By Yvonne Yue Li and James Attwood

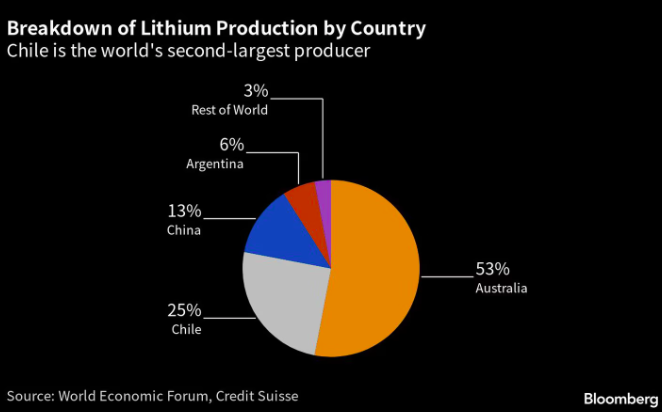

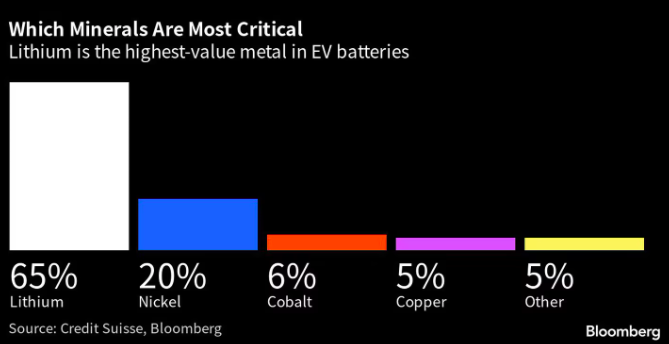

By moving to a state-run system, the second-largest lithium producer risks hindering the supply of the highest-value mineral in the battery supply chain, just when the automotive world needs it more than ever.

“Money is coward,” Canadian mining billionaire Robert Friedland said this week, predicting that the new Chilean framework will deter investment.

“It flees at the first sign of trouble.”

Under Chile’s current model, companies sign mining contracts and are allocated quotas.

The royalties paid to the government are by far the highest in the world, at a marginal rate of 40% of the lithium export price.

With only two operations in a single salt flat, Chile has lost world production share to countries with more investor-friendly rules, such as Argentina.

Uncertainty over how the new state-owned model will work is “a big negative issue,” said Joe Lowry, founder of advisory firm Global Lithium.

Shares of SQM, which runs the world’s largest brine farm in Chile’s northern desert, plunged 19% on April 21, a day after Boric announced his new strategy.

Albemarle Corp, the other Chilean producer, fell 10%.

Boric is seeking a bigger share of mining windfall profits to help fund schools, hospitals, roads, and bridges and address inequalities after social protests erupted in 2019.

His model will also require mines in one of the driest places on Earth to adopt a new technique that uses less water, although the method is relatively untested at scale and initially may mean lower production.

“The objective is to control,” Economy Minister Nicolas Grau told Bloomberg in an interview.

Companies’ various fundamental decisions must “respond to the interests we have as a country.”

Boric’s administration has said the measures have been well received as companies benefit from partnering with the state on projects that tap more of the world’s greatest resources.

Getting buy-in from local communities and society and navigating red tape can be easier for companies if they have the state as a partner.

César Pérez-Novoa, an analyst at BTG Pactual, said these advantages might apply to smaller exploration companies, but more established players would prefer not to be relegated to minor roles.

The government has pledged to honor existing agreements with SQM and Albemarle, which supply companies such as Tesla Inc. and South Korean battery maker LG Energy Solution Ltd.

The government has given the two incumbents two options: maintain full control for the remainder of their contracts and risk losing it or let the state acquire a majority stake sooner with the understanding that they could continue to operate longer.

SQM, whose contract expires in 2030, hopes to agree to continue producing under the new model. Albemarle has more flexibility because its contract does not expire until 2043.

Although it had been anticipated, the new Chilean model for lithium surprised many investors.

According to analysts at Citigroup, investors are likely to stay on the sidelines until there is more clarity on financial risk sharing.

If uncertainty persists, they could divert capital to Australian and Canadian companies, they wrote in a report to clients this week.

Argentina is another potential beneficiary.

President Gabriel Boric announced five axes of his plan to exploit and manage the resource.

Even if the money shifts to other countries, EV manufacturers may not have time to wait for those first projects to get up and running and producing, which takes years.

Resource nationalism is also gaining traction elsewhere, with Mexico’s President Andres Manuel Lopez Obrador declaring lithium too strategic for private investors and Myanmar, Zimbabwe, and Indonesia implementing restrictions affecting various raw materials.

“Chile has an undisputed reputation for sourcing critical minerals for the entire world, and this specific development (at least for the EV world) adds new uncertainty in the supply chain,” said BTG Pactual’s Perez-Novoa.

“This uncertainty is counterproductive for the lithium market as a whole and, by extension, for the EV industry that needs the supply.”

With information from Bloomberg