RIO DE JANEIRO, BRAZIL – A metal unknown to the majority of Brazilians until now, Niobium gained visibility when President Jair Bolsonaro mentioned it during a live broadcast in June of this year.

However, the metal should have greater name recognition in this country, since Brazil is the world’s largest producer, supplying approximately 90 percent of the world market. Among its properties is that it increases the resilience of steel, which enables savings of more than 20 percent in the quantity of material used and a reduction of 30 percent in weight.

One hundred grams of niobium (at a cost of about US$ 8) are enough for one ton of steel to increase the binding strength of its atoms and, consequently, increase its thermal and mechanical resistance, as well as the potential to absorb loads without breaking or distorting. In addition, niobium increases the welding properties of other materials, and removes the risk of metal corrosion.

These characteristics make it possible to use niobium in the construction of rockets, planes, turbines, automotive parts, metal structures, ships, rails, batteries, sensors, lenses, superconductors, ships, pipelines and much more.

“It is basically used in steel, but recently we have also been developing applications in chemistry,” Eduardo Ribeiro, president of the Brazilian Metallurgy and Mining Company (CBMM), told Agência Brasil. The company is a world leader in the production and supply of niobium products.

In 2018, CBMM generated revenues of approximately R$7.8 billion and paid R$1.8 billion in taxes from the sale of the product. Approximately 95 percent of profits were derived from sales to foreign markets, where approximately 95,000 tons of niobium iron, niobium metal, nickel niobium and niobium oxide were channelled. “All high-added-value products,” adds Ribeiro.

The CBMM group is 70 percent national. The remainder 30 percent are in the hands of the two main Japanese steel companies, the main Korean steel company and the four main Chinese steel companies.

“This division, which includes our clients as shareholders, was a strategic move we implemented in 2011, with the goal of expanding the market. On the other hand, they have priority in a certain percentage of production”, he explains.

Myths and theories

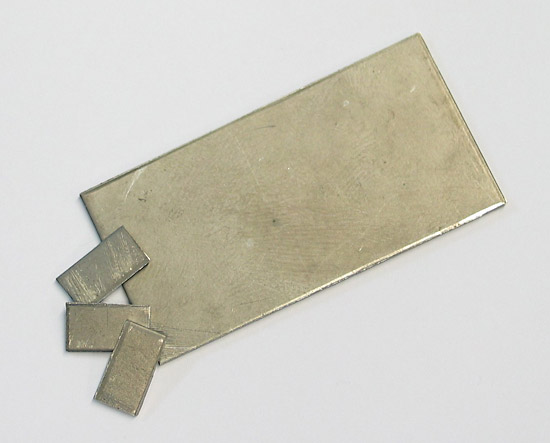

The people’s lack of knowledge about niobium led to the development of myths and conspiracy theories about metal, he said. “To begin with, niobium is a metal. It is not ore. Ore contains about 2.5 percent niobium, and it has to go through complex processing until it reaches the final product [niobium], which is the metal we sell,” he said.

“Myths interfere. There are several deposits of Niobium in Brazil, particularly in the Amazon. But to convert these into a niobium reserve, exploratory drilling holes are needed to quantify mass and content,” he added.

Ribeiro also minimized the risk of the country losing ground to foreign competitors. “In CBMM, we hold a reserve for more than 100 years. So there is lack of interest [from other groups] in investing [in the production of niobium]. We currently hold approximately 90 percent of the world market. Nor is it true that niobium exists only in Brazil”.

According to him, there are reserves in 85 world regions, including Australia, Africa, Greenland and Russia. “If many of them are not currently in operation, it is because current producers have a greater production capacity than the market size. They will not invest billions of dollars in a small market,” he argued.

Against this backdrop, the president of CBMM points to the development and growth of the market as the “greatest challenge” for the country – as market leader and holder of the most productive mine and the lowest production cost.

The greatest competition for Brazilian niobium is not foreign companies, but other metals with similar characteristics and uses – such as vanadium, among other metals. “One of the advantages of niobium is that it has a more stable price on the world stage, which provides greater security for those using it,” he explains.

Also according to Ribeiro, niobium offers other advantages in relation to competing metals. “There are advantages and unique applications when combined with nickel, particularly for aircraft turbines, in order to withstand higher temperatures”.