By Vildana Hajric and Carly Wanna

With a cumulative climb of 80% since the beginning of the year, bitcoin is trading above US$30,000 for the first time since June 2022.

The cryptocurrency’s advance far outpaces the nearly 20% rise in the Nasdaq 100, an index with which bitcoin has swung in tandem.

Still, bitcoin is far from regaining its all-time high of November 2021, accumulating a 50% drop since then.

“US$30,000 is very significant for both technical and fundamental reasons,” says Mati Greenspan, CEO of Quantum Economics.

“Resistance has been forming for three weeks in a row, and now it’s finally broken.”

“It’s the first time we’ve broken above that level since Terraform Labs’ Luna token and cryptocurrency hedge fund Three Arrows Capital collapsed.”

“That means the price has fully recovered from Celsius, FTX, and the US regulatory crackdown.”

At 3:56 pm (New York time), bitcoin was trading at US$30,113, up 3.44% from the previous session.

At the same time, index-linked futures contracts on the Nasdaq were up 0.07% to 13,167 points.

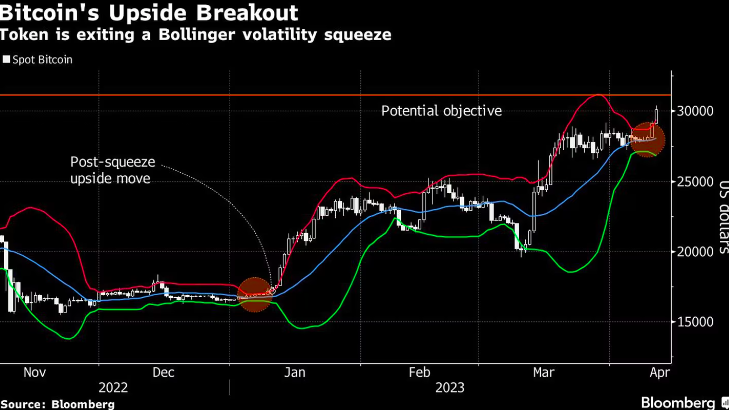

Bitcoin’s break above the tough US$30,000 resistance follows the “tightening” of the Bollinger band, which saw historical volatility fall to the lowest level since January.

The tightening then led to a strong upward move that resembles Tuesday’s pattern breakout.

Traders following technical analysis may now look at the US$30,800 range as a potential first target, followed by US$31,200.

The cryptoasset industry continues to face a period of heavy scrutiny.

Crypto exchange Coinbase Global Inc. said it had received a notice from the Securities and Exchange Commission (SEC) indicating its intention to take enforcement action.

The SEC sued cryptocurrency tycoon Justin Sun for allegedly violating securities rules in a case Sun said was without merit.

In addition, the US Commodity Futures Trading Commission has sued Binance founder Changpeng Zhao and his cryptocurrency exchange for allegedly violating derivatives rules.

However, Binance disagrees with many of the agency’s allegations.

Despite these setbacks, bitcoin’s rally has gained momentum in the past month following the failure of three US banks, reviving among bitcoin bulls the idea that the token offers a more attractive alternative to traditional finance.

Analysts say the drop in liquidity to 10-month lows – after markets were rocked by the bankruptcy of Silvergate Capital Corp. and Signature Bank – could also explain the rally, at least partly.

With lower trading volume, price swings can appear more dramatic.

“Order books are thin, and trades are fewer,” says Strahinja Savic, head of data and analytics at FRNT Financial.

“Under these circumstances, it is difficult to attribute price swings to a single reason.”

With information from Bloomberg