Brazil’s Central Bank has declared that cryptocurrency firms are free to operate without the need for specific authorization.

This covers exchanges, wallets, and service providers. The Bank will release detailed rules later. The current legal provisions are not yet valid.

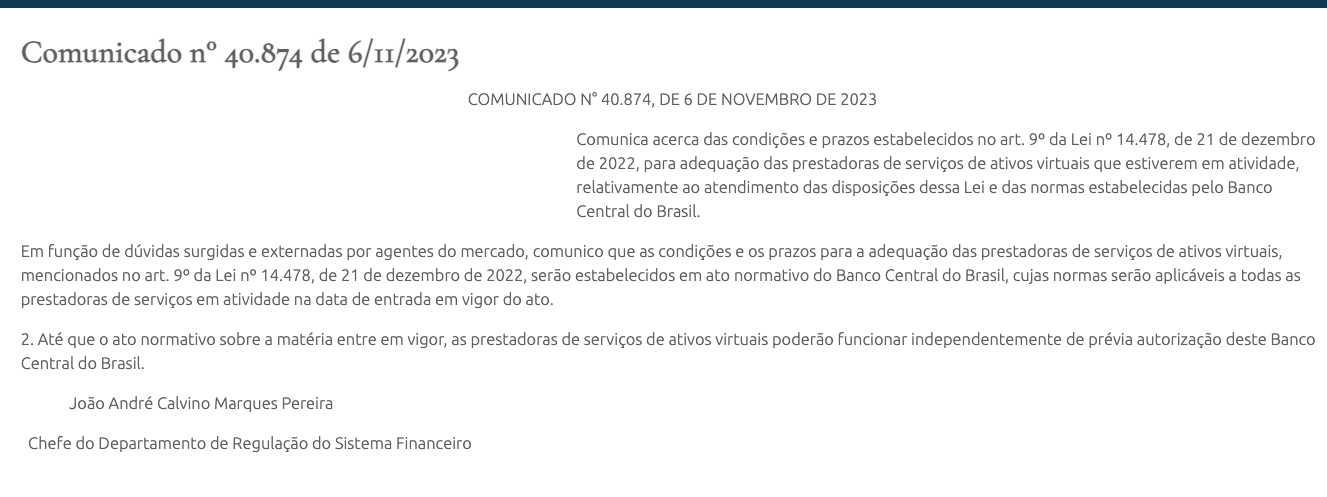

The Central Bank’s notice, number 40,874, explains this. It says that the Bank oversees the crypto market.

But, the rules for this are still not ready. Because of this, a law from December 2022 doesn’t apply yet.

When the Bank issues new regulations, all active service providers will follow them. For now, virtual asset companies do not need the Bank’s approval.

The Bank aims to bring out cryptocurrency regulations by mid-2024. They have also shared plans for a public consultation in November.

Fabio Araujo of the Bank mentioned the focus on Virtual Asset Service Providers (VASPs). These are important in the digital economy.

They handle various tasks involving virtual assets.

Here’s what VASPs do:

- They help users buy and sell cryptocurrencies, ensuring safe and efficient trades.

- They keep users’ digital assets secure.

- They make it possible to use cryptocurrencies to buy things and pay for services.

- They let people trade other digital items, not just cryptocurrencies.

- They offer more complex financial services, like lending.

After the public consultation, the Bank wants to start the first regulation phase in the following year’s first half.

They are also looking at stablecoins. These are a type of cryptocurrency tied to an asset like the dollar to keep their value steady.

Araujo believes stablecoins need careful regulation. But they might not be in the first regulation phase.

This first phase will likely focus on service providers like Binance and others.