RIO DE JANEIRO, BRAZIL – Foreign investors are in a holding pattern with respect to Brazil. Despite the positive flow through October 20th of R$2.647 billion (US$529 million) from countries listed on the B3 secondary market, the outflow is still R$85.106 billion in the aggregate for 2020.

To understand this trend and what can encourage investors to come to Brazil for good, Andre Carvalho and Fernando Cardoso, Bradesco BBI strategists, held a round of talks – 35 in total – with international investors in recent weeks.

The overall perception is that investors are waiting for greater visibility on fiscal policy: “while they see attractive valuations, they also see great tail risks”, Carvalho and Cardoso point out. They stress that two extreme scenarios have been discussed: compliance with the spending cap versus Brazil no longer having fiscal support amid increased uncertainties. “All eyes are on Brazilian politics and fiscal policy,” the strategists say.

Among the eight points that Bradesco BBI emphasizes that investors question about Brazil in addition to the fiscal aspect, are the municipal elections.

“In our opinion, a first reason for concern with the municipal elections is simply the evidence that President Jair Bolsonaro and members of Congress are concerned with them. They stopped the reform agenda because of the elections. In this regard, the time after municipal elections could see the resumption of some voting, particularly the budget law and the proposed amendment to the Constitution (PEC) that governs the spending cap [nicknamed “emergency PEC”], as well as some microeconomic reforms,” point out the strategists. Regarding the elections, one of the key points will be the elections in the city of São Paulo, they say.

Below are the main questions from foreign investors for the Bradesco BBI and the bank’s strategists’ answers:

1. Fiscal issue

According to the bank’s strategists, this is the investors’ main issue for Brazil amid the sharp increase in Brazil’s debt to meet spending during the pandemic. In the BBI baseline scenario, the ratio of debt to GDP is expected to stabilize at around 100 percent and drop after a few years: “However, we recognize that the risks surrounding our baseline scenario are high and tilted to the negative side.”

Fiscal risk is expected to drop in four steps: (1) Bolsonaro outlining how to finance the new social program after the municipal elections on November 29th (date of the second round of voting). The assessment is that he will support Minister of Economy Paulo Guedes’ plan to meet the spending cap; (2) a vote on the PEC currently in the Senate that establishes emergency control measures if public spending threatens the spending cap – among the measures, the proposal provides for a cut in civil servants’ salaries and working hours; (3) a decision on the end of the state of calamity in December 2020; and (4) distribution of the Covid-19 vaccine, hoping it will be approved within the next two to three months.

On this last point, the strategists emphasize: “this would be a positive driver of economic rebound and fiscal adjustment, in our opinion. The vaccine would be a kind of positive shock to supply in the economy, allowing companies to reopen, having a positive impact on job creation and confidence. The impact on fiscal accounts would not only come from stronger economic activity, but also by reducing the existing risks around the new social program.”

2. Municipal Elections

In addition to the fact that the post-electoral period may lead to a return of the reform agenda to Congress, the BBI strategists also point out other factors for monitoring the elections. Cardoso and Carvalho point out that there is a common belief in Brasília that electing a large number of mayors helps elect representatives to the federal Legislative branch. “This seems to be a good reason for politicians to be so involved in the municipal elections, even those who are not running for mayor,” they point out.

Over the past few decades, the “centrão” bloc parties have often been in line with the government but used to contest the president’s party in municipal elections. “For the first time in decades, this is not going to happen, since Bolsonaro currently has no party. In addition, Bolsonaro’s approval rating could help candidates from center parties aligned with the government. As a result, the center parties could ultimately elect more mayors and be better placed for the next Congressional elections in October 2022,” they say.

They point out that investors should keep an eye on these parties’ performance (among them, PP, PL, Republicanos, Solidarity, PTB, and PSD).

“In addition, it is important to monitor the performance of PSDB in the city of São Paulo. The party has been dominant in the state and city of São Paulo for decades, leveraging on the national political scene.” The strategists highlight recent polls that showed the current mayor of São Paulo Bruno Covas in second place although technically tied with Celso Russomanno.

However, it should be noted that the latest Datafolha poll showed Russomanno for the first time numerically behind Covas in the dispute, with 20 vs. 23 percent for the latter. “Taking into account their approval rates, our baseline scenario is that Covas will be reelected. Alternative scenarios may undermine the party’s position on the national stage,” they argue.

Despite the party’s dominant position in the state, the PSDB candidate for president in 2018 (former São Paulo Governor Geraldo Alckmin) won only 4.76 percent of the national vote, bitterly finishing fourth in the first round.

3. Structural reforms: will they be passed, and when?

This issue is related to the second since the pace of voting in Congress has slowed since September and is expected to return after the elections. “All eyes will be on the budget guidelines bill, the 2021 budget, the emergency CSP, and the decision on the state of disaster,” they assess.

No decision on these issues means the end of the state of calamity on December 31st, 2020, and with that, the government would need to meet the spending cap next year, that is, with no new social program. Thus, the period after the municipal elections (i.e., December) will be critical for reforms and fiscal policy. In this respect, they point out that Chamber president Rodrigo Maia has been highlighting two priorities: the emergency PEC and the vote on the 2021 budget. Some politicians are considering calling on Congress to function in January, during the recess.

4. Inflation on the rise

Over the past three months, inflation as measured by the Broad Consumer Price Index (IPCA) has risen above projections, particularly for food prices. The October IPCA-15 rose by 0.94 percent, the highest figure for the month since 1995.

However, a significant reduction in government income transfers is expected in 2021,

combined with high idle capacity and a gradual economic rebound will likely set the stage for a benign inflation scenario in the future, they estimate.

Thus, Carvalho and Cardoso see the risk of inflation materially rising in Brazil as low in a scenario where the government meets the spending cap. The IPCA is projected to reach 2.6 percent in 2020 and 3.5 percent in 2021, with the Central Bank starting to raise the SELIC by mid next year.

5. How will the economic rebound occur in Brazil?

Also of great concern to investors, the BBI strategists believe that the drop in Gross Domestic Product is likely to reach 4.5 percent in 2020, a lower figure than the consensus of about five percent, with growth catalysts changing in 2021.

“With the government materially reducing the income transfer, we see a high risk that GDP in 2021 will fall below 3.5 percent. As a result, we are more cautious with consumption, choosing sectors more sensitive to credit and focused on higher income groups,” the strategists say.

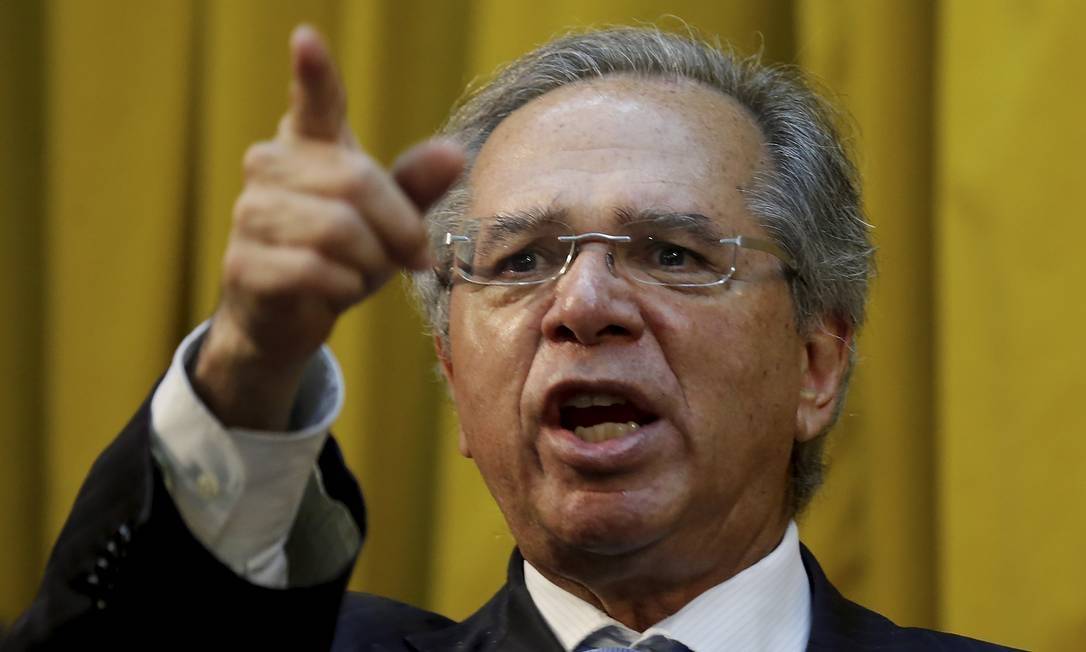

6. What is the likelihood of Paulo Guedes leaving?

Guarantor of the reform agenda, the permanence of Paulo Guedes in the Ministry of Economy is always a question for investors in Brazil.

Strategists consider it highly probable – between 70 and 80 percent – that Guedes will remain in office for the next 12 months. They acknowledge the major challenges Guedes faces today: first, the challenge of reducing the primary deficit from 12 percent in 2020 to three percent in 2021 and, secondly, the negotiation of an unpopular agenda directly with Congress.

7. What to expect for the Brazilian currency?

Establishing itself more and more as the “worst currency in the world” in 2020, with the dollar rising about 40 percent in the year-to-date, the real and the outlook for the Brazilian currency for the remainder of the year are also the subject of debate. After rising from R$4 to R$5.60 during the year, strategists expect the real to remain above R$5 in the short and medium term, closing 2020 at R$5.40 and 2021 at R$5.10.

8. What are the main investment topics in Brazil?

According to the bank’s strategists, the compression of risk premiums and the recovery of profits per share are prominent topics for Brazil in the coming months.

They point out that they are placed in highly depreciated stocks, such as banks, shopping malls, and Petrobras and bond-like (which have a behavior more similar to securities), like concessionaires and again the shopping malls sector. They expect these stocks to perform strongly if the baseline scenario of positive news with a decrease in the fiscal scenario with the advent of a vaccine materializes.

Some long-term domestic growth rates of profit per share would be: (1) the return of concessions in the infrastructure sector; (2) consolidation in some sectors with companies having greater access to the credit market; (3) capital market development; and (4) structural changes benefiting e-commerce companies, although they see the valuations of companies in the sector as stretched at the moment.

“We also like some exporters with the perception that the real will remain weak in the coming years and commodity prices will remain high,” point out the strategists. The BBI strategy portfolio includes Itaú Unibanco (ITUB4), Santander Brasil (SANB11), B3 (B3SA3), BR Distribuidora (BRDT3), Lojas Renner (LREN3), Notre Dame Intermédica (GNDI3), EcoRodovias (ECOR3), Iguatemi (IGTA3), Vale (VALE3) and Petrobras PN (PETR4) stocks.

Source: InfoMoney