By Juan Pablo Álvarez

A report from Moody’s risk rating agency warns that market volatility will continue to threaten the refinancing plans of Latin American companies, given that there will be a drop in liquidity in the region.

The document details that these hurt high-yield debt (ie, lower quality) in Asia and that it will be a headwind for the stability of Latin America.

“In the high-yield LatAm market, companies’ healthy liquidity buffers, built up through the cheap debt era, will shrink as global economies weaken,” said Carolina Chimenti, Moody’s vice president and senior analyst.

“With the dollar bond market largely closed, the road back to market stability, high growth and maturity will likely be long and winding for companies in the region,” the executive added.

THE KEYS TO MOODY’S ANALYSIS

The North American financial company exposed the three points that it seeks to emphasize:

- Volatility reveals vulnerabilities in smaller and less diversified Asian and Latin American high-yield markets

- Asia’s high-yield market has taken a devastating blow

- Consequences for LatAm liquidity levels are in early stages

- The expansion of private capital remains moderate for both regions

COLLAPSE IN THE HIGH YIELD MARKET IN LATIN AMERICA

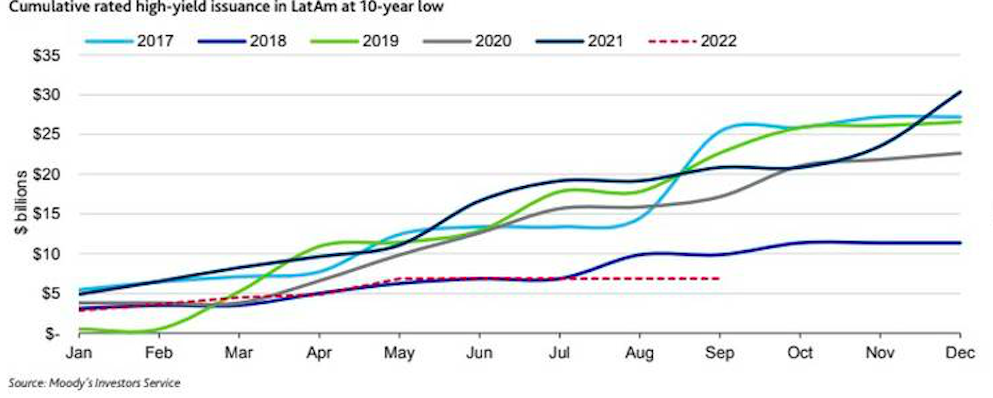

The document mentions that the debt issues of the 94 high-yield companies that Moody’s rates in Latin America have plummeted almost 67% from last year’s level.

The drop is largely due to the region’s reliance on access to US credit markets, which have all but closed their doors. Consequently, many companies have turned to their domestic capital markets, even with local interest rates at high levels.

At the same time, Moody’s notes, leveraged buyouts, financed in government bond markets, have remained relatively muted in Asia, reflecting in part the reluctance of founders to cede majority control of family businesses.

Moody’s points out that: “The volatility of the economic environment will probably contain, for now, the growth of operations backed by venture capital in the region. Similarly, in Latin America, many large companies are still owned or controlled by the founding families.

ARGENTINA, THE MOST RISKY

Moody’s indicates that liquidity risk is relatively low for non-financial, utility and infrastructure companies in Brazil, Chile and Mexico, but higher in Argentina due to short- and medium-term debt maturities.

In Peru, liquidity risk is medium, but it is increasing as the country’s growth slows.

With information from Bloomberg Línea