The Monetary Policy Committee (Copom) hinted at a potential change in the Selic rate, which currently stands at 12.25%.

By December 12-13, they might reduce it to 11.75%. This decision follows a recent reduction of 0.5 percentage points.

That drop brought the Selic to 12.25%, its lowest since May 2022.

This reduction is not new. The Central Bank decreased the Selic rate in three consecutive meetings.

Each time, they reduced it by 0.5 percentage points. Every decision was unanimous.

What’s driving this change? Internationally, there are challenges. US long-term interest rates are rising.

Inflation cores in many countries are proving tough to bring down. Geopolitical tensions also add uncertainty.

Major economies’ central banks want inflation rates to meet targets. They see labor market pressures. The Committee believes emerging countries need to be cautious.

Brazil’s economy is slowing down. That’s what the data indicates. Although Brazil’s inflation is slowing, it’s still above the targeted range.

The unanimous prediction is another 0.5 percentage point cut. This would take the Selic rate from 12.25% to 11.75%.

Why does the Selic rate matter? It’s a tool to control inflation. Specifically, it affects the IPCA, Brazil’s official inflation index.

The IPCA’s 12-month rate was 5.19% in September. That’s above the 3.25% target, but within the 4.75% tolerance.

Market experts predict inflation rates for the coming years. They expect 4.63% in 2023 and 3.90% in 2024. Both are within target ranges.

Interest rate decisions impact the future. Their effects appear after about 18 months. Therefore, the recent rate decision will influence early 2025.

Inflation Target 2024

By 2024, the inflation target is 3%. This target remains steady with a 1.5% to 4.5% tolerance range.

After the COVID-19 pandemic, Brazil was quick to raise its base interest rate. They did this to combat rising inflation.

But as inflation expectations lowered, they decreased the Selic rate. Meanwhile, the US Federal Reserve kept its rates unchanged at 5.25-5.50%.

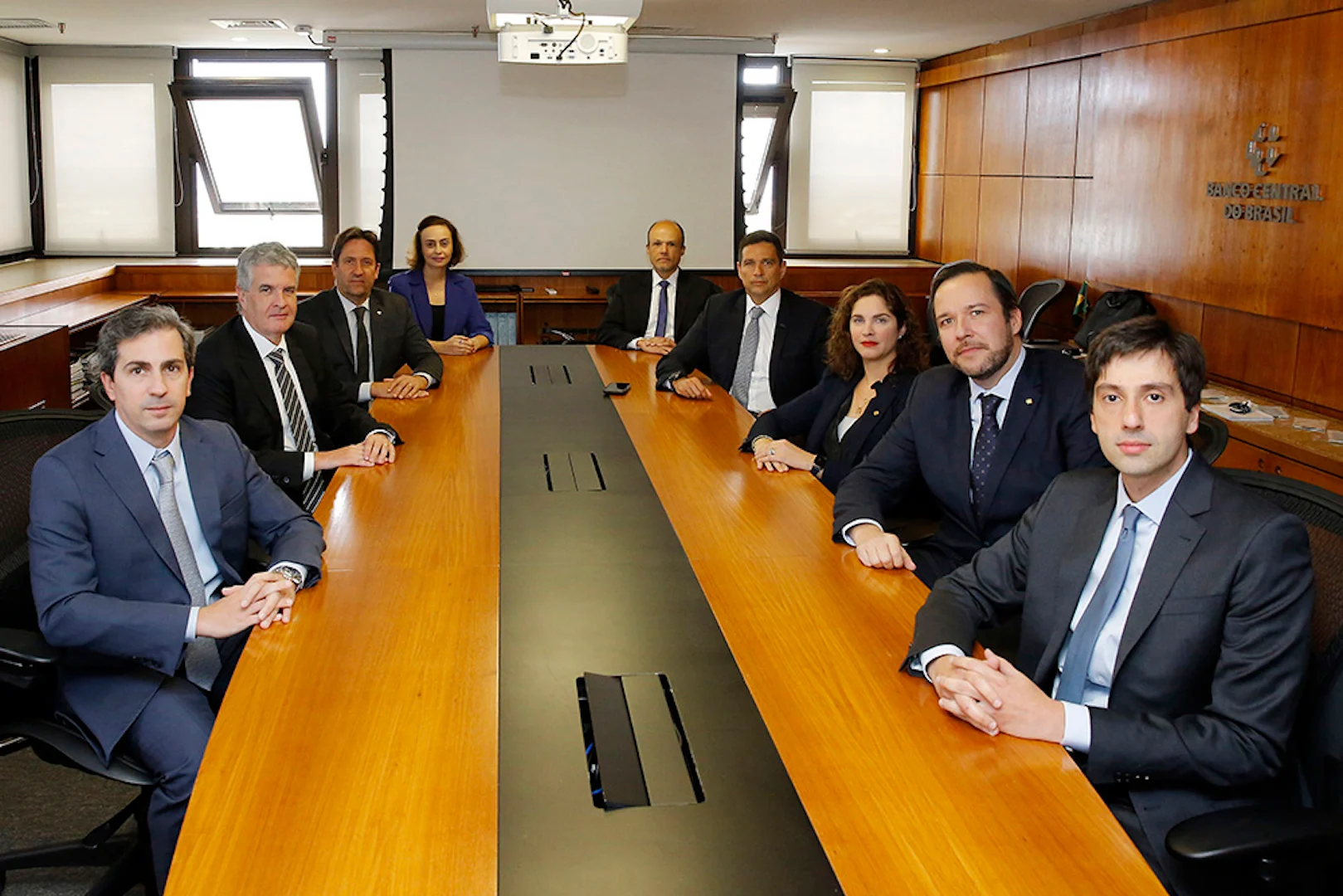

Recently, two individuals got nominated for Central Bank positions. These nominations require Senate approval.

The government aims to finalize these appointments before year-end recess. If not, the committee’s composition will remain unchanged in early 2024.

Lastly, a public employee demonstration took place. It occurred during the Copom’s recent meeting.

The Central Bank’s top officials participated, supporting staff demands for better pay and career restructuring.