.9892, accumulating a 2.81% increase for January.

In the futures market, the leading dollar contract on B3 advanced 1.13% to R$ 4.9945.

The Ministry of Development, Industry, Commerce, and Services (MDIC) clarified that of the total R$ 300 billion, R$ 106 billion (approximately $21.2 billion) had been previously announced in July.

The plan emphasizes sustainable financial instruments, innovation, infrastructure, export credit, and subsidies, including tax incentives.

These measures are already partly implemented by institutions like BNDES and Finep.

Despite BNDES operations supporting the program, market professionals have expressed concerns, indicating a negative market perception.

This sentiment persists, even though the program may not directly impact the government’s fiscal status.

Post-announcement, interest rates in the DI market also saw an increase, reflecting the market’s response to the government’s new economic measures.

This scenario underscores the delicate balance Brazil faces in stimulating industrial growth while maintaining fiscal stability.

Background

Brazil faces a big challenge with public debt. The OECD forecasts the debt will hit 80% of the GDP by 2024.

Without proper fiscal management, it could reach 100% by 2037. Debt levels are sensitive to policy changes.

The OECD stresses the need for strong reforms.

The Brazilian government has made some reforms. A key tax reform was passed in late 2023. These changes aim to control public debt.

The new fiscal policy, which started in August 2023, targets budget issues. It introduces more flexibility and predictability.

The OECD notes that under Bolsonaro, debt decreased from 87% to 73% of GDP between 2021 and 2022.

This decrease was due to economic recovery. However, there is a risk of debt growing again. This is because of current fiscal policies.