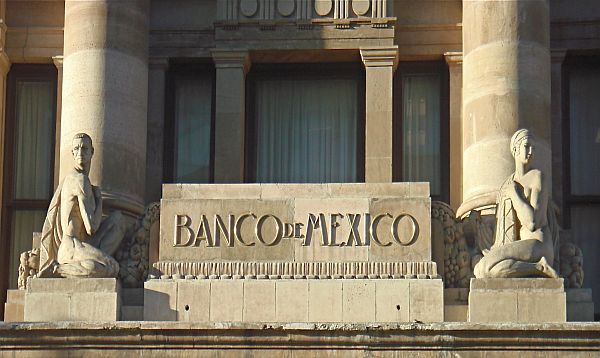

For the third consecutive time, the Bank of Mexico (Banxico) has kept its interest rate unchanged at 11.25%, a record high.

This decision highlights the end of its upward cycle, reflecting the ongoing slowdown in inflation.

In its statement, Banxico mentioned that inflationary pressures are being mitigated, leading to an ongoing deflationary process.

Nevertheless, they acknowledged that inflation remains high, emphasizing the complexity of the current inflationary environment.

Despite the U.S. Federal Reserve’s recent rate hike to between 5.25% and 5.5%, a two-decade peak, Banxico’s decision to maintain its rate met market expectations.

This follows the disclosure that July’s inflation rate dropped to 4.79%, the lowest since March 2021, down from its peak of 7.82% in December, the highest year-end rate this century.

Banxico noted, “From our last monetary policy meeting, the annual headline and core inflations continued to decline. However, both remained high, registering 4.79% and 6.64% in July respectively.”

They predict that by the end of 2023, the annual inflation rate will average around 4.6%, with an anticipated 3.1% by the end of 2024.

The central bank warned of a challenging and uncertain inflationary landscape and emphasized potential risks, including elevated core inflation levels, currency depreciation due to global financial volatility, increased cost pressures, and fluctuations in energy and agricultural prices.

Banxico’s next monetary policy decision is scheduled for September 28th.