The number of medium- and high-net-worth Chileans putting some or all of their capital outside of Chile is the obligatory commentary in the legal and financial world.

So far, it has been known in dribs and drabs who they are: The Paulmann family opened accounts in London, Jean-Paul Luksic, who changed his residence to Switzerland, the Binimelis, the Hites, and so on.

But DF MAS asked Chile’s Internal Revenue Service (SII) through the Transparency Law to know the full detail of how much money of Chilean taxpayers is lodged abroad and specifically in which country for the Income Operations of the years 2020, 2021, and 2022.

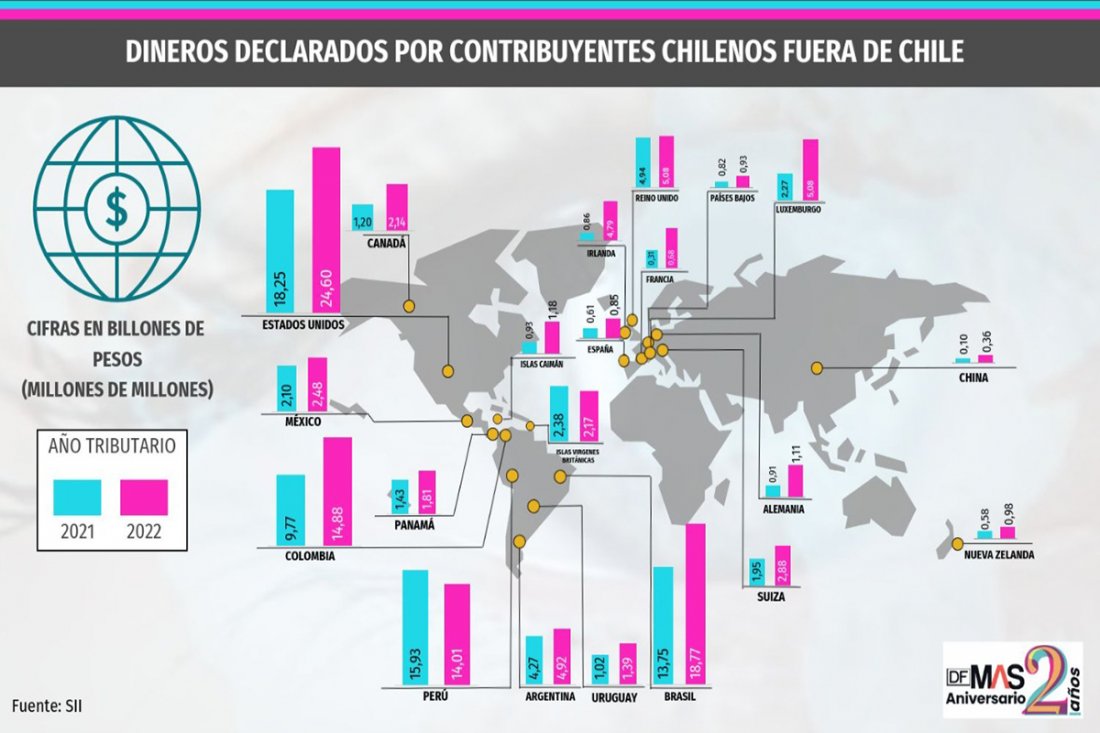

The result was a five-page Excel spreadsheet detailing that, in total, 144 countries in the world received CLP 115 billion (US$122 million) during 2021, declared in this year’s Operation Income.

The figure represents an increase of 35% from the CLP 85 billion reported in 2019.

But the destinations have also diversified. If in 2019, 128 countries were declared; last year, there were 144.

By far, the country that concentrates the largest amount of money declared abroad is the United States, with a total of CLP 24.6 trillion in 2021, an increase of 33% from the CLP 18.25 trillion reported in 2020. And even more so when considering that in 2019 it was CLP 16.8 trillion.

It is closely followed by Brazil, which increased the reported amount of Chileans’ money from CLP 13.75 billion in 2020 to CLP 18.77 billion last year. And in third place is Colombia, which rose from CLP 9.77 billion in 2020 to CLP 14.88 billion in 2021.

TAX HAVENS

There are other countries as well that, although not on the list of the most important, do stand out for the level of increase. For example, in 2019, Australia received CLP 191 billion from Chile, which increased to CLP 206 billion in 2020 and reached CLP 362 billion last year.

Guatemala also attracted attention, which went from registering assets of Chileans for CLP 9 billion in 2020 to CLP 231 billion last year. Or Ireland, which in 2020 received CLP 862 billion and last year, rose to CLP 4.79 trillion.

In others, for example, it has been the other way around. The traditional Caribbean island that is a tax haven, Bermuda, went from registering CLP 108 billion from Chileans in 2020 to only CLP 7 billion last year.

A tax lawyer explains that after the successive leaks of data of accounts in tax havens in journalistic investigations, and the greater tools of the SII to investigate, many have decided to reduce their investments deposited in that type of destination.

It also fell in the British Virgin Islands, El Salvador, and Peru. Likewise, Luxembourg was a destination coveted by Chileans. If in 2021, it reported having CLP 2.27 billion, last year, it exceeded CLP 5.08 billion.

According to the SII, all investments abroad must be declared in form 1929 of the Sworn Statement, regardless of whether they generated income in the year or were already taxed abroad.

As well as investments abroad in controlled foreign entities, regardless of whether they have received or accrued passive income during the fiscal year, in addition to operations that do not require an investment but generate foreign income and operations carried out abroad through a permanent establishment.

LESS THAN 10 IN RUSSIA

But in the list sent by the SII to DF MAS, a total of 88 countries appear for this year’s income tax return where no data was provided.

That is to say, the Service declares that there is Chileans’ money in those jurisdictions, but it is not provided “when it is a value declared by a number equal to or less than ten taxpayers and, therefore, such information loses the quality of statistics and is transformed into specific and determined information or that at least allows to determine one or more taxpayers,” he explained.

“Disclosing the required information would affect privacy and the affectation of commercial and economic rights concerning the value declared by less than ten taxpayers. In addition, the required information is protected by tax confidentiality,” he added.

In this way, it is possible to conclude that, in countries such as Armenia, United Arab Emirates, Ivory Coast, Cuba, Egypt, Honduras, Iraq, Iran, Nicaragua, Palestine, Qatar, and Russia, there are less than ten Chileans who have assets. The amount, for the citizenry, is a mystery.

A third group reveals countries where Chileans withdrew all their capital. For example, in 2020, in Bangladesh, there were less than ten Chilean taxpayers with money in that country located in South Asia, but last year no assets were registered in that country.

The same happened with the following countries: Anguilla, Brunei, Republic of Congo, Christmas Islands, Greenland, Sri Lanka, Lesotho, Monaco, Montserrat, Mauritius, Pakistan, Seychelles, Suriname, St. Martin, St. Vincent and the Grenadines, and Yemen.

DÉLANO, HITES, RAVINET, AND YACONI

In recent months DF MAS has unveiled a series of movements of high-net-worth families abroad.

In June, it was reported that Jean-Paul Luksic, president of Antofagasta PLC – and member of the controlling company – changed his residence to Switzerland, while three Paulmann siblings – Heike, Peter, and Manfred – set up family investment companies in London in December last year.

The same was done previously by the businessman Isidoro Quiroga and the Silva family (shareholders of Grupo Security). In Spain, Gabriel Ruiz Tagle also set up his new domicile, while in Delaware, Cristóbal Piñera Morel decided to establish his new venture capital fund Daedalus Ventures.

But these are not the only cases. In the last year, several business people have set up companies abroad. For example, the Paulmann brothers also opened – on December 3, 2021 – a firm in Miami called PK Managing Investments LLC.

On July 28, Carlos Alberto Délano -shareholder of Empresas Penta- incorporated, with his wife Verónica Méndez, the company Piedra Roja LLP in the United Kingdom. DM Brothers Investments LLC, an investment company based in Delaware, which would be linked to the couple’s children and domiciled in Miami, Florida, also appears as a shareholder.

Sources close to the Délano Méndez family comment that this company was incorporated to have an investment vehicle in Europe within the framework of a diversification policy. Resources already taxed in Chile will be contributed and do not imply a change of domicile.

His partner in Penta, Carlos Eugenio Lavín, has incorporated six companies in Delaware for real estate investment through his family office Inversiones Convento Viejo. The last one was opened in June and was named ICV Rep Minneapolis 1 LLC.

Another company of Chilean origin in Florida is Vichuquén Managements LLC, founded in February by Ignacio Binimelis Yaconi, director of Lipigas. Insiders explain that, as a national company subsidiary, profits are paid in Chile according to the local tax regime.

For its part, Nialem – the Chilean real estate company linked to the Hites group – was also incorporated three months ago in the city of Florida. It was baptized as Nialem Real Estate 1 LLC, and its founders are Alberto Ureta (general manager of the local company), Andrés Hites Mosovich, and Jaime Hites Weber.

In September 2021, the businessman and former mayor of Santiago, Jaime Ravinet, incorporated the family investment company Ravinvest LLC with his wife, Ximena Lyon, and his daughter Macarena. It is the first company that Ravinet established in Florida.

Two months later, in Miami, the controller of the real estate and construction company Socovesa, Eduardo Gras, constituted his second personal company in Florida. He called it Calle Calle Investment LLC and opened it with María Eugenia Amunátegui, another national company’s shareholder.

Part of the Aboitiz Domínguez family – which has had stakes in companies such as Sigdo Koppers and Puerto Ventanas – opened Elcano Investments LLP, a London-based investment firm.

AVALANCHE OF DONATIONS

Donations during the lifetime of prominent businessmen to their relatives have also been labeled as an “avalanche”.

The Internal Revenue Service was also consulted through the Transparency Law on the declared amounts of donations in the life of Chilean taxpayers in 2019, 2020, 2021, and 2022. The Service only sent those of December last year and this year, up to July 24.

The reason for this partial delivery was that there is no systematized information for the remaining periods requested.

So far this year, a total of CLP 420.8 billion have been donated, with March being the month with the highest value, with a total of CLP 100.4 billion, and June with CLP 115.5 billion.

At least since the middle of last year, a series of donations by business people have been reported.

For example, in June, Carlo Solari – president of Falabella – initiated a legal process to give two properties to his four daughters. This year, three Paulmann brothers (Manfred, Heike, and Peter) requested authorization to donate part of their wealth to their respective offspring.

Luis Enrique Yarur (president of Bci) transferred 1,038,951 shares of the bank and CLP 7.5 billion to his nine children. And in March, Roberto Angelini and his children requested authorization to give CLP 4.2 billion to the family foundation.

The boom in donations occurs amid the recently presented tax reform, which proposes to apply a wealth tax, to which individuals domiciled in Chile would be subject, for assets exceeding US$5 million.

There would be about 6,300 people who would be taxed with this tax, and according to the proposal designed by the Minister of Finance, Mario Marcel, they will have to present an annual declaration of the composition of their wealth.

With information from DF MAS