RIO DE JANEIRO, BRAZIL – The last thing impoverished countries need in the fight against the devastation of the coronavirus pandemic are the demands of powerful multinational corporations in their efforts to prevent public health measures from reducing their profits.

The country was in free fall. Middle-class families were selling their valuables on the streets. By nightfall, the most desperate were looking for food in dumpsters.

That was Argentina in 2002. In those dark times, as Argentinian officials struggled to relieve the pains of a deep economic crisis among the population, a flood of corporate claims was the last thing they needed. But it was what they got.

For instance, CMS Gas sued Argentina for freezing public utility tariffs. The state had set these tariffs to protect consumers from rampant inflation. A supranational court sentenced the government to pay US$133 million to the US company. Other companies reached an agreement with the Argentine government for another several hundred million dollars.

Many of the countries fighting for survival in the face of the global Covid-19 pandemic could suffer Argentina’s fate. As the economy begins to decline, decision-makers and politicians now fear that their policies could make them the target of multi-million dollar demands.

An exclusive legal system for companies

Law firms already seem to be rubbing their hands in view of the potential of such lawsuits.

“While the future remains uncertain,” says Aceris Law, a multinational arbitration firm, “government responses to the Covid-19 pandemic are likely to violate several bilateral investment treaty (BIT) protections and lead to future claims by foreign investors.” Washington-based Aceris has won arbitration proceedings for several multinationals.

This is a field of law that has become lucrative through the expansion of some 3,000 international investment treaties and trade agreements. These treaties and agreements grant companies the right to sue governments for reducing the value of their foreign investment, or even for reducing their expected profits by hundreds of millions or even billions of dollars. This is enabled through the use of the “indirect expropriation” clause.

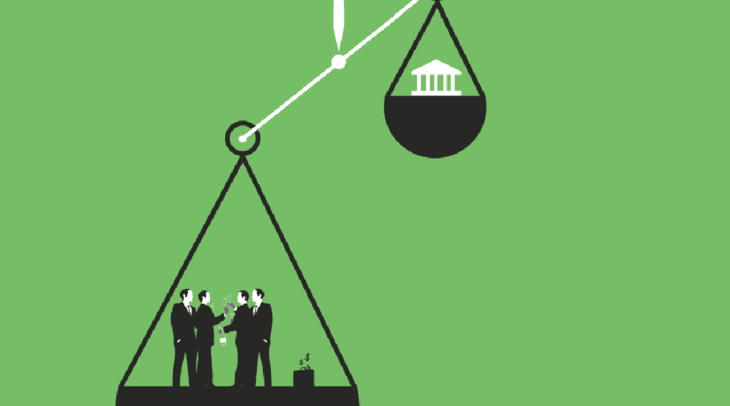

This system of “investor state dispute settlement”, better known as ISDS, allows foreign investors to bypass national courts and submit claims directly to supranational arbitration. The most frequently invoked arbitration court is the World Bank’s International Centre for Settlement of Investment Disputes – ICSID.

A rich country like the USA could obviously oppose such claims for political action against the coronavirus. Consider, for instance, that the Trump administration would force the South Korean Hyundai plant in Alabama to produce ventilators instead of cars. Hyundai would then be entitled to file a complaint under the Free Trade Agreement between the USA and Korea.

However, in practice, few foreign companies would take legal action against the Trump administration. In fact, the United States has never lost a case. By contrast, the governments of developing countries are exposed to a much greater risk. They are hosting countries for multinational companies and are therefore also more vulnerable politically.

For instance, there are now concerns that the Peruvian government could face multiple complaints from foreign companies operating tollbooths on highways, if they were to comply with the proposed emergency measure of suspending tolls, as Peruvian families fill the highways when fleeing the cities – for fear of the virus.

Several other legal experts alerted that if governments were to take emergency public health and economic policy measures in reaction to Covid-19, massive pressure from foreign investors in the form of demands for payment could arise. Such measures could include production restrictions, export bans on medical equipment or tariff reductions on the import of medical devices.

Targeting poor countries

Companies’ use of the ISDS to circumvent requirements and regulations issued in the public interest did not just begin with the pandemic. According to the United Nations Conference on Trade and Development (UNCTAD), foreign investors have reached the mark of over 1,000 investor-state lawsuits in 2020. Due to the lack of transparency in arbitration proceedings, nobody knows exactly how much governments have had to pay to date.

Research conducted by the Institute for Policy Studies (IPS) in Washington D.C. found that in cases of disputes over oil, gas, and mining contracts alone, governments have been forced to settle outstanding payments of at least US$72.4 billion. Extractive industries such as mining account for a large share of the lawsuits.

These are frequently triggered by governments trying to prevent the damage to the environment or public health caused by these business activities, or to ensure that a higher yield is retained in the country where the products originate.

Out of the 34 past cases of claims by extractive companies investigated, only one was directed against Canada. All other cases were directed against the governments of Southern countries. In the 59 known cases pending, the commodity companies are suing for at least another US$73 billion.

Of these claims, only five are directed at governments of wealthy countries. Claims for billions more have been filed from companies in the agricultural, financial, energy sectors, and many others. These companies are threatening to reroute resources that were originally earmarked for pandemic management and other urgent social needs.

Even before the current public health crisis, some countries had already gone into debt to pay off transnational companies’ claims from arbitration rulings.

Pakistan was ordered to pay some US$5 billion to the Australian company Tethyan Copper in 2019, in an arbitration proceeding concerning a gold and copper mine. This amount represents a significant portion of the recently negotiated International Monetary Fund rescue loan of US$6 billion to Pakistan, which is also linked to severe economic austerity measures.

Ecuadorian organizations last year argued that IMF loans linked to austerity measures that led to large protests in the country were used to pay transnational companies like Chevron. The US oil company secured US$77 million in a suit filed by investors against Ecuador, and other suits are pending.

With the new agreement between Mexico, the US and Canada (or the renegotiated “NAFTA 2.0”), some progress has been made to soften the mechanism for settling disputes between investors and states. On the one hand, it is to be abolished between the US and Canada, while on the other Mexico remains vulnerable to lawsuits from US and Canadian companies (the latter under the Transpacific Agreement) due to the complexity of the agreement. This will further bolster the neo-colonialist nature of the investment protection system.

The victims of the economic consequences of Covid-19 will not be foreign investors, but rather the poorest and most vulnerable societies in the world. As countries across the world struggle for funds to deal with the Covid-19 pandemic, governments should meet at the multilateral level and agree to immediately suspend all investor-state cases and outstanding payments to companies.

Moreover, in the longer term, foreign investors’ excessive powers under trade and investment treaties should be entirely removed.